Hedera (HBAR) Takes a 49% Moon Shot—Then Gets Sucker-Punched by Market Reality

HBAR's bull run hits a wall as traders take profits—because nothing scares crypto like success.

After a blistering 49% monthly rally that left traditional finance clutching its pearls, Hedera's native token just got served a brutal reminder: In crypto, gravity always wins eventually. The pullback came hard and fast—no gentle retracements here, just the market's way of saying 'show me the fundamentals.'

The Whiplash Effect

Turns out even enterprise-grade DLT projects aren't immune to trader psychology. The sell-off mirrors classic crypto behavior—FOMO begets FUD, and everyone pretends they 'saw it coming.'

Silver Linings Playbook

For all the hand-wringing, a 49% monthly gain still puts HBAR in the winner's circle. But as any degens knows, in this market you're either a contrarian or a bagholder—no in-between.

So goes another day in crypto, where the only thing more predictable than irrational exuberance is the inevitable 'correction' that follows. Traders: start your hopium engines.

Overbought signals trigger sharp correction

HBAR’s Relative Strength Index (RSI) hit extreme levels—87.9 on the 7-day and 79.8 on the 14-day—indicating overbought conditions. Historically, such levels have often preceded price corrections. The token was also trading 30% above its 50-day moving average, making it vulnerable to mean reversion.

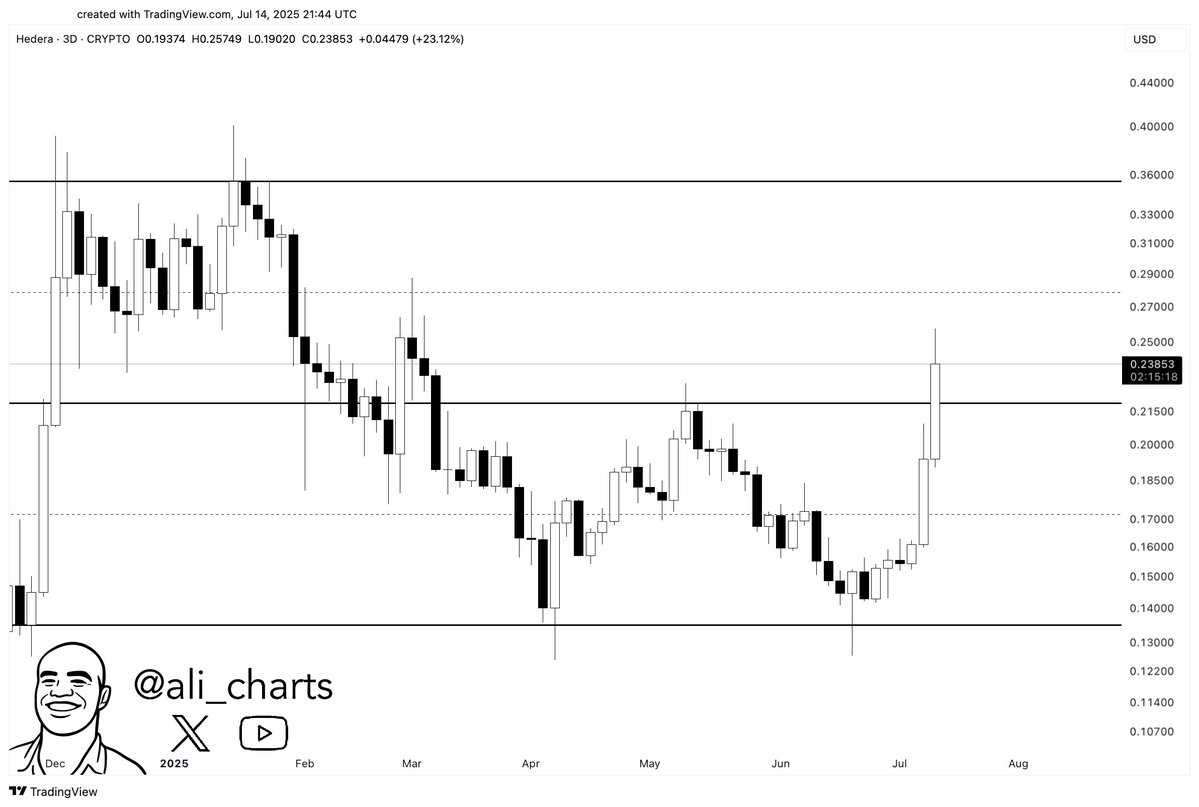

Support NEAR $0.225, based on Fibonacci retracement (23.6% level), failed to hold during Tuesday’s pullback. The next key support is around $0.206, corresponding to the 38.2% Fibonacci level.

Market-wide headwinds add pressure

HBAR’s underperformance came amid a 1.8% drop in the overall crypto market cap and a rise in Bitcoin dominance to 63.12%. This signals capital rotation toward BTC and away from riskier altcoins. Meanwhile, the Crypto Fear & Greed Index remains at 70, a traditionally contrarian signal warning of potential downside.

Still, prominent analyst Ali Martinezbullish potential if HBAR breaks above the $0.36 resistance. For now, traders are watching whether institutional adoption narratives can offset technical headwinds—especially if Bitcoin stabilizes above $117,000.

Key levels to watch: $0.206 support, $0.265 resistance, and Bitcoin’s $117.4K macro pivot.

READ MORE:

Futures market shows signs of overheating

Open interest in HBAR futures climbed to a record $450 million, according to Coingape, intensifying volatility. Within 24 hours, long positions worth $7.1 million were liquidated as the token failed to break resistance in the $0.233–$0.263 zone.

Trading volume also dropped 43% to $834 million, indicating fading momentum. The spot-to-perpetual ratio sits at 0.46, implying price movements are being driven largely by speculative derivatives rather than organic demand.

![]()