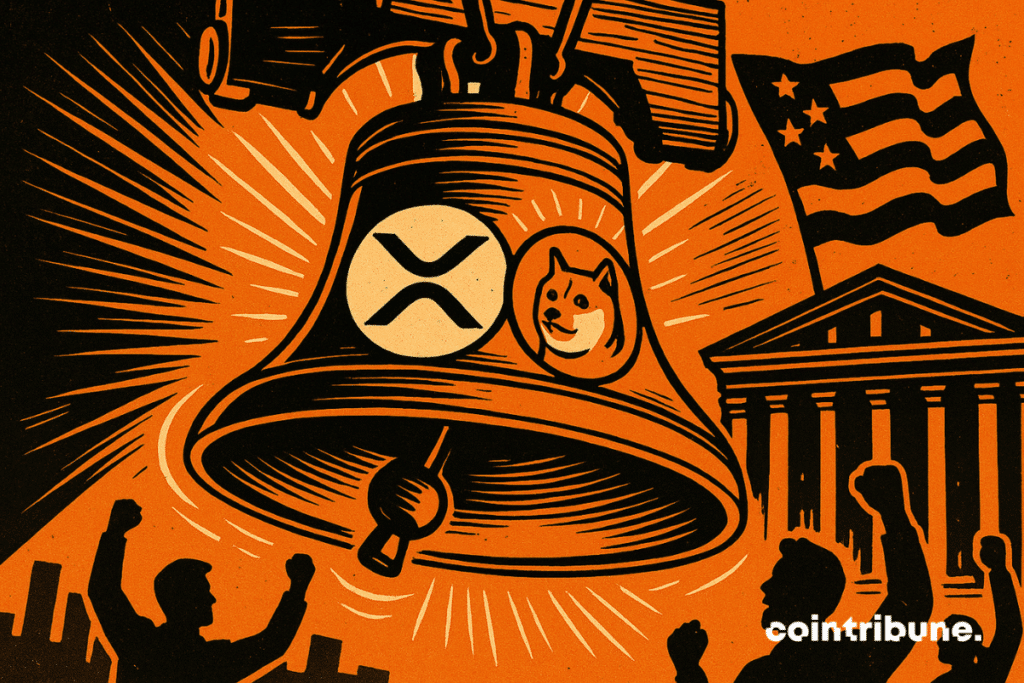

BREAKING: First Regulated ETF For XRP And Dogecoin Hits Markets This Week

Crypto's rebel twins just got a Wall Street makeover.

REGULATION MEETS MEMES

The SEC finally greenlights what crypto traders have demanded for years—mainstream access without the usual brokerage hurdles. XRP and Dogecoin ETFs land on major exchanges Thursday, letting investors ride these volatile assets without direct ownership.

INSTITUTIONAL DOGE? SERIOUSLY?

Yes, the joke coin that started as a literal meme now shares ETF space with Bitcoin and Ethereum. Meanwhile, XRP—long tangled in regulatory battles—gets its biggest legitimacy boost since the Ripple case ruling.

TRADITIONAL FINANCE JAB

Because nothing says 'mature asset class' like packaging an internet joke and a legally-contested token into products bankers can finally understand—and charge fees on.

This changes everything. Or nothing. Depends who's holding the bag.

In brief

- Two ETFs backed by XRP and Dogecoin will be launched this week in the United States by Rex Shares and Osprey Funds.

- These products are registered under the Investment Company Act of 1940, distinct from Bitcoin and Ethereum ETFs.

- Crypto exposure relies on an indirect structure through subsidiaries based in the Cayman Islands.

- This launch occurs while over 90 other crypto ETF applications await SEC approval.

ETFs under constraint : an unusual regulatory architecture

While the chances of an approval of XRP and dogecoin ETFs had already risen to 90 %, two new exchange-traded funds are expected to debut this Thursday, offering regulated exposure to these two cryptos on the U.S. market.

Carried by Rex Shares and Osprey Funds, these products are registered under the Investment Company Act of 1940, which distinguishes them from previously launched crypto ETFs, generally governed by the Securities Act of 1933.

XRPUSDT chart by TradingViewAs explains Greg King, founder and CEO of REX Financial : “investors see ETFs as access and trading tools. The crypto revolution is already underway, and offering exposure to spot XRP within the framework of the ’40 US ETF Act is something Rex-Osprey is proud of and has worked hard for”.

Unlike Bitcoin or ethereum ETFs already on the market, these new products do not rely on direct ownership of cryptos. Exposure to the assets will be through an indirect structure, primarily via offshore subsidiaries. Here are the main elements of this architecture :

- For XRP, the fund will use an entity based in the Cayman Islands: REX-Osprey™ ;

- For Dogecoin, an equivalent model is planned, although its exact name is not mentioned in the public prospectus ;

- These ETFs may optionally use derivative products linked to the assets to complement their exposure ;

- The model does not constitute a pure spot ETF, but includes exposures to spot XRP ETFs from other jurisdictions, reinforcing the indirect link with the asset ;

- Their approval under the 1940 Act offers a more regulated framework for investor protection, while circumventing certain barriers imposed by the SEC on traditional spot products.

This arrangement reflects a willingness for regulatory innovation, given the inability to offer 100 % spot ETFs on assets still sensitive from the perspective of U.S. authorities.

Strategic choices that defy market standards

The choice of XRP and Dogecoin as underlying assets for these new ETFs is not accidental. While other products, notably on Solana, TRUMP or BONK, are still awaiting launch, XRP and DOGE are the first to cross this threshold.

Indeed, over 90 crypto ETF applications are still pending with the SEC, with decisions expected as early as October. Thus, the approval of XRP, DOGE and solana ETFs would even be a certainty, highlighting the favorable evolution of regulatory stance.

XRP, despite its turbulent legal history with the SEC, enjoys growing recognition among institutional investors. As for Dogecoin, it benefits from its historical popularity, abundant liquidity and ease of integration into derivative products.

These characteristics make them relevant candidates for ETFs built on an indirect architecture. It should be noted that Rex-Osprey has already successfully experimented with this type of arrangement. Last June, the company launched a Solana-based staking ETF, a world first.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.