Crypto Cycles Are Evolving: Why Old Patterns Are Officially Dead (And What’s Next)

Crypto’s playbook is burning—and analysts say the old rules won’t cut it anymore.

The Death of Predictable Cycles

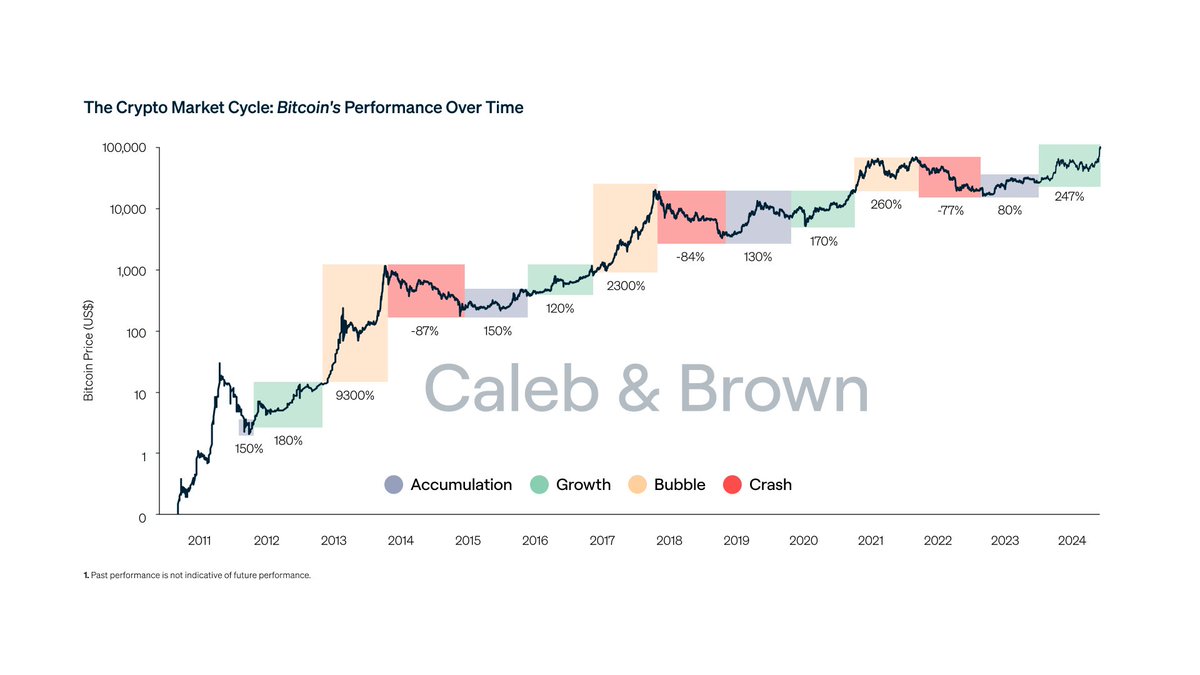

Remember when Bitcoin’s four-year halving was the only chart that mattered? Traders clinging to that script are now watching their spreadsheets turn to confetti. The 2025 market isn’t following past scripts—it’s writing new ones in real-time.

Why Institutions Broke the Model

BlackRock’s ETF approval tsunami and pension fund nibbles shattered retail-dominated patterns. Now, macro whales move markets while Reddit threads trend. (Yes, Wall Street co-opted your anarchy—deal with it.)

The New Triggers Nobody Saw Coming

AI-driven algo wars, CBDC domino effects, and that one tweet from a Tesla bot now swing prices harder than any ‘historical support level.’ Technical analysis? More like astrology for finance bros.

Where the Smart Money’s Looking

Chainlink’s CCIP adoption, Ethereum’s bleeding-edge restaking yields—today’s alpha isn’t in cycle tracking. It’s in infrastructure even the ‘experts’ barely understand yet.

Wake-up call: The market’s not ‘broken.’ You’re just using last decade’s map. Adapt or get rekt—your choice.

Bitcoin has become a macroeconomic asset

Atlas argues that bitcoin is no longer a speculative tech investment, but rather a $2 trillion macro asset class embraced by institutions and sovereign actors. Major players like BlackRock now treat BTC as digital gold, with demand increasingly driven by ETFs, custody solutions, and derivatives markets. Sovereign interest is also rising, with the U.S. building strategic reserves, Middle Eastern nations quietly accumulating, and Germany’s BTC sales reinforcing its role as a national asset.

This shift, Atlas says, places Bitcoin firmly in the category of assets influenced by interest rates, inflation, and global liquidity cycles—factors previously foreign to crypto investors.

The old altseason rotation is broken

In past cycles, capital WOULD typically rotate from Bitcoin to Ethereum, then into large-cap altcoins and eventually into meme coins. Atlas claims this pattern no longer applies. Instead of flowing predictably through the ecosystem, liquidity now either exits the market entirely or chases emerging narratives with greater speed and volatility. Legacy altcoins—once core to altseason expectations—have become “liquidity traps,” offering little reason for capital to rotate into outdated projects with no traction.

Narratives now drive performance

Retail-driven meme coins have emerged as the most consistent outperformers, despite offering no traditional fundamentals. Atlas notes that performance is increasingly dictated by attention and narrative strength rather than utility or technology. The market now rewards projects that align with viral themes like AI, tokenized assets (RWA), and other HYPE cycles. Assets without a compelling narrative—even in bull markets—are likely to be ignored.

READ MORE:

Traders must adapt to survive

According to Atlas, success in this new structure requires a shift in mindset. Traders must treat BTC as a macroeconomic instrument, quickly rotate between narratives as they emerge, and avoid holding onto outdated altcoin positions. While market cycles still exist, they are no longer tied to predictable halving timelines or four-year resets. Instead, volatility is higher, predictability is lower, and adaptability is the key differentiator between winners and those left behind.

![]()