ETH Price Prediction 2025: Can Ethereum Reach $5,000 This Month? Analyzing the Bullish Case

- What Do the Technical Charts Say About ETH's Price Movement?

- How Are Supply Dynamics Affecting ETH's Price Potential?

- What Role Is Institutional Adoption Playing in ETH's Rally?

- Could ETH Realistically Reach $5,000 in September 2025?

- What Are Analysts Saying About ETH's Long-Term Potential?

- Frequently Asked Questions

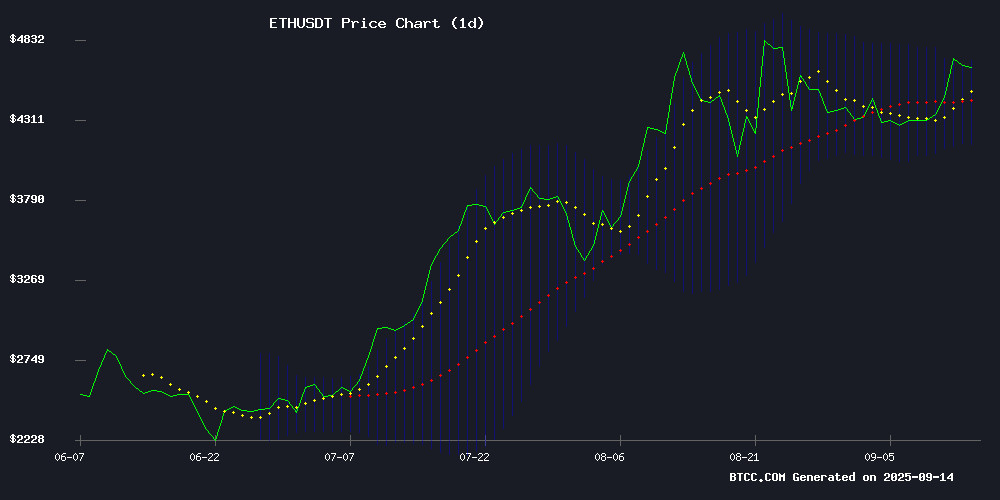

Ethereum (ETH) is showing remarkable strength as we approach mid-September 2025, with technical indicators and fundamental factors aligning for a potential push toward the psychological $5,000 barrier. Currently trading at $4,634.23, ETH has gained 13% in the past two weeks while demonstrating strong institutional adoption and favorable supply dynamics. The cryptocurrency maintains its position above key moving averages, with daily exchange outflows of 56,000 ETH creating a supply squeeze that could propel prices higher. Let's examine whether ETH can break through $5,000 this month and what factors are driving this potential rally.

What Do the Technical Charts Say About ETH's Price Movement?

As of September 14, 2025, ETH's technical setup paints a bullish picture. The cryptocurrency is trading comfortably above its 20-day moving average of $4,422.88, representing a healthy 4.8% premium that suggests sustained upward momentum. The Bollinger Bands show ETH hovering NEAR the upper band at $4,691.70, typically indicating strong buying pressure.

The MACD indicator shows a reading of -40.61, suggesting some near-term consolidation might occur before another potential leg up. According to TradingView data, ETH has established $4,070 as a firm support floor after multiple successful tests throughout August and early September.

How Are Supply Dynamics Affecting ETH's Price Potential?

The ethereum network is experiencing unprecedented supply constraints that could significantly impact price action. Three key factors stand out:

| Factor | Current Status | Impact |

|---|---|---|

| Exchange Outflows | 56,000 ETH daily | Reduces selling pressure |

| Staked ETH | 30% of supply | Locks up circulating tokens |

| Exchange Reserves | 18.8M ETH (lowest since 2016) | Creates supply squeeze |

These metrics suggest that available ETH for trading is becoming increasingly scarce, which historically precedes significant price appreciation. The current outflow rate mirrors patterns seen during ETH's previous major bull runs.

What Role Is Institutional Adoption Playing in ETH's Rally?

Institutional interest in Ethereum has reached new heights in 2025, with several landmark developments:

1. Fidelity's Ethereum-based money market fund surpassed $200 million in assets under management by September 1st, demonstrating growing confidence among traditional finance players.

2. WisdomTree launched its tokenized private credit fund (CRDYX) on both Ethereum and Stellar, bringing more institutional capital onto the blockchain.

3. Daily stablecoin inflows exceeding $1 billion indicate substantial capital rotation into Ethereum's ecosystem.

As one BTCC analyst noted, "We're seeing institutions treat Ethereum more like a technology platform than just a cryptocurrency. The network effects from these developments could have long-term implications for ETH's valuation."

Could ETH Realistically Reach $5,000 in September 2025?

Given current momentum, the $5,000 target appears achievable within the month. Here's why:

- The 8% required gain from current levels is modest compared to ETH's historical monthly movements

- Short liquidations totaling $14 million show strong buying pressure

- Open interest has surged 4.11% to $32.27 billion, indicating growing speculative interest

- The 30-day NVT ratio sits at historic lows, suggesting ETH may be undervalued relative to network activity

However, traders should watch for potential resistance around $4,700 where significant leverage clusters exist. A clean break above this level could accelerate the MOVE toward $5,000.

What Are Analysts Saying About ETH's Long-Term Potential?

While the $5,000 target dominates short-term discussions, some analysts see potential for significantly higher prices. September 2025 price forecasts suggest:

- Conservative estimates: $5,000-$5,500 range

- Bullish scenarios: $7,000+ if current momentum holds

- Extreme bullish cases: $10,000+ in 2026 under optimal macro conditions

The Ethereum Foundation's recent focus on privacy protections could provide additional fundamental support. Their September 12 roadmap announcement emphasized making privacy a default feature, potentially broadening Ethereum's appeal for institutional and regulatory purposes.

Frequently Asked Questions

What is the current ETH price as of September 2025?

As of September 14, 2025, ETH is trading at $4,634.23 according to CoinMarketCap data.

How much ETH is being withdrawn from exchanges daily?

Approximately 56,000 ETH is being withdrawn from exchanges daily, creating significant supply pressure.

What percentage of ETH supply is currently staked?

About 30% of Ethereum's total supply is currently locked in staking contracts.

What was Fidelity's Ethereum fund AUM in September 2025?

Fidelity's Ethereum-based money market fund surpassed $200 million in assets under management by September 1, 2025.

What is the key support level for ETH in September 2025?

The $4,070 level has established itself as strong support after multiple tests in recent months.