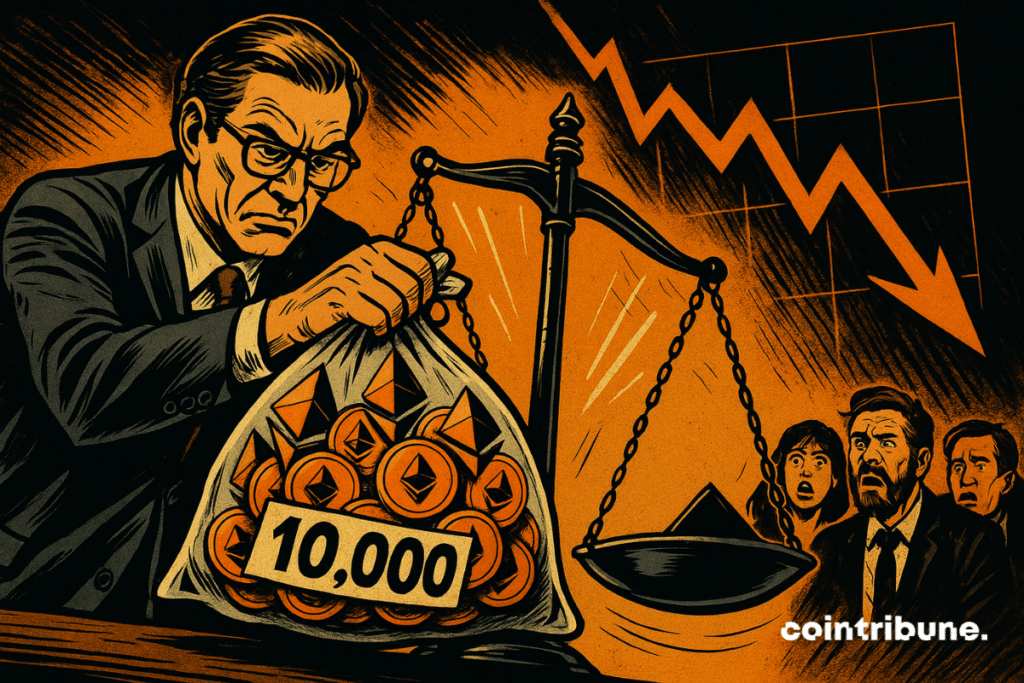

Ethereum Foundation Plans Strategic 10,000 ETH Sale to Fuel Ecosystem Development

Ethereum's core development arm makes bold move to fund next-generation projects

Strategic Treasury Management

The Ethereum Foundation isn't just dumping coins—they're executing a calculated treasury rebalancing. Selling 10,000 ETH positions them to fund groundbreaking development while maintaining substantial reserves.Ecosystem Funding Engine

This isn't about cashing out; it's about fueling innovation. The proceeds will pour into scaling solutions, security enhancements, and developer grants that keep Ethereum ahead of the competition.Market Impact Considerations

While 10,000 ETH represents meaningful volume, it's a drop in Ethereum's liquid ocean—smart money sees this as development funding, not desperation selling. Unlike traditional finance's quarterly earnings panic, crypto foundations actually build through market cycles.

In brief

- The Ethereum Foundation sells 10,000 ETH to finance research, donations, and grants.

- The sale is conducted via centralized platforms, through several split orders to limit impact.

- The crypto community criticizes this choice, preferring the use of DeFi protocols like Aave.

- The foundation retains about 224,800 ETH in treasury, equivalent to over one billion dollars.

Ethereum Foundation: a treasury under pressure

The Ethereum Foundation, from whom SharpLink bought 10,000 ETH last July, confirmed on X its intention to convert its ethers through several small transactions. The organization justifies this strategy by the need to fund its research programs, donations, and grants. According to its reports, the foundation still holds about 224,800 ETH, valued at over one billion dollars.

This announcement didn’t fail to stir the crypto-sphere. Gnosis co-founder Martin Koppelmann called out EF directly stating:

Curious. What’s missing from DEXs to do this operation on DEXs?

The remark illustrates deep frustration: why does an organization advocating decentralized finance choose a centralized crypto exchange (CEX) to liquidate its assets?

The answer might be summed up in one word: efficiency. By splitting its sales, EF limits the risk of price slippage and reduces operational exposure. But this pragmatism has a price: its image, as it fuels suspicion of ideological betrayal.

The builders’ anger: when DeFi feels betrayed

The crypto community quickly reacted. Marc Zeller, founder of AaveChan, summed up his disagreement succinctly: “Just use Aave.” For him and many others, it is incomprehensible that the foundation does not use the DeFi protocols it helps to grow.

A former Meta engineer, Josiah Gulden, went even further. “There are better ways to get liquidity than selling massively on the market,” he asserted.

Selling rather than borrowing doesn’t really inspire confidence in EF’s vision for ETH as a treasury asset

These criticisms remind us that, in the crypto universe, every technical decision turns into a philosophical question. EF acts like a traditional institution securing its income in fiat. Its detractors see this as a contradiction with Ethereum’s original promise: to free finance from intermediaries.

Ethereum: assumed transparency or ideological compromise?

Despite criticisms, some highlight a positive point: the foundation plays the transparency card. Unlike other organizations, it announced its sale before execution. A foundation collaborator, Binji, sought to put the sale’s scope into perspective. According to him, the 10,000 ETH sold weigh little against the overall market activity. He points out that, during the same week, treasury companies purchased about 403,800 ETH.

ETHUSD chart by TradingViewThese figures put the debate into perspective on the scale of a market that moves billions every day. But beyond the order size, it is the fragile balance between ideology and pragmatic management that draws the spotlight.

The question is not so much whether 10,000 ETH will MOVE prices, but whether the foundation betrays its own mission.

Some key figures

- $43.6 million: estimated value of the ETH sale;

- 224,800 ETH: remaining balance in the foundation’s treasury;

- 15%: cap on operational expenses set by the new policy;

- 2.5 years: liquidity reserve duration planned by EF;

These measures reflect a will for financial discipline. But they also foster the perception that the foundation is walking a tightrope: balancing the need for stability with the demand for ideological consistency.

This sale of 10,000 ETH is not a first for the Ethereum Foundation. Already in July, it sold a similar amount to SharpLink Gaming, a listed player. And more broadly, it is used to unlocking significant sums to anticipate major future challenges. Recently, it even mobilized several million to prepare for the post-quantum era, evidence that its vision remains focused on the sustainability of its ecosystem. Behind every sale lies the same equation: how to reconcile treasury, ideals, and Ethereum’s future?

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.