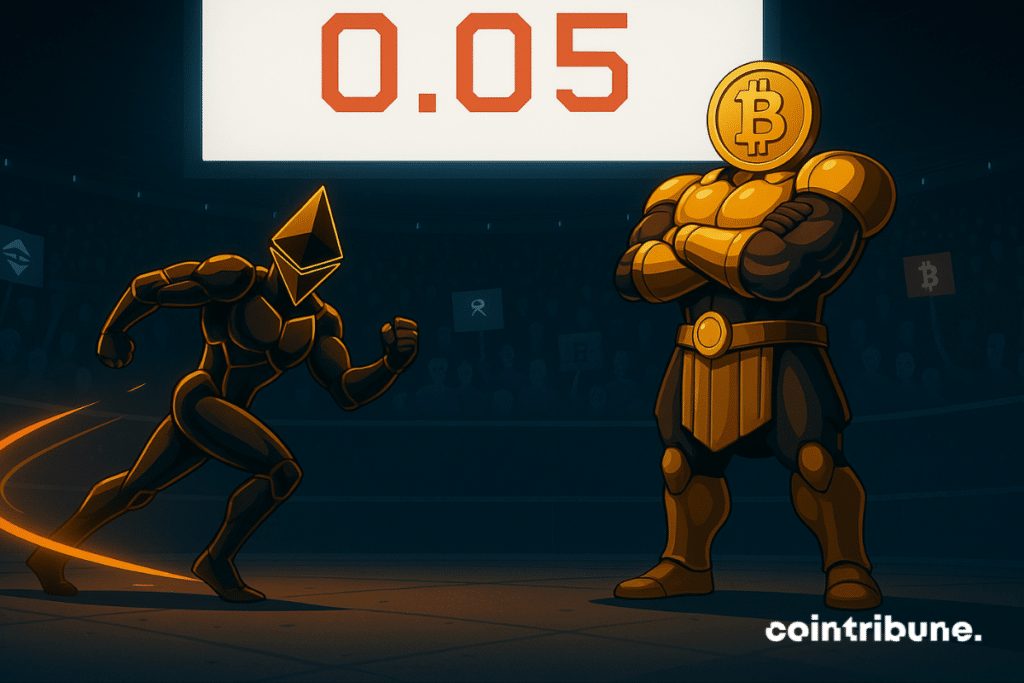

ETH/BTC Ratio Stays Below 0.05 - Ethereum’s Resilience Faces Ultimate Test

Ethereum keeps fighting—but Bitcoin's shadow looms larger than ever.

The 0.05 Barrier

That magic number just won't break. Despite network upgrades and surging DeFi activity, ETH continues trading at a discount against its older sibling. The ratio hasn't seen meaningful upward momentum in months—stuck in a pattern that's frustrating bulls and delighting Bitcoin maximalists.

Strength in Strange Places

Ethereum's fundamentals scream strength: transaction volumes hit new highs, Layer-2 networks process millions daily, and the merge remains on track. Yet none of it moves the needle against BTC. It's like bringing a flamethrower to a glacier—lots of heat, very little melt.

The Institutional Gravity

Bitcoin's first-mover advantage creates gravitational pull that even Ethereum's innovation can't escape. Wall Street's embrace of BTC as 'digital gold' leaves ETH fighting for oxygen in portfolios. Traditional finance's obsession with simple narratives—another reason crypto purists roll their eyes at suits.

Ethereum's patience game faces its toughest opponent: Bitcoin's relentless dominance. Sometimes, being better tech just isn't enough in a market that still treats crypto like speculative casino chips.

In brief

- Ethereum’s ETH/BTC ratio has stayed below 0.05 for 14 consecutive months, hitting extended lows.

- The yearly average ETH/BTC ratio dropped to 0.027 in 2025, its lowest in five years.

- Network activity remains high, signaling resilience despite underperformance relative to Bitcoin.

ETH/BTC Ratio Hits Extended Lows

A report from CoinGecko shows that the ETH/BTC ratio has stayed below 0.05 for 14 consecutive months, after dropping under that level at the end of July last year. The longest previous stretch below 0.05 lasted around 33 months, from August 14, 2018, to April 28, 2021.

In 2025, the yearly average ETH/BTC ratio dropped to 0.027, its lowest level in five years and comparable to levels seen during the 2019–2020 bear market. CoinGecko attributes the decline to Bitcoin’s continued institutional support and shifts in altcoin trading trends.

Adding to the decline is Ethereum’s price drop, which fell to $1,471 on April 9, 2025, pushing the ETH/BTC ratio below 0.02—a point not seen since February 2020. The measure later rebounded to 0.04 on August 23 as ethereum surged to a new record of $4,946. After a modest 6% decline from that peak, it currently stands at 0.039.

ETHBTC chart by TradingViewThe strong rebound between July and August saw Ethereum’s price rise by more than 100%. This rally was driven by financial institutions adding Ethereum to their reserves, wider investor participation through ETFs, and outreach by the Ethereum Foundation to major market participants.

CoinGecko estimates that if the ETH/BTC ratio rises back to 0.05 while Bitcoin trades between $100,000 and $124,000, Ethereum could reach new highs between $5,000 and $6,200.

Ethereum’s Journey from Outperformance to Underperformance

Looking back, in April, market analyst James Check stated on X that Ethereum strongly outperformed bitcoin between late 2015 and mid-2017. During that period, the ETH/BTC ratio peaked, and most trading days were profitable for Ethereum holders compared to Bitcoin.

Since late 2020, however, Bitcoin has regained dominance, and the ETH/BTC ratio has trended downward. As a result, the majority of trading days have been less profitable for Ethereum compared to Bitcoin.

Ethereum Shows Resilience Amid Market Challenges

Despite its underperformance relative to Bitcoin, Ethereum continues to show resilience. Large investors are actively increasing their holdings, and the network’s usage remains high. Figures from CryptoQuant reveal this trend:

- Ethereum fund holdings have doubled since April 2025 to 6.5 million ETH.

- This institutional activity is complemented by large wallets holding between 10,000 and 100,000 ETH, which now control over 20 million ETH, highlighting strong participation from major holders.

- At the same time, staking has reached a record 36.15 million ETH, reinforcing long-term commitment, reducing circulating supply, and potentially slowing new inflows if price momentum softens.

- Network activity is also on the rise, with total transactions and active addresses reaching record highs and daily smart contract calls surpassing 12 million.

At the time of writing, ETH is trading at $4,639, down about 1% over the past 24 hours. While it has lagged behind Bitcoin in recent years, the second-largest cryptocurrency remains well-positioned for growth according to current market indicators.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.