Greenback Flexes Muscle—Gold Miners Get Crushed

The dollar’s bull run just turned gold miners into collateral damage. As the USD index surges, traditional safe-haven assets are getting hammered—proving once again that in finance, the only ’safe’ bet is volatility itself.

Miners’ margins evaporate when fiat strength overpowers metal lust. Another day, another lesson in why tying fortunes to centralized monetary whims is a rigged game.

In Brief

- The US dollar climbs to 99.44 points, making gold less attractive and causing a 0.6% drop in price.

- Major mining companies record significant declines, revealing the sector’s vulnerability.

- Amid uncertainty about Fed policy, miners adapt their strategies while bitcoin emerges as a safe-haven alternative.

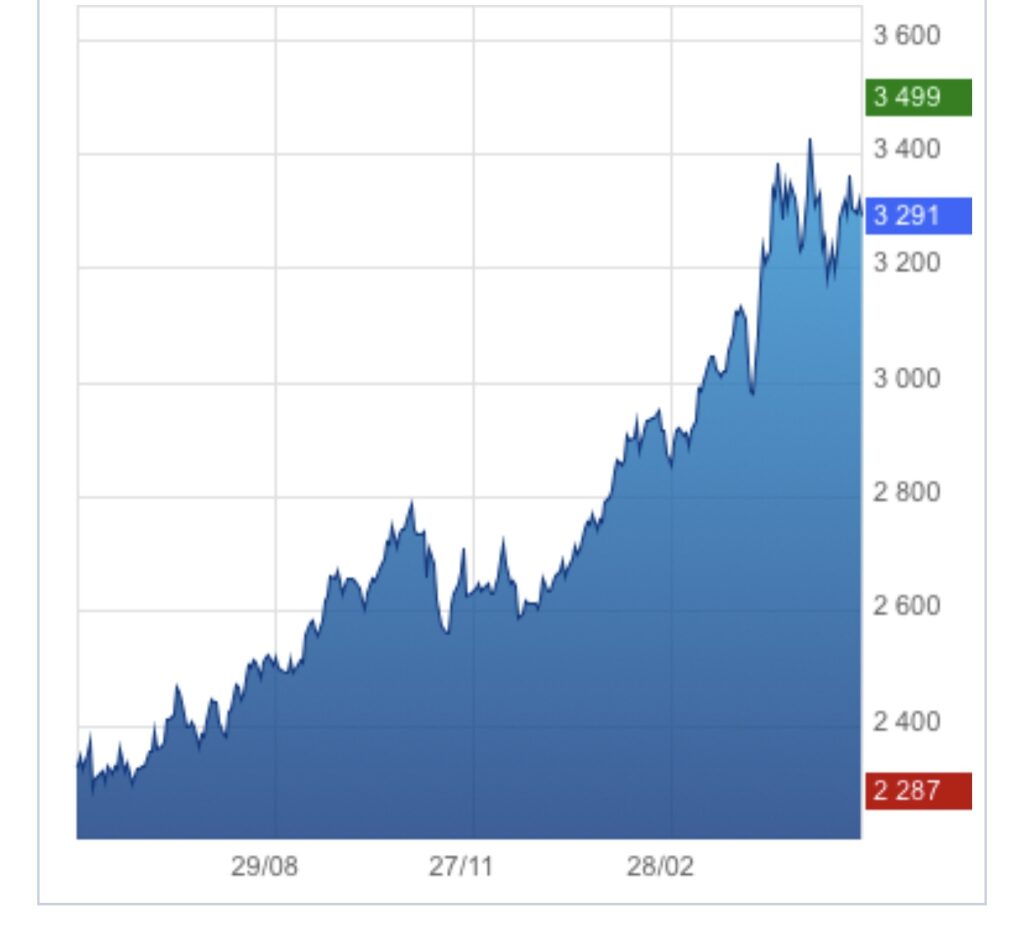

The Rising Dollar: A Setback for Gold

Two months after Goldman Sachs’ warning about a dollar surge, the prediction is confirmed: the DXY index reaches 99.44 on May 31, 2025, up 0.11% in one day. This surge is fueled by expectations of tighter monetary policies from the Federal Reserve. Result: gold becomes less attractive to foreign investors. The ounce falls 0.6% to $3,296.30 — compared to its peak of $3,499 — wiping out recent gains and raising doubts about its safe-haven status.

A dynamic that directly affects gold mining companies, whose shares record significant declines:

- Newmont: nearly a 1% drop;

- Barrick Gold: similar decline;

- AngloGold Ashanti (South Africa): -2%;

- Sibanye Stillwater: -1.8%;

- Harmony Gold: -1.4%;

- Agnico Eagle Mines (Canada): -1%;

- Kinross Gold: -1%.

This massive downward movement reflects the structural fragility of the gold sector in the face of monetary shocks and dependency on the precious metal’s price.

Gold Miners Facing the Dollar’s Monetary Storm

Markets hold their breath approaching the Fed meeting in June. Between sluggish growth, declining consumption, and uncertain employment, the dilemma persists. Rate cuts in June? Concern grows over a fragile economy. The monetary pivot remains highly uncertain. Faced with this monetary pressure, mining companies adapt:

- Reducing operational costs to preserve margins;

- Financial hedges against dollar fluctuations;

- Geographic and mineral diversification to limit systemic risks.

Their survival will depend on their ability to navigate this restrictive cycle.

What Room for Maneuver Does a Struggling Sector Have?

While gold prices fall, gold miners’ revenues drop, creating a fragile economic model: high extraction costs facing volatile gold prices. In this context, some choices become inevitable, and here are the levers still available:

- Freezing projects with high capital intensity;

- Revising long-term investment plans;

- Exploiting deposits with lower marginal costs;

- Negotiating commercial or merger agreements to consolidate balance sheets.

Each strategic decision could determine the survival or disappearance of major players in the gold sector. In this fragile context, some investors redirect their attention to bitcoin, seen by some as a new store of value.

BTCUSD chart by TradingViewGold, the eternal barometer of economic uncertainties, now falters under the weight of an overly strong dollar. However, a US bill will cause the downfall of this Dollar, according to Peter Schiff. But until that fateful day, it is indeed the mining value chain that pays the highest price. Resilience is forged in adversity. One must only hold on long enough to rebound.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.