Bitcoin’s Corporate Adoption Surges as Wall Street Giants Stack Sats

Institutional FOMO reaches fever pitch as Bitcoin's balance sheets multiply.

Wall Street's new gold rush? BlackRock, MicroStrategy, and Fortune 500 firms are quietly building war chests of BTC—while retail traders get squeezed out.

The ultimate irony? Banks that once called Bitcoin 'rat poison' now hold more BTC than El Salvador's treasury. Welcome to hyperbitcoinization's corporate phase—where the suits profit while pretending they invented the idea.

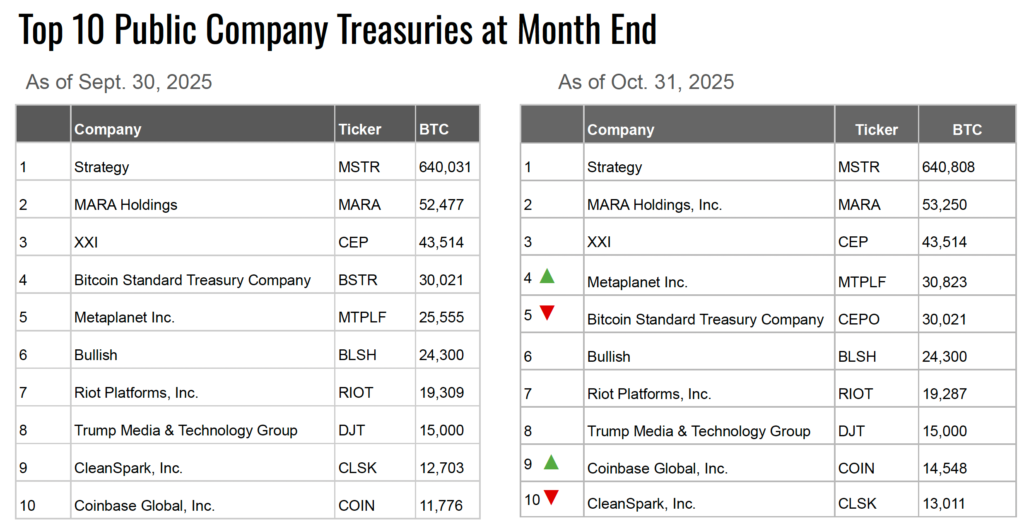

The shift doesn’t mean companies are abandoning Bitcoin – quite the opposite. October saw a broader base of public and private entities adding the asset to their balance sheets, though at a slower clip than previous months. Collectively, businesses accumulated just over 14,400 BTC, the smallest monthly rise in 2025.

New Entrants Drive Broader Distribution

Japan’s Metaplanet was the standout buyer, scooping up 5,268 BTC to bring its total stash to more than 30,800 BTC, earning it the fourth spot among all corporate holders. Coinbase followed, adding 2,772 BTC to reach roughly 14,500 BTC by the end of the third quarter. CEO Brian Armstrong confirmed the purchases publicly, emphasizing the exchange’s long-term confidence:

Coinbase is long bitcoin.

Our holding increased by 2,772 BTC in Q3. And we keep buying more.

— Brian Armstrong (@brian_armstrong) October 30, 2025

By the end of October, a record 353 entities – including 276 private and public companies – reported Bitcoin holdings, more than double the number seen in January. The United States remains the global leader with 123 such companies, followed by Canada, the United Kingdom, and Japan.

READ MORE:

Bitcoin Supply Tightens as Corporate Hoards Grow

With the rise of long-term corporate holding strategies, analysts note that more of Bitcoin’s circulating supply is effectively being removed from active circulation. Fidelity Digital Assets described this trend as the beginning of a new accumulation era led by two dominant groups: institutional holders and long-term believers.

According to Fidelity’s projections, by 2032, over 8.3 million BTC – about 42% of total supply – could become illiquid, as companies and investors lock up their coins for the long haul.

![]()