Optimism Price Prediction: OP Targets $1.50 as Bullish Momentum Accelerates in 2025

Layer-2 token OP surges toward key resistance as crypto markets heat up

The Technical Breakout

Optimism's native token cracks through resistance levels with conviction, eyeing that psychologically significant $1.50 mark. Trading volume spikes 40% as institutional money finally discovers there's more to crypto than just Bitcoin.

Market Momentum Builds

Whales accumulate positions while retail FOMO starts creeping in—classic bull market behavior. The token's outperforming major altcoins this cycle, proving layer-2 solutions aren't just theoretical scaling talk anymore.

The Road Ahead

Key hurdles remain before claiming that $1.50 target, but the chart setup suggests traders aren't waiting for permission. Meanwhile, traditional finance guys still think 'OP' stands for operational performance—bless their spreadsheet-loving hearts.

Greed index flashes warning signals, but since when did crypto traders ever care about rational valuation metrics?

The coin has been consolidating for months, but renewed buyer activity signals a possible breakout on the horizon. With resistance zones being tested, investors are eyeing higher targets that could define the next stage of the bull run.

Breakout Potential and Resistance Tests

Optimism has spent months trading under a descending trendline that kept buyers from regaining momentum. However, recent sessions have brought the token close to the $0.85 resistance level, a point seen as a key pivot for the next market move.

A decisive breakout here could open the path toward $1.00, $1.20, and eventually $1.50, where stronger selling pressure may emerge. Such a move WOULD mark a significant shift in market structure and restore investor confidence.

Source: X

The formation of higher lows has provided the foundation for renewed tokens in the market. Price stability above $0.80 strengthens the bullish outlook, as it shows that sellers have struggled to push the coin lower. This gradual accumulation suggests that market participants are positioning ahead of a potential expansion in volatility. If resistance flips into support, the groundwork will be laid for a sustainable upward trend.

Volume dynamics also play a critical role in confirming the validity of this breakout attempt. A breakout supported by increasing participation typically signals stronger conviction from buyers, reducing the chances of a false rally. If these conditions align, the crypto’s technical setup points to a significant opportunity for upside movement in the NEAR term.

Market Performance and Liquidity Flow

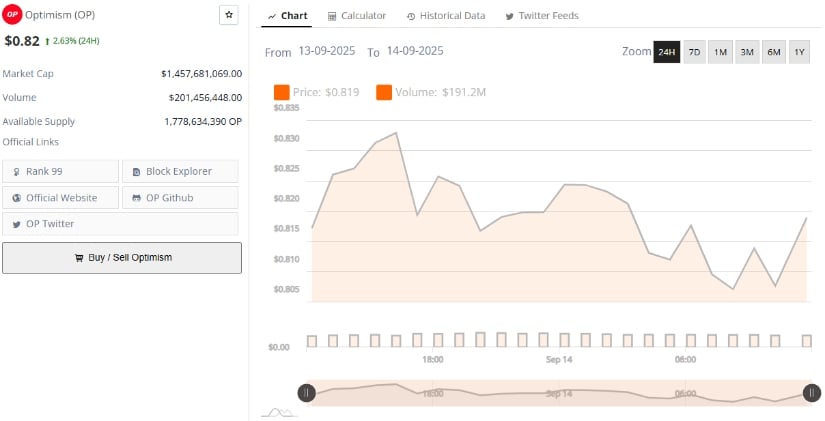

At the time of writing, the coin trades at $0.82, reflecting a 2.63% increase over the past 24 hours. The coin holds a market capitalization of $1.45 billion, ranking it 99th among cryptocurrencies by total value.

Daily trading volume stands at $201 million, underscoring growing participation and liquidity flowing into the project. These numbers highlight renewed interest from both retail and institutional participants.

Source: BraveNewCoin

The steady rise in trading activity shows that the asset is attracting consistent demand, even as broader market conditions remain uncertain. This liquidity inflow provides a buffer against sharp downside moves, reinforcing price stability around current levels. If volume continues to build, the token will be in a stronger position to sustain an eventual rally.

Technical Indicators and Bull Run Outlook

Additionally, Optimism’s technical indicators support a bullish narrative. The Chaikin Money FLOW (CMF) stands at 0.09, confirming net inflows into the asset, while the MACD line above its signal points to accelerating upward momentum. Together, these metrics reflect improving sentiment in the short term.

Source: TradingView

The structure suggests that breaking $0.85 decisively could trigger momentum toward $1.50, with interim resistance around $1.00 and $1.20. These levels may attract profit-taking but also act as stepping stones for higher valuations.

Looking ahead, the asset outlook ties closely to sustained market confidence in Layer-2 adoption. Should the breakout fully materialize, the bull run could push valuations beyond $1.50, marking a critical recovery phase after prolonged consolidation.