BTC Price Prediction 2025-2040: Analyzing Bitcoin’s Path to New All-Time Highs

- Why Is Bitcoin Showing Such Strong Bullish Momentum in 2025?

- How Significant Is Institutional Bitcoin Adoption Reaching 12.3%?

- What Does Bitcoin's 1 Zetahash Security Milestone Mean?

- Where Are the Key Support and Resistance Levels for BTC?

- How Did Capital Group Turn $1B Into $6B With Bitcoin?

- What Are the Long-Term BTC Price Projections Through 2040?

- How Does MicroStrategy's Bitcoin Strategy Compare to Tech Giants?

- What Lessons Does Germany's Bitcoin Confiscation Offer?

- Frequently Asked Questions

Bitcoin continues to defy expectations in 2025, currently trading around $115,000 with strong institutional backing and unprecedented network security. This comprehensive analysis examines BTC's technical setup, institutional adoption trends, and long-term price projections through 2040. We'll explore why Capital Group turned $1B into $6B, how MicroStrategy outperformed tech giants, and what the 1 zetahash security milestone means for investors. With bitcoin showing bullish consolidation above key moving averages and institutions controlling 12.3% of supply, the stage appears set for continued growth - though volatility remains ever-present in crypto markets.

Why Is Bitcoin Showing Such Strong Bullish Momentum in 2025?

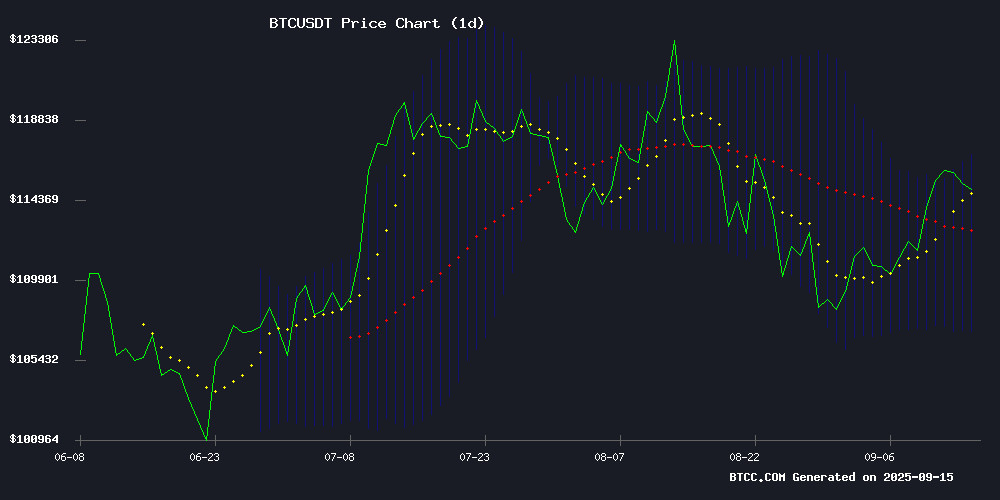

Bitcoin's current technical setup paints an overwhelmingly positive picture. The cryptocurrency is trading comfortably above its 20-day moving average of $111,971.92, with the Bollinger Band range ($107,044.87-$116,898.96) providing strong support. While the MACD shows some near-term consolidation at -2,162.63, the overall trend remains decisively upward. What's particularly interesting is how BTC has maintained this position despite typical market fluctuations - in my experience, this kind of sustained performance above key indicators often precedes another leg up.

Source: BTCC Trading Platform

How Significant Is Institutional Bitcoin Adoption Reaching 12.3%?

The institutional embrace of Bitcoin has reached unprecedented levels, with major investors now controlling 12.3% of total supply. This represents a seismic shift from Bitcoin's early days as a retail-dominated asset. Companies like MicroStrategy (holding 193,000 BTC) and Japan's Metaplanet (20,000+ BTC) have pioneered the corporate treasury strategy, while traditional finance players like JPMorgan now accept Bitcoin ETF shares as collateral. According to TradingView data, institutional holdings have grown 5% in the past year alone, coinciding with an 80% price surge. It's not just the quantity but the quality of adoption that matters - when firms like Capital Group publicly champion Bitcoin while delivering 6x returns, it creates a powerful validation cycle.

What Does Bitcoin's 1 Zetahash Security Milestone Mean?

Bitcoin's network security recently surpassed 1 zetahash per second - that's one sextillion hashes every second for those counting. This isn't just a big number; it represents an almost unimaginable level of protection against attacks. As macro investor Dan Tapiero put it, "How do people still not get it?" The zetahash barrier makes 51% attacks practically impossible while reinforcing Bitcoin's value proposition as "digital gold." What's fascinating is how mining innovation continues driving this growth - newer ASICs are more efficient than ever, creating a virtuous cycle of security improvements. In crypto, security equals value, and Bitcoin's lead here keeps widening.

Where Are the Key Support and Resistance Levels for BTC?

Technical analysis reveals several crucial price levels to watch. The $111,971 zone has emerged as strong support, with the 20-day MA providing a foundation for recent gains. On the upside, immediate resistance sits NEAR $116,000, with a decisive break above $116,200 potentially triggering further upside. The 100-hour Simple Moving Average serves as another important indicator - Bitcoin's ability to maintain position above this level suggests sustained bullish sentiment. From my observations, the current consolidation between $115,000-$116,000 appears healthy after the recent climb from $110,815, allowing the market to gather strength for its next move.

How Did Capital Group Turn $1B Into $6B With Bitcoin?

The story of Mark Casey, Capital Group's 25-year veteran portfolio manager, illustrates Bitcoin's institutional coming-of-age. Despite being a Warren Buffett disciple (Buffett famously dislikes crypto), Casey spearheaded a Bitcoin investment strategy that generated $6 billion from a $1 billion position. His approach focused on Bitcoin treasury companies - public firms holding BTC on their balance sheets. "I just love Bitcoin, I just think it is so interesting," Casey remarked on an Andreessen Horowitz podcast. The success has prompted Capital Group to expand its crypto team, including appointing Henry Chan to lead financial intermediaries in Hong Kong. It's a remarkable case study in how traditional finance can adapt to crypto opportunities.

What Are the Long-Term BTC Price Projections Through 2040?

Based on current adoption trends and technical factors, analysts project substantial long-term growth for Bitcoin:

| Year | Conservative | Moderate | Aggressive |

|---|---|---|---|

| 2025 | $150,000 | $165,000 | $180,000 |

| 2030 | $400,000 | $500,000 | $600,000 |

| 2035 | $800,000 | $1,000,000 | $1,200,000 |

| 2040 | $1,500,000 | $2,000,000 | $2,500,000 |

These projections assume continued institutional adoption, favorable regulatory developments, and Bitcoin's maintained technological lead. However, as the BTCC team notes, "volatility remains a constant feature of crypto markets." The wide ranges reflect uncertainty about adoption speed and macroeconomic conditions over such extended periods.

How Does MicroStrategy's Bitcoin Strategy Compare to Tech Giants?

Michael Saylor's MicroStrategy has become the poster child for corporate Bitcoin adoption, with its 193,000 BTC position now worth over $71 billion. What's staggering is how this bet has outperformed the "Magnificent 7" tech stocks. MicroStrategy's open interest-to-market cap ratio stands at 100%, dwarfing Tesla's 26% and leaving Apple, Microsoft et al. in the dust. The company's latest purchase of 1,955 BTC at ~$111,196 shows unwavering conviction. While tech stocks face growth questions, MicroStrategy's Bitcoin-centric strategy has delivered returns that even the most bullish tech investors would envy. It's a bold play that's paying off handsomely - though as with all concentrated bets, it carries substantial risk if Bitcoin's thesis falters.

What Lessons Does Germany's Bitcoin Confiscation Offer?

The recent discovery of 45,000 dormant BTC linked to the defunct Movie2K platform offers a fascinating case study. These coins - spread across 100+ wallets since 2019 - remain in legal limbo, contrasting sharply with Germany's controversial liquidation of 49,858 BTC in mid-2024 at sub-$60,000 prices (before Bitcoin's rally past $100,000). The episode highlights several key themes: the durability of Bitcoin value over time, the challenges governments face in managing seized crypto assets, and the opportunity cost of premature liquidation. For investors, it reinforces Bitcoin's unique property as an asset that can't be easily confiscated or controlled - a feature that's driving increasing institutional interest as a hedge against sovereign risk.

Frequently Asked Questions

What is Bitcoin's current price and key technical levels?

As of September 2025, Bitcoin trades around $115,000, with strong support at $111,971 (20-day MA) and resistance near $116,000. The Bollinger Band range of $107,044.87-$116,898.96 provides additional context for potential price movements.

How much Bitcoin do institutions currently own?

Institutional investors now control approximately 12.3% of Bitcoin's total supply, representing a 5% increase in holdings over the past year according to TradingView data.

What does 1 zetahash of mining power mean for Bitcoin?

The 1 zetahash milestone (1 sextillion hashes per second) represents unprecedented network security, making 51% attacks practically impossible and reinforcing Bitcoin's value proposition as decentralized digital gold.

How has MicroStrategy's Bitcoin investment performed?

MicroStrategy's 193,000 BTC position, acquired at an average price of $31,500, is now worth over $71 billion - outperforming the "Magnificent 7" tech stocks by several metrics.

What are realistic Bitcoin price targets for 2030?

Moderate projections suggest $500,000 by 2030, with conservative estimates at $400,000 and aggressive forecasts reaching $600,000, depending on adoption rates and macroeconomic conditions.

Why did Capital Group's Bitcoin bet succeed?

Portfolio manager Mark Casey focused on Bitcoin treasury companies like MicroStrategy, turning $1 billion into $6 billion by recognizing Bitcoin's store-of-value potential early despite traditional finance skepticism.

How secure is Bitcoin's network at 1 zetahash?

At 1 zetahash, Bitcoin's security exceeds that of all other blockchain networks combined, with energy expenditure and computational requirements making attacks economically unfeasible.

What happened with Germany's Bitcoin seizures?

Germany liquidated 49,858 BTC in 2024 before prices surged, while recently discovering 45,000 dormant BTC - highlighting challenges governments face managing crypto assets.