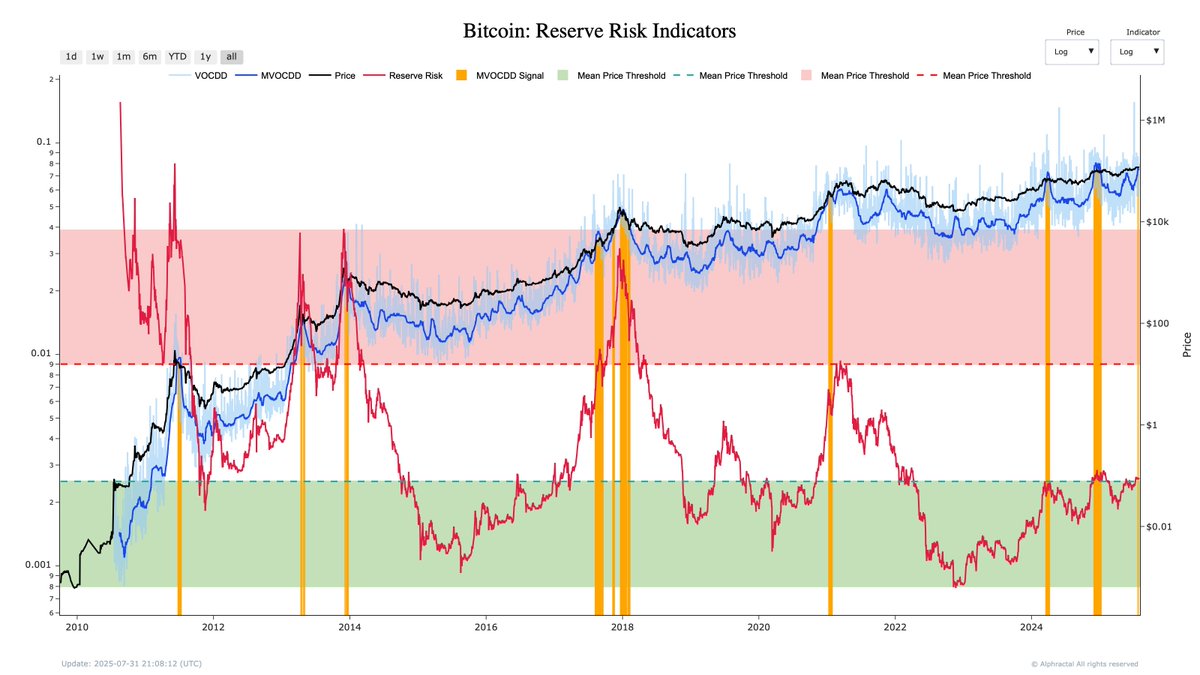

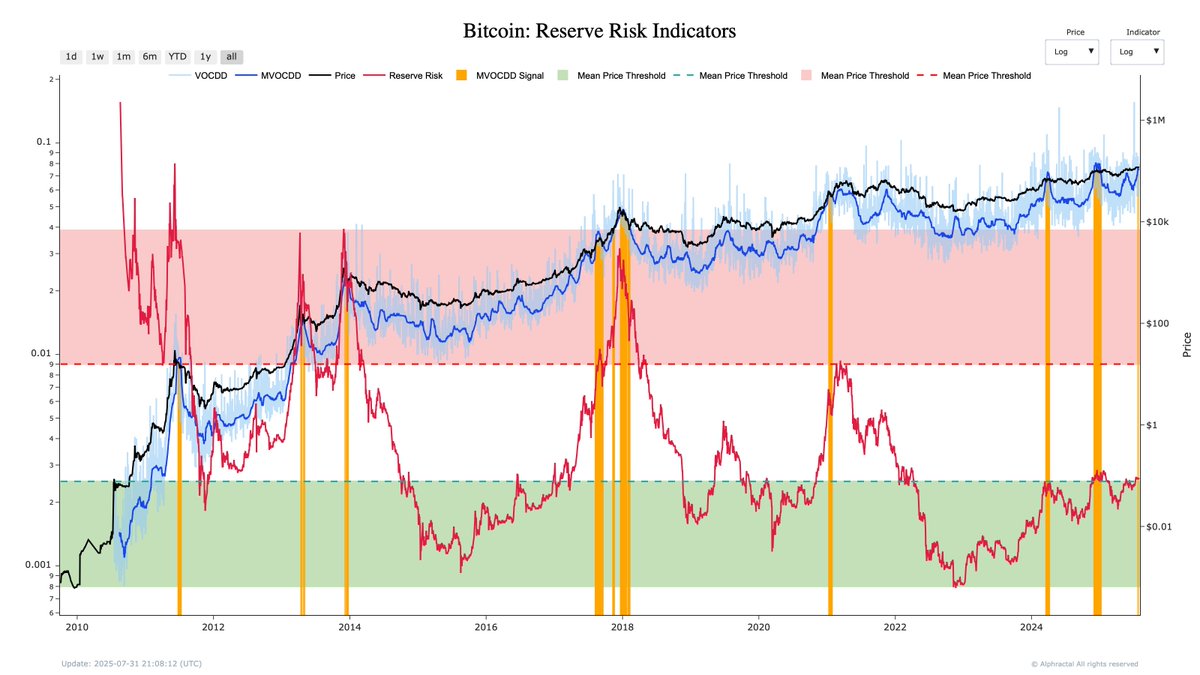

Bitcoin’s Reserve Risk Chart Just Triggered a Critical Top Signal – Here’s Why It Matters

Bitcoin’s reserve risk metric just flashed a red alert—and savvy traders are paying attention. This obscure but powerful indicator has a history of calling major market tops with eerie precision. Here’s what it’s saying now.

The signal nobody’s talking about (yet)

While retail investors chase memecoins and CNBC anchors debate ‘institutional adoption,’ Bitcoin’s reserve risk ratio quietly crossed into danger territory. No fancy algorithms required—just cold, hard on-chain data screaming ‘overbought’ in blockchain’s native tongue.

Why this isn’t your average ‘sell signal’

Unlike shaky technical analysis or influencer hype, reserve risk measures the fundamental tension between HODLer conviction and price action. When the line spikes too high? That’s when diamond hands start itching for sell buttons. And right now? We’re flirting with levels that preceded the 2021 and 2018 crashes.

The cynical truth Wall Street won’t admit

Fund managers will spin this as ‘healthy consolidation’—right up until their overleveraged clients get liquidated. Meanwhile, the smart money’s already rotating into puts and stablecoins. Typical finance playbook: talk your book while quietly exiting stage left.

What comes next could redefine crypto’s decade

Either this signal fails for the first time in Bitcoin’s history (bullish as hell), or we’re about to witness the mother of all corrections. Grab your popcorn—and maybe some downside protection.

The Reserve Risk model combines metrics like Coin Days Destroyed (CDD) and its momentum (MVOCDD) to evaluate the confidence of long-term holders (LTH) relative to Bitcoin’s price.

When this metric surges—particularly after a large amount of aged coins move—it often reflects growing investor eagerness to offload into strength, typically NEAR local tops. As shown in the latest chart from LookIntoBitcoin, this is the third time MVOCDD has flashed such a warning since 2017. Each prior instance led to a notable price cooling-off period.

READ MORE:

What makes this instance especially notable is the sharp uptick in MVOCDD at a time when Bitcoin remains near multi-year highs. The latest move suggests long-term holders—who historically sell only during strong market euphoria—are starting to reduce exposure. With Bitcoin still hovering above $60K, this shift may imply that institutional or OG wallets are preparing for turbulence ahead.

While not a guarantee of reversal, Reserve Risk has a strong track record of identifying overheated conditions. Traders and investors may want to stay alert. A local top may already be in—unless new momentum overrides historical behavior.

![]()