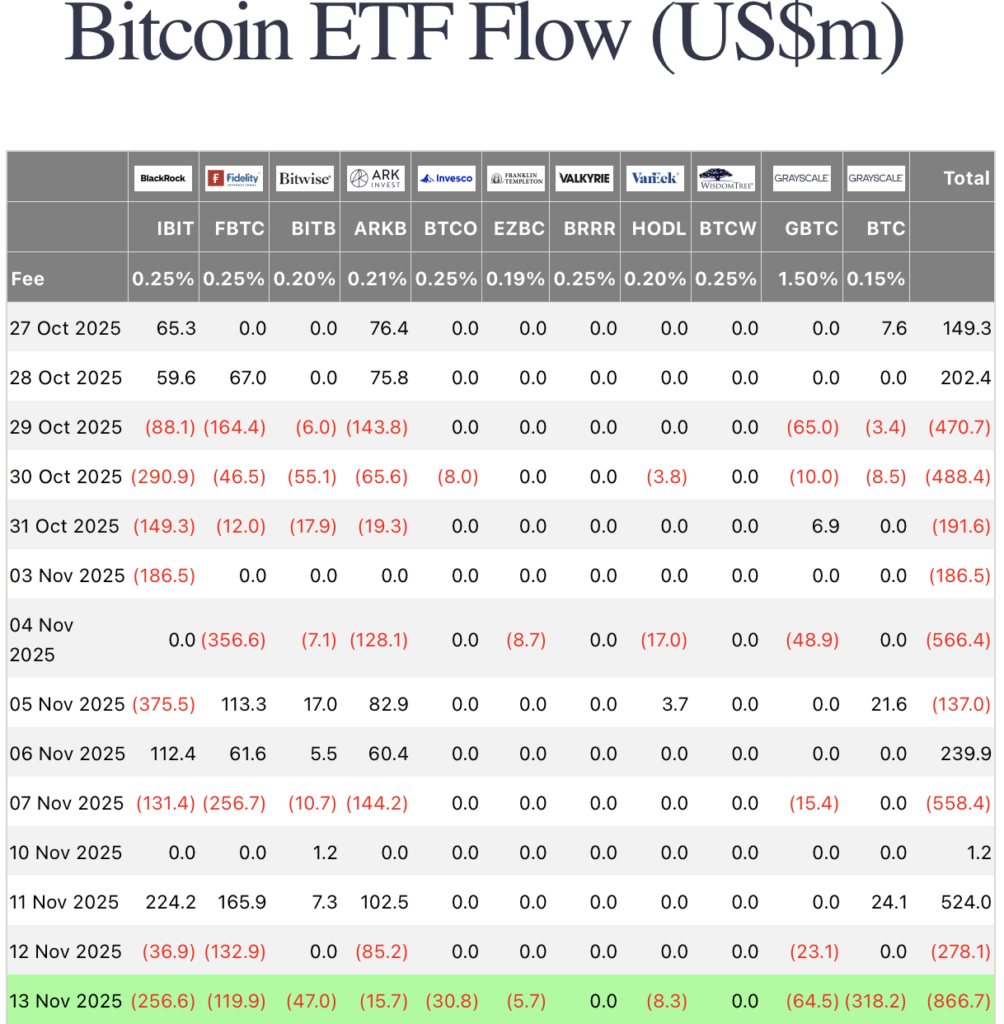

Bitcoin ETFs Bleed Out: Second-Worst Daily Outflow in History Rattles Market

Wall Street's crypto experiment hits a brutal speed bump.

### Record Outflows Signal Investor Jitters

Bitcoin ETFs just faced their second-worst day ever—massive withdrawals suggest even institutional players get cold feet during volatility. The 'safe' exposure play isn't looking so stable now.

### The Numbers Don't Lie (But Traders Might)

While exact figures aren't disclosed here, the scale mirrors past capitulation events. Funny how fast 'digital gold' turns into 'hot potato' when markets sneeze.

### A Cynic's Take

Another reminder: Wall Street loves crypto—until it's time to hold bags. Maybe next they'll invent an ETF for diamond hands.

The selloff marks the second-worst day on record for the category. The only larger outflow event occurred on Feb. 25, 2025, when redemptions topped $1.14 billion.

Market analysts said the scale of withdrawals reflects investors backing away from high-beta assets amid growing macro uncertainty. Kronos Research CIO Vincent Liu described the moves as a “risk-off reset,” noting that institutions often trim exposure when liquidity thins and volatility rises. He added that while the withdrawals dampen near-term momentum, the structural demand for bitcoin remains intact.

Min Jung of Presto Research echoed that sentiment, pointing to concerns around the Federal Reserve’s policy path and weakening economic signals. “It’s a broad de-risking across markets,” she said, citing investors’ preference for safer positioning as labor and business data hint at a cooling U.S. economy.

READ MORE:

Bitcoin’s price dropped sharply alongside the ETF outflows, sliding 6.4% over 24 hours and falling to around $96,956 early Friday morning. Analysts attributed the decline to a cascade of forced liquidations meeting thin buy-side liquidity. Liu noted that buyers seem to be defending the $92,000 to $95,000 area, but warned that until deeper liquidity returns, elevated volatility is likely to persist.

Arctic Digital’s Justin d’Anethan said the current region is a “logical support,” but if it breaks, Bitcoin could test the lower $90,000s – levels he believes sidelined investors may view as attractive long-term entry points.

Jung added that the downward move did not stem from a single news trigger. Instead, she said, a blend of softening macro indicators and shifting rate-cut expectations has eroded risk appetite. Odds of a December Federal Reserve cut have dropped to 52.1%, according to CME FedWatch, adding another LAYER of uncertainty to market positioning.

![]()