U.S. Regulators Greenlight Spot Crypto Trading on Major Exchanges - Game Changer for Digital Assets

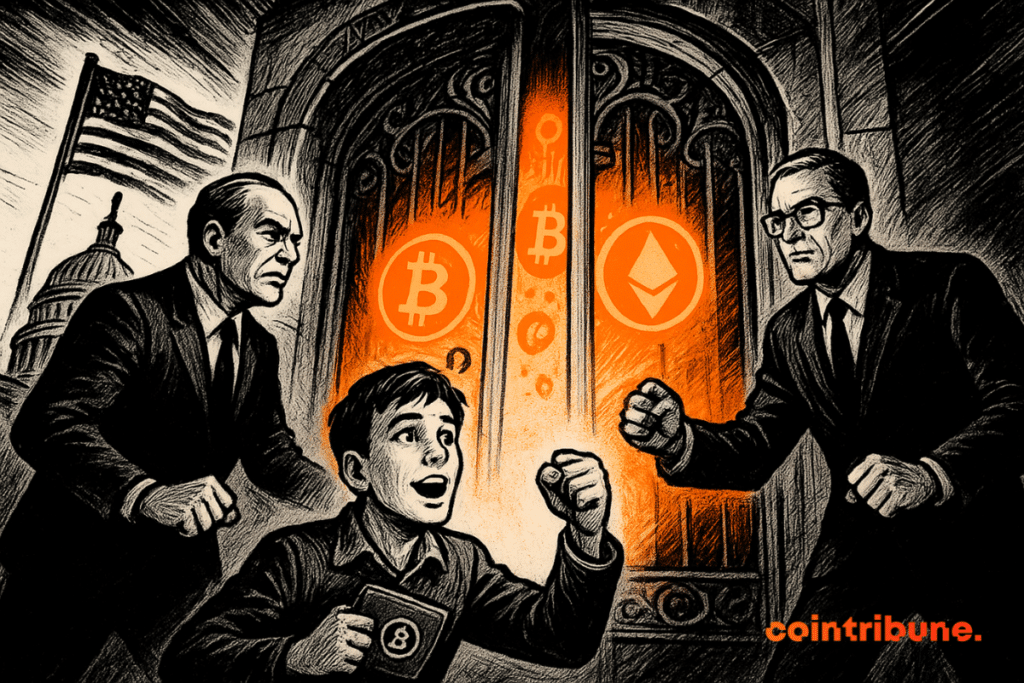

Wall Street's gates swing open for crypto—regulated exchanges now cleared for spot trading.

The Regulatory Shift

Federal agencies just handed institutional investors the keys to direct cryptocurrency exposure. No more futures contracts or synthetic products—real bitcoin, real ethereum, on platforms they already trust.

Market Impact

Expect liquidity surges as traditional finance giants finally get to play with digital assets properly. The move legitimizes crypto trading while giving regulators actual oversight—something they've been craving since Bitcoin first made bankers nervous.

The Fine Print

Exchanges must comply with stricter reporting and surveillance requirements. Because nothing says 'mature market' like more paperwork—Wall Street's favorite innovation killer.

This isn't just approval—it's assimilation. Crypto grows up, puts on a suit, and finally gets a seat at the big kids' table. Whether that's progress or surrender depends on which side of the ledger you're on.

In brief

- The SEC and CFTC clarify that regulated exchanges can facilitate spot cryptocurrency trading under current laws.

- Guidance applies to NSEs, DCMs, and FBOTs, allowing expanded crypto product offerings with oversight.

- Regulators stress the importance of compliance, investor protection, and market transparency in new spot markets.

- The move aligns with U.S. efforts to strengthen crypto rules, foster innovation, and encourage institutional adoption.

Regulators Invite Dialogue on Spot Crypto Trading and Market Standards

In the Tuesday statement, both agencies clarified that existing law does not stop regulated exchanges—both on U.S. soil and abroad—from listing spot crypto products, including those with leverage and margin features.

As the disclosure states, this included exchanges such as the national securities exchanges (NSEs), designated contract markets (DCMs), and foreign boards of trade (FBOTs). Regulators mentioned they are prepared to re-examine exchange filings and look into questions regarding ownership and clearing of crypto assets.

They further emphasized the need for new spot markets to adhere to regulatory standards. Meanwhile, investors and industry stakeholders were urged to contact the SEC or CFTC with questions and proposals.

Today, the Divisions provide their view that DCMs, FBOTs, and NSEs are not prohibited from facilitating the trading of certain spot crypto asset products. Market participants are invited to engage with SEC staff or CFTC staff, as needed.

SEC and CFTC joint statementThis MOVE is part of the President’s Working Group on Digital Asset Markets’ efforts to improve clarity over digital assets and drive blockchain innovation. Acting CFTC Chair Caroline Pham maintained that the U.S. has moved past the “regulatory hesitation” era. She also called on the country to position itself as a leading nation in the crypto space.

Regulated Exchanges Set to Expand Spot Digital Asset Trading

Recently, the CFTC has taken a softer stance on crypto assets, including the approval of listed spot crypto contracts on a futures exchange in August. Crypto commentators believe these recent moves could help drive institutional adoption, as regulated exchanges provide improved security and oversight compared to offshore platforms.

The recent statement by the CFTC and SEC indicates that traditional finance bodies can join crypto exchanges such as Coinbase and Kraken to pursue spot trading options. As clarified by the staff guidance, top regulated platforms such as the New York Stock Exchange, Cboe Global Markets, CME Group, and Nasdaq, alongside other CFTC-recognized exchanges, can offer spot crypto trading products.

Under the current administration, lawmakers and the WHITE House have laid the groundwork for clearer rules regarding crypto assets. Recent efforts by Congress include the Genius Act and CLARITY Act, alongside the President’s Working Group report.

The recent regulatory headway could help exchanges meet the growing demand for crypto trading. At the same time, it signals the intention of regulatory bodies to allow for a transparent, secure, and improved crypto trading environment.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.