Ethereum Flips Bitcoin: Trading Volume Hits Historic Milestone in 2025

Markets roared as Ethereum's trading volume surged past Bitcoin's for the first time—proof that the 'flippening' isn't just hopium anymore.

The king is dead? Not quite, but the crown's looking wobbly.

Ethereum's Defi dominance and institutional adoption finally tipped the scales, while Bitcoin maximalists scrambled to explain why 'store of value' shouldn't need trading volume anyway. Classic hedge fund cope.

One thing's clear: the smart money's voting with their wallets—and they're not stacking sats this time.

ETH Outperforms BTC as Volume, Demand Spike

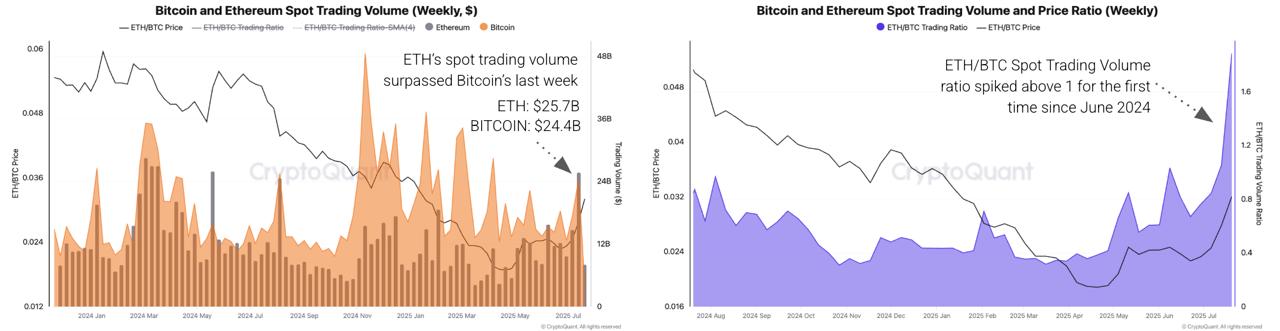

Ethereum’s weekly spot trading volume hit $25.7 billion, topping Bitcoin’s $24.4 billion. This marks the first time in over a year that ETH has consistently led in spot trading activity. The ETH/BTC trading volume ratio also ROSE above 1.0, a significant technical milestone last seen in mid-2024.

Since bottoming out in April, ETH has outperformed Bitcoin by 72%, with the ETH/BTC price ratio rising from 0.018 to 0.031—the highest since January. Analysts link this momentum to Ethereum’s undervaluation phase, now reversing as accumulation grows and sell pressure fades.

Altcoin and ETF Data Confirm Rotation Trend

Altcoin interest isn’t limited to Ethereum. Total spot trading volume for altcoins surged to $67 billion on July 17, the highest since March. Meanwhile, U.S.-based ETF data shows Ethereum allocations gaining ground against Bitcoin. The ETH/BTC ETF Holding Ratio climbed from 0.05 to 0.12, indicating institutional investors are buying ETH in larger quantities.

READ MORE:

This momentum is further supported by exchange inflow data. Significantly less ETH is being deposited on exchanges compared to BTC, suggesting lower selling pressure and potential for continued outperformance.

Outlook: ETH/BTC Gains Could Extend

With rising institutional inflows, spiking spot volumes, and a favorable on-chain profile, Ethereum appears to be regaining market dominance. If this rotation trend holds, ETH/BTC could continue climbing—pushing more capital toward Ethereum and broader altcoin markets in the coming weeks.

![]()