BlackRock’s Bitcoin ETF Faces Largest Monthly Exodus Since Inception - What Wall Street Isn’t Telling You

Massive capital flight hits institutional crypto darling as traditional finance meets digital asset reality.

The Withdrawal Wave

BlackRock's flagship Bitcoin ETF just witnessed its most significant monthly capital outflow since launching - a staggering development that's sending shockwaves through both crypto and traditional finance circles. The numbers don't lie, and they're painting a concerning picture for institutional adoption narratives.

Institutional Cold Feet

While mainstream media touts the 'maturation' of crypto markets, this withdrawal surge reveals deeper structural issues. Major players are pulling back precisely when the crypto evangelists predicted mass adoption would accelerate. The timing couldn't be more ironic - or more telling about Wall Street's true commitment to decentralization.

Market Implications

This isn't just about one ETF. It's about the entire institutional crypto infrastructure facing its first real stress test. The numbers suggest traditional finance might be realizing what crypto natives have known all along - you can't truly decentralize while keeping one foot in the centralized banking system.

Another case of suits trying to play revolutionary while still checking their stock tickers every five minutes.

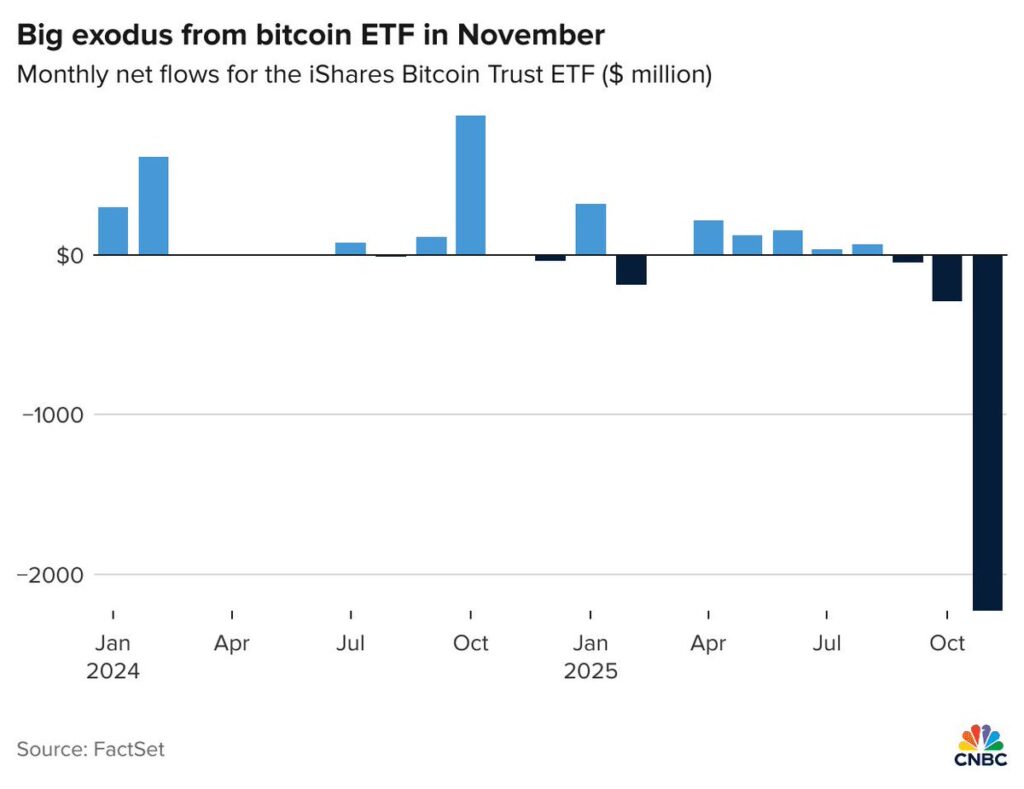

The chart underscores just how dramatic the shift has been: the November bar plunges far below all others, erasing almost two years of consistent accumulation with a single month’s withdrawal.

READ MORE:

Analysts attribute the reversal to a blend of profit-taking after strong multi-year performance, caution around global macro conditions, and a broad risk-off tilt across markets. Whatever the cause, November has become the clearest sign yet that IBIT’s trajectory is no longer moving in a single direction.

With only one month left in the year, attention has now turned to whether the ETF’s redemptions stabilize in December – or if the November outflow marks the beginning of a deeper trend investors will carry into 2026.

![]()