Venture Capital Floods Back Into Crypto With Explosive Q3 Rebound

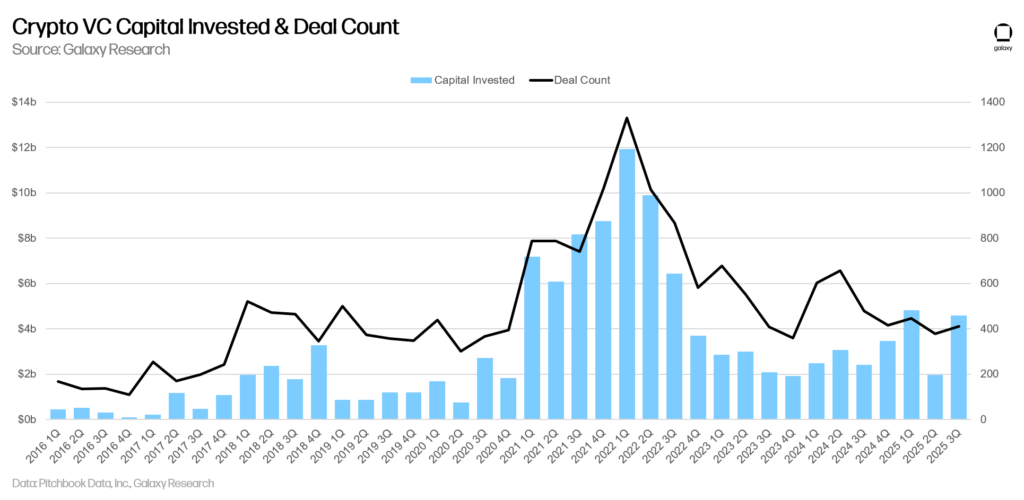

Smart money just placed its biggest bet on crypto since the bull market frenzy.

The Comeback Kids

After playing it safe through regulatory uncertainty, VC firms are diving back into digital assets with conviction that would make your financial advisor nervous. The third quarter saw investment surge as institutional players finally acknowledged what retail traders knew all along—the blockchain train isn't waiting for permission to leave the station.

Follow the Money

Deal flow isn't just returning—it's accelerating at a pace that suggests FOMO isn't just for Reddit forums anymore. From DeFi protocols to infrastructure plays, the checks are getting bigger and the term sheets are getting signed faster than you can say 'tokenomics.'

Wall Street's Awkward Embrace

The same institutions that once dismissed crypto as a passing fad are now scrambling to understand smart contracts while trying to maintain their usual air of superiority. Watching traditional finance try to sound knowledgeable about decentralized governance is almost worth the institutional baggage they bring.

So while your bank still charges $25 for wire transfers, the future of finance is being built by teams funded by people who actually understand technology. Maybe ask your portfolio manager what they think about liquid staking derivatives—if they don't panic, they're probably lying.

Big Deals Drive Majority of Capital

Despite the overall recovery, funding remained concentrated. Out of 414 deals, just seven absorbed half of the capital, including Revolut’s $1 billion round, Kraken’s $500 million, and Erebor’s $250 million.

Established companies attracted most of the money, while 2024-founded startups generated the highest deal count. Thorn added that pre-seed activity has continued to shrink as the industry matures and institutional players deepen their presence.

READ MORE:

ETF Growth Pulls Attention From Early-Stage VC

Thorn said venture activity now lags rising crypto prices, a break from earlier cycles. Competing capital demands from AI startups, higher interest rates, and waning enthusiasm for NFTs, gaming, and Web3 have contributed to the slowdown.

At the same time, large allocators increasingly prefer spot bitcoin ETFs and digital-asset treasury firms, gaining sector exposure through liquid investment vehicles rather than long-horizon startup bets.

Geographically, the U.S. led with 47% of capital and 40% of deals, followed by the UK and Singapore. Thorn expects U.S. dominance to grow under the crypto-friendly TRUMP administration and with new legislation like the GENIUS Act setting the stage for expanded institutional involvement.

![]()