🚀 Bitcoin’s Next Stop? Fibonacci Targets $140K as BTC Hyper Cycle Nears $27M

Bitcoin’s chart is painting a bullish masterpiece—Fibonacci extensions suggest a rally to $140K is brewing. Meanwhile, the so-called 'hyper cycle' narrative gains steam as Bitcoin flirts with the $27M market cap milestone.

### The Fibonacci Factor

Technical traders are glued to their screens as Bitcoin’s price action aligns with Fibonacci extension levels. Historically, these patterns have preceded explosive moves—and this time, the 1.618 extension points to $140K.

### Hyper Cycle or Hyper Hype?

The 'hyper cycle' theory—where institutional FOMO meets scarcity—has Bitcoin’s market cap racing toward $27M. Skeptics whisper about 'greater fool' dynamics, but hey, since when did Wall Street care about fundamentals?

### The Bottom Line

Whether you’re a chart purist or a macro maximalist, Bitcoin’s setup is undeniably juicy. Just remember: in crypto, the only thing thicker than the gains is the irony of traditional finance crying 'bubble' while quietly stacking SATs.

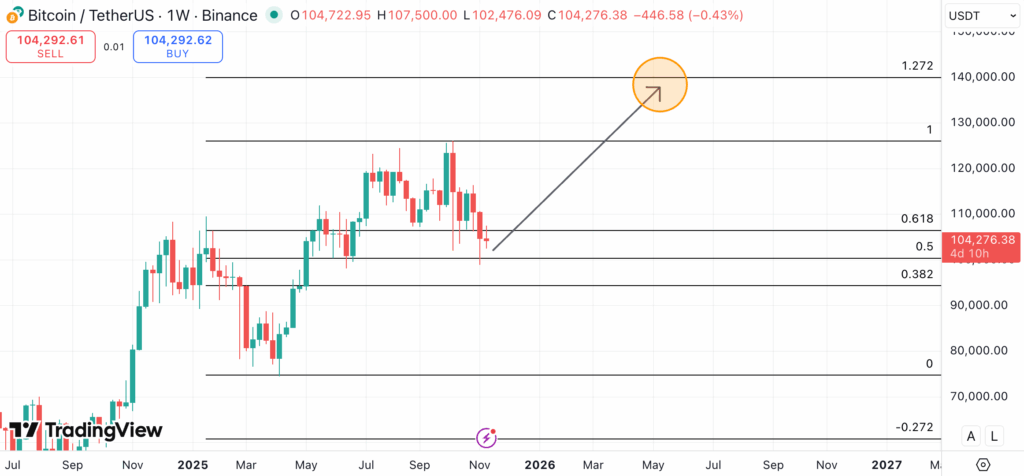

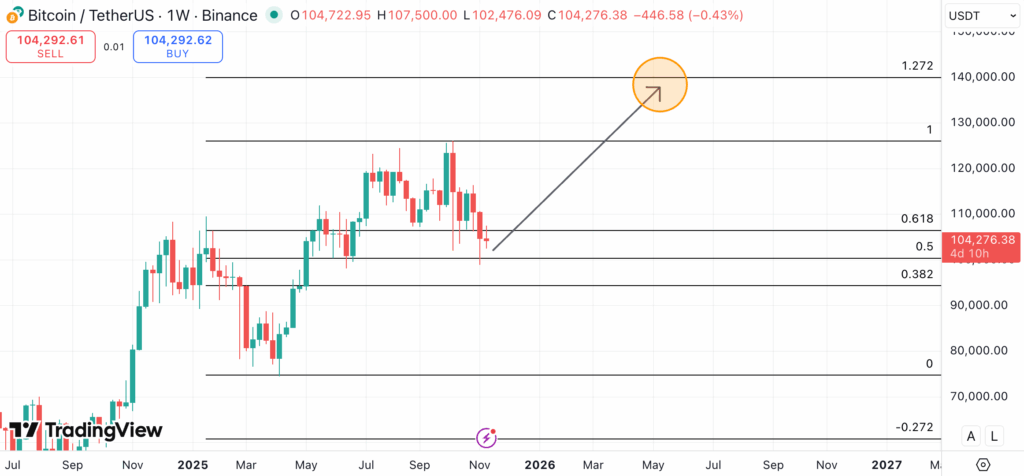

Bitcoin Price Prediction – Fibonacci Extension Points to $140K Target

Fibonacci retracements and extensions are popular tools for anyone doing technical analysis in crypto. Traders use them to identify potential support and resistance levels – along with price targets – based on mathematical ratios that show up in financial markets.

Currently, Bitcoin’s weekly chart is displaying an interesting trend. If you plot the Fibonacci tool from April, when BTC’s rally first kicked off, all the way up to October’s peak, the 0.5 retracement level lines up almost perfectly with last week’s low.

That’s not random – it’s a key inflection point. And if Bitcoin rebounds cleanly from that level in the coming weeks, it could retest its October high and potentially push toward the 1.272 extension.

That extension comes in at around $140,000. So, assuming this Fibonacci pattern plays out as cleanly as the chart suggests, Bitcoin could be looking at another 34% rally from here.

Institutional Players Align on Bullish Price Targets for Bitcoin

Some of the biggest institutional players and analysts are also pointing to high year-end targets for Bitcoin. Interestingly, their reasoning lines up with what Bitcoin’s technicals indicate.

Standard Chartered’s team is on record with a $200,000 year-end target, citing spot ETF inflows and a weakening dollar as the two main drivers. Meanwhile, VanEck’s team is calling for $180,000, focusing on post-halving dynamics.

JUST IN: VanEck predicts Bitcoin will reach $180,000 by the end of this year. pic.twitter.com/X8jgrdUKrj

— Bitcoin Junkies (@BTCjunkies) August 18, 2025

Even the more conservative banks are bullish. For example, Citigroup’s target is $133,000 – still well above today’s price. This target is largely based on the trend of corporations adding BTC to their balance sheet.

So, you’ve got the Fibonacci extension pointing to $140,000 and the institutional outlook clustering around the same level (or even higher). When the charts and the big money start saying the same thing, usually something is about to happen.

Bitcoin Hyper Could Offer Higher Upside as New BTC Layer-2 Network Goes Viral

Bitcoin soaring 34% WOULD be great – but low-cap altcoins with utility can post even higher returns when the market turns bullish. Bitcoin Hyper is one of these coins that’s been gaining momentum lately.

The project’s presale has raised nearly $27 million, with HYPER tokens currently priced at $0.013255 each. And just this week, a crypto whale invested over $220,000 in a single transaction, which is usually a sign that high-net-worth players see something of value here.

So, why are they interested? It’s mainly because Bitcoin Hyper is a new Layer-2 solution designed to bring scalability and proper DeFi functionality to Bitcoin without forcing users to swap out of BTC.

$HYPER is here to SUPERPOWER Bitcoin.⚡️

This unleashes the true power of Bitcoin. Payments. Meme Coins. dApps. 🔥https://t.co/VNG0P4FWNQ pic.twitter.com/LFIgoKlvNf

— Bitcoin Hyper (@BTC_Hyper2) November 10, 2025

Bitcoin Hyper’s architecture uses a canonical bridge to lock BTC and mint an equivalent on Bitcoin Hyper, where transactions settle almost instantly. Activity gets batched and verified using zk-proofs for security, while the Solana VIRTUAL Machine (SVM) handles throughput.

Also, Bitcoin Hyper has a staking protocol (live during the presale) offering 43% APY to HYPER holders. Over 1.2 billion HYPER tokens are already committed to the staking pool.

For investors willing to take on more risk than BTC alone, Bitcoin Hyper’s combination of low-cap positioning and Layer-2 potential makes it worth keeping an eye on. It’s a project that could deliver outsized returns if the tech rolls out successfully.

Visit Bitcoin Hyper PresaleThis publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page. Readers should do their own research before taking any action related to cryptocurrencies. CryptoDnes shall not be liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with use of or reliance on any content, goods or services mentioned.

![]()