Bitcoin Plunge Triggers Altcoin Avalanche: Here’s What’s Bleeding

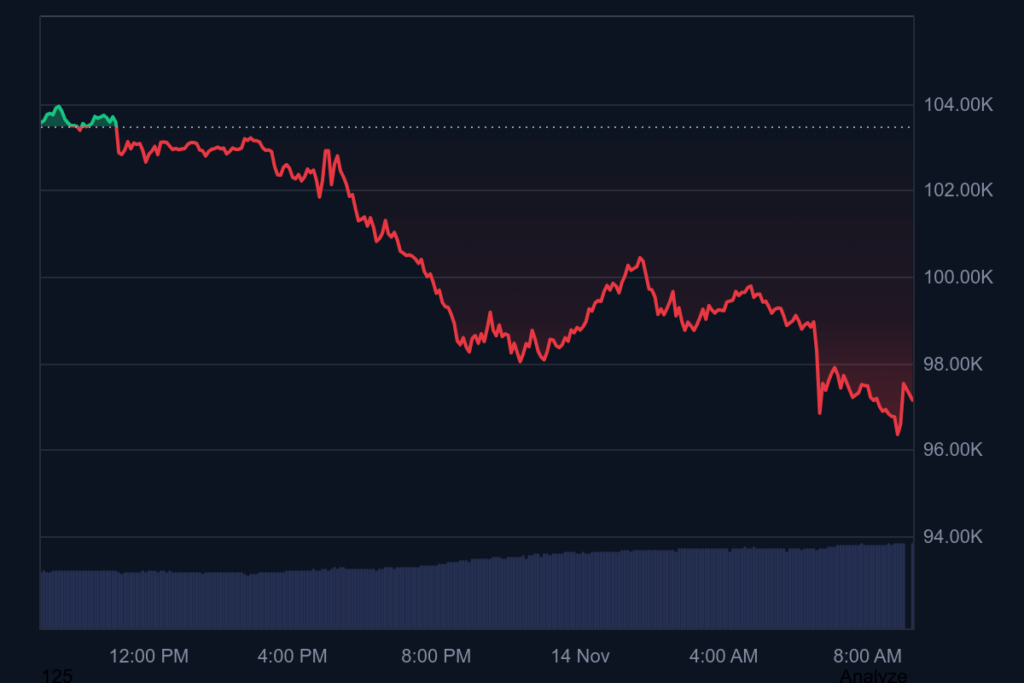

Crypto carnage spreads as Bitcoin's nosedive drags majors into the red.

Blood in the water

Ethereum, Solana, and BNB get caught in the downdraft—no safe havens left as leveraged longs get liquidated. Classic crypto domino effect.

Wall Street's 'risk-off' playbook looks almost prudent today—if you ignore the fact they still don't understand proof-of-work.

Solana and BNB were hit as well, retreating to $142.89 and $920.14 respectively, each closing out the day with declines above 4% to 8%. Several other large-cap tokens – including XRP, Dogecoin and Cardano – also posted notable drawdowns, contributing to the market-wide correction.

READ MORE:

Key sentiment indicators show the mood weakening. The Fear & Greed Index sits at 22, signaling Fear, while the average crypto RSI shows the market drifting into oversold territory. Traders appear to be rotating out of Leveraged positions, with volatility higher across multiple networks.

Despite lower prices, trading activity remains strong. Bitcoin’s 24-hour volume reached $112 billion, while Ethereum saw over $52 billion in trading turnover. Stablecoins held steady, with USDT and USDC maintaining their pegs as capital moved defensively into lower-volatility assets.

Altcoin performance varied, with some tokens attempting intraday recoveries but failing to escape overall downward momentum. The “Altcoin Season” indicator sits at 32/100 – well below the threshold that WOULD signal outperformance relative to Bitcoin.

With pressure building across the top 10 assets and sentiment trending negative, analysts expect volatility to remain elevated in the short term. Traders will be watching whether Bitcoin can defend the mid-$90K zone and whether Ethereum can reclaim territory above $3,300. A break lower, however, could lead to further unwinding as the market searches for stability.

![]()