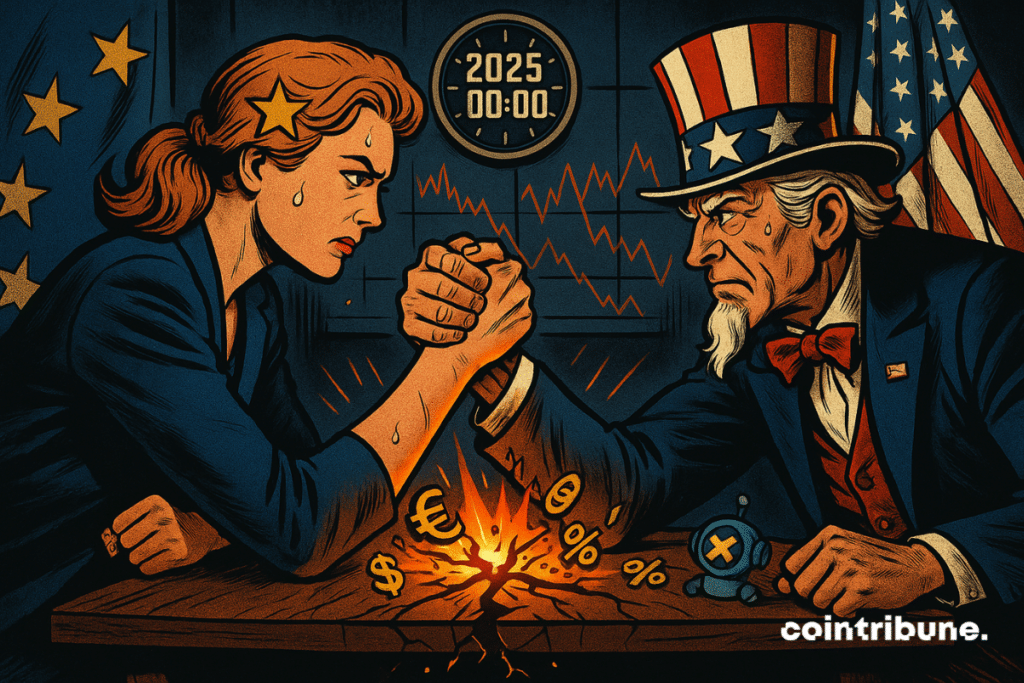

Trade War Escalation? Brussels Considers Unprecedented Retaliation Moves

Brussels sharpens its knives as global trade tensions hit a boiling point. The EU's next move could rewrite the rulebook—or spark a full-blown economic cold war.

Behind the chessboard: Insiders whisper about targeted sanctions that'd make Switzerland's neutrality look like a Vegas crapshoot. No sector appears safe—from luxury goods to blockchain infrastructure.

The crypto wildcard: Watch for digital asset markets to either panic or profit as traditional finance scrambles. (Because nothing says 'hedge' like volatile assets during geopolitical meltdowns—ask your 2022 Luna bagholders.)

One thing's certain: when bureaucrats start playing hardball, the only winners are lawyers and offshore account managers.

In brief

- France and Germany are stepping up pressure on the European Commission to organize a response to US tariff threats.

- Two rounds of European customs sanctions are ready : €21 billion worth of goods targeted from August 6, then an additional €72 billion from August 7.

- A third offensive, still in preparation, would directly target American digital giants via taxes on digital services and online advertising.

- Brussels is also considering activating the Anti-Coercion Instrument (ACI), a new tool allowing restrictions on American companies’ access to EU public markets.

The EU brings out the customs artillery

In a rare show of unity, France and Germany have officially called on the European Commission to activate targeted tariff measures against the United States if the TRUMP administration does not withdraw its threat to raise tariffs before August 1st.

A series of progressive retaliations is already ready. According to Financial Times revelations, a first package worth €21 billion could be deployed as early as August 6, targeting emblematic American products. A second wave, even heavier, an additional €72 billion of goods, WOULD be put to a vote the same day for possible implementation on August 7.

The decision is already mapped out, but hope remains that the United States will back down before the deadline.

The American products targeted by these European retaliations are not chosen at random. The European Union deliberately targets sectors with high visibility or strong political value in the American domestic market :

- The first salvo (€21 billion) : consumer goods such as chicken and jeans, with a high symbolic impact on the daily lives of US households ;

- A second salvo (€72 billion) : strategic products, notably Boeing planes or bourbon, industries strongly established in key Trump states ;

- The third salvo being prepared : it would target American digital services, with potential taxes on online advertising and certain GAFAM business models.

This rapid toughening is a direct response to a letter sent by Donald Trump, in which the American president warns the EU of his intention to raise tariffs to 30 %. This message has, according to several diplomatic sources, caused a radical change of tone in Berlin.

Germany has made a 180-degree turn in a few days, as even the most moderate within Europe now want to show they will not yield without leverage.

A new weapon in the European arsenal : the Anti-Coercion Instrument

Alongside classic customs measures, Berlin and Paris now support a tool never before activated but potentially explosive : the Anti-Coercion Instrument (ACI). This legal mechanism, designed to counter economic pressures exerted by foreign powers, would allow the European Commission to ban American companies from European public markets, cancel their intellectual property protections, or even suspend their operations in certain sectors.

Activation of this instrument would require a formal investigation into American practices, followed by validation by member states if economic coercion is confirmed.

However, the ACI divides opinion within the Union itself. While France and Germany see it as a credible deterrent amid rising tensions, several European diplomats warn. For some, “there is a silent majority against triggering the ACI”, while others think : “it would be nuclear. The situation is too unstable to confidently assess the opinion of member states”. This hesitation reflects the caution of some European countries, who fear a commercial spiral difficult to control.

As tensions worsen and threats of trade retaliation multiply, some investors are beginning to seek assets likely to escape traditional political turbulences. In this climate of uncertainty, Bitcoin is gaining credibility among institutional actors as a digital safe haven.

If a customs escalation were to impact the euro or the dollar, markets could turn to decentralized assets, perceived as independent of states’ monetary and fiscal policies. In the event of a decline in confidence in fiat currencies, or cross-sanctions on technological sectors, the crypto queen could benefit from renewed attractiveness, both as a hedge against instability and as a systemic alternative.

Adoption of the ACI would have major implications far beyond EU-US relations. It would signal a Europe ready to assert itself as a sovereign power in the global economic confrontation. For the technology sector, including American digital giants, the impact could be immediate, notably with plans for taxation of digital services or advertising tax mentioned in a third list prepared by Brussels, as evidenced by its response last March to the announcement of US taxes on metals.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.