Tron Slashes Gas Fees - Daily Revenue Plummets 64% in Just 10 Days

Tron's bold fee reduction sends revenue into freefall—cutting daily earnings by nearly two-thirds within a single week and a half.

The Gas Gamble

Network activity surged as transaction costs dropped, but the math doesn't lie—lower fees mean thinner margins. Users cheer while treasury numbers bleed crimson.

Revenue Reality Check

That 64% drop hits harder than a margin call—proof that even in crypto, you can't escape basic economics. Cutting fees might boost adoption, but it's brutal on the balance sheet.

Welcome to decentralization's dirty little secret—someone always pays the price, even when they're trying to make things cheaper.

In Brief

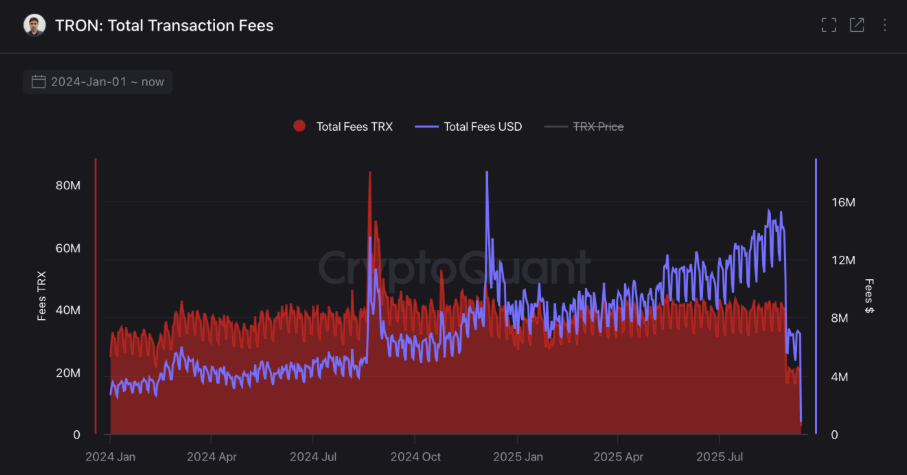

- Tron’s gas fee cut reduced daily revenue by 64%, falling to $5M, the lowest in over a year.

- Proposal #789 lowered Tron’s energy unit price from 210 sun to 100 sun, cutting transaction costs by 60%.

- Despite reduced fees, Tron still captured 92.8% of layer-1 blockchain revenue over the past week.

Daily Revenue Falls After Proposal #789

Tron’s total daily network fees fell to $5 million on Sept. 7 as reported by CryptoQuant. This was the lowest level in more than a year. Just before the adjustment, on Aug. 28, daily revenue stood at $13.9 million.

The reduction followed the approval of TRON Proposal #789, which became active on Aug. 29. The proposal was supported by the Super Representative community. It lowered the energy unit price from 210 sun to 100 sun.

Average gas fees dropped by 60% after the change. Gas fees on the tron network are measured in sun, the smallest divisible unit of TRX. One TRX is equal to one million sun. The new fee model has therefore reduced the cost of each transaction across the network.

TRXUSDT chart by TradingViewCommunity Argument for Lower Transaction Fees

GrothenDI issued the proposal in August, seeking to create more user activity on Tron. “This change will ensure the sustainable and healthy development of the Tron ecosystem,” the proposal stated.

The adjustment was expected to encourage new transactions by making transfers less costly for users. GrothenDI estimated the lower fees could allow for 12 million additional transfers on the network. This WOULD create new activity that may balance the lower revenue from fees.

Super Representatives, who validate and produce blocks on Tron, experienced the direct effect of the reduced revenue. However, the fee cut was designed to support the longer-term growth of the ecosystem by attracting more usage. The MOVE also aimed to make Tron more competitive against other blockchains.

Tron Maintains Lead in Blockchain Revenue

Even with reduced fees, Tron remains the leading layer-1 network in terms of revenue. Data from Token Terminal showed that over the past seven days, Tron captured 92.8% of total revenue among layer-1 blockchains.

In the last 90 days, fees generated on Tron reached $1.1 billion. This placed it well ahead of Ethereum, Solana, BNB Chain, and Avalanche in the same period. Ethereum, however, continues to lead over a longer timeframe, with $13 billion in revenue over the past five years compared to Tron’s $6.3 billion.

The data shows Tron’s strong position despite the drop in daily income from gas fees. The network continues to handle large volumes of transactions that keep it ahead of its competitors. The long-term effect of the fee reduction will depend on whether higher user activity offsets the lower fee rate.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.