Crypto: The Polish Parliament Ignores the President’s Veto

Poland's legislature just bulldozed a presidential veto on crypto legislation. It's a move that cuts through bureaucratic red tape and signals a stark shift in regulatory posture.

The Power Play

Forget gentle persuasion. The parliament bypassed the executive branch entirely, overriding the veto with a decisive majority vote. This isn't just policy—it's a political statement. The message to the crypto industry is clear: Warsaw is open for business, presidential objections be damned.

What It Means for Markets

Legal clarity is the oxygen markets breathe. By solidifying a regulatory framework, Poland just pumped fresh air into its domestic digital asset ecosystem. Expect exchanges and blockchain firms to accelerate expansion plans, viewing the country as a new beachhead in the European Union. It's a classic case of legislation trying to outpace innovation—a race governments usually lose, but this time they're sprinting.

The Ripple Effect

Watch Brussels. Poland's unilateral move puts pressure on the EU's slower, consensus-driven approach to crypto regulation. One nation's decisive action could force the bloc's hand, potentially fragmenting the regulatory landscape or, conversely, catalyzing a unified policy. Either way, the inertia is broken.

Poland isn't just updating its rulebook; it's rewriting the political playbook on how to handle disruptive tech. In the high-stakes game of crypto regulation, they've just gone all-in. Let's see if the hand holds, or if it's another case of politicians chasing a trend they barely understand—the financial equivalent of buying the top.

Read us on Google News

Read us on Google News

In brief

- The Polish Parliament revives a controversial crypto bill, ignoring President Nawrocki’s veto.

- In the United States, Charles Hoskinson accused Donald Trump and his $TRUMP token of causing the CLARITY Act to fail, turning crypto regulation into a partisan issue.

- Bitcoin positions itself as the big winner of regulatory tensions, strengthening its status as a safe haven amid political instability.

Poland: the terrible crypto standoff between Parliament and the president

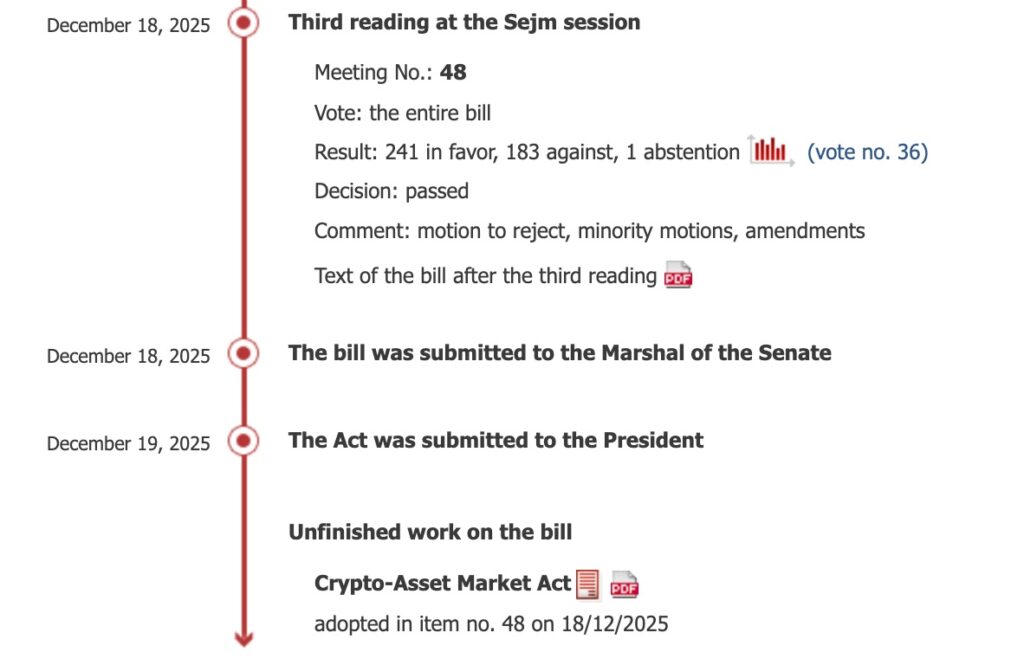

The Polish Parliament has reapproved the Crypto-Assets Market Act, defying President Karol Nawrocki’s veto. This bill, aligned with the European regulation MiCA, aims to strictly regulate the crypto market in Poland. In a tense vote, 241 deputies supported the text against 183 opponents, sending the file to the Senate for further evaluation.

Nawrocki had rejected this bill in December, arguing it threatened individual freedoms and economic stability. Yet, legislators, supported by Prime Minister Donald Tusk, reintroduced the text unchanged. Critics point to the extensive powers granted to the Polish Financial Supervision Authority (KNF), including enormous fines and website blocks.

Players in the crypto industry fear these measures will stifle innovation and push businesses to leave the country. Meanwhile, the Senate must now decide. If the text is adopted, it could return to Nawrocki’s desk, who, after a security briefing, seems more inclined to sign it. A decision that could redefine the future of cryptocurrencies in Poland.

Trump derailed crypto regulation in the United States, according to Charles Hoskinson

In the United States, crypto regulation took an unexpected turn with the arrival of the $TRUMP token. According to Charles Hoskinson, founder of Cardano, this memecoin sabotaged bipartisan efforts to adopt the CLARITY Act, which will be debated in the US Senate in January. Before its launch, the bill enjoyed broad support, with nearly 70 senators ready to vote in its favor. But the arrival of $TRUMP changed everything.

Hoskinson explains that this memecoin turned the regulatory debate into a political issue, associating cryptocurrencies with partisan polarization. Democrats, reluctant to support a bill perceived as pro-Trump, withdrew their backing. The timing was therefore catastrophic. Instead of clear regulation, the American crypto market finds itself in a gray area where innovation is hampered by uncertainty.

Bitcoin: the big winner of regulatory wars?

In this context of regulatory tensions, Bitcoin emerges as the main beneficiary. While altcoins suffer the consequences of political uncertainties, BTC strengthens its position as a safe haven. Investors, seeking stability, turn to this crypto, perceived as less vulnerable to legislative upheavals.

In Poland, as in the United States, debates about regulation create a climate of instability. Yet, bitcoin continues to progress, demonstrating its resilience. Its status as a decentralized and limited-quantity asset makes it an attractive option compared to traditional currencies and more speculative cryptos. However, the recent institutional enthusiasm for XRP and Solana ETFs is shifting the trend, and could dethrone BTC.

Poland and the United States illustrate the challenges of crypto regulation. Between innovation and control, governments struggle to find a balance. Bitcoin, meanwhile, pulls its weight, confirming its status as a SAFE haven asset. These tensions raise a crucial question: which regulatory model should the crypto world adopt to reconcile security and growth?

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.