Dogecoin Price Prediction: DOGE Eyes $0.15 Rebound in 2025

Dogecoin's price action is flashing a bullish signal—traders are watching for a potential surge toward the $0.15 level.

The Meme Coin's Technical Setup

DOGE's chart is carving out a classic recovery pattern. After a period of consolidation, key momentum indicators are hinting at a shift. The $0.15 mark isn't just a random number; it represents a critical psychological and technical resistance zone that, if broken, could open the door to more significant gains. The market's sentiment around the asset is turning, driven by a mix of technical alignment and that ever-present, slightly irrational, meme-fueled optimism.

Why This Rebound Matters

A move to $0.15 would represent a substantial percentage climb, reinforcing Dogecoin's unique position as a bellwether for retail crypto sentiment. Its performance often acts as a gauge for the broader "risk-on" appetite in digital assets. While fundamentals might be… debatable, its liquidity and community backing give it a staying power that continues to baffle traditional finance pundits who still think an asset needs a spreadsheet to have value.

The Road Ahead

All eyes are on whether DOGE can gather enough buying pressure to stage a clean breakout. Success hinges on maintaining support at key lower levels and seeing volume confirm the upward move. Failure to do so could see it retreat back into its trading range—a reminder that in crypto, even the most cheerful memes face the cold, hard laws of supply and demand. After all, what's a little volatility between friends when you're betting on the digital equivalent of a Shiba Inu?

TLDR

- Dogecoin price defends $0.124–$0.126 support after liquidity sweep

- Bullish RSI divergence signals fading downside momentum

- Reclaiming $0.128–$0.130 may open path toward $0.15

- Long-term descending wedge suggests structural accumulation

Dogecoin price is showing early signs of stabilization after a volatile short-term decline, as analysts assess emerging reversal signals across multiple timeframes. Short-term charts point to weakening sell pressure, while momentum indicators and long-term structures suggest accumulation behavior. If key levels are reclaimed, Doge could attempt a rebound toward the $0.15 region and beyond.

Short-Term Dogecoin Price Battles Key Support

According to analyst Crypto Tony, the 4-hour Doge price chart reflects a sharp sell-off from the $0.1360 area, followed by repeated tests of lower support. Price briefly swept liquidity below $0.1240 before rebounding, a move often associated with capitulation rather than trend continuation. Recent candles show higher lows forming near $0.1260, signaling growing buyer interest as downside volume fades.

SOURCE: X

In addition, the chart highlights a critical zone between $0.1280 and $0.1300, which previously acted as resistance. A successful reclaim of this range could flip market structure in favor of buyers. crypto Tony noted that failure to hold this area risks renewed weakness toward $0.1200, while confirmation above support may open a path toward $0.1350–$0.1400.

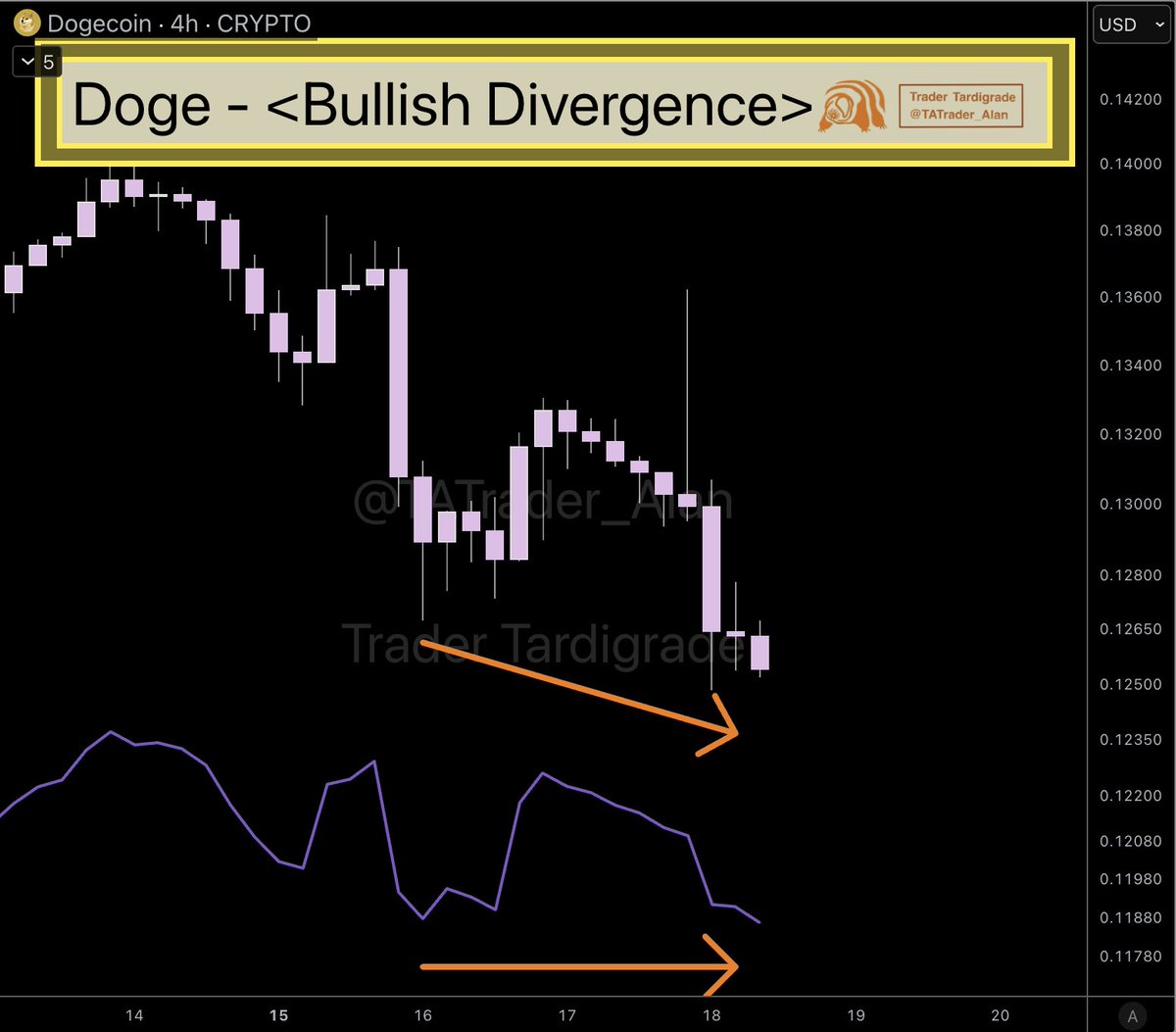

RSI Divergence Suggests Momentum Shift

Meanwhile, analyst Trader Tardigrade pointed to a developing bullish divergence on the 4-hour RSI. While Dogecoin price has continued to print lower lows from above $0.1400, the RSI has formed higher lows, indicating waning bearish momentum. This divergence often appears near inflection points, particularly after extended declines.

SOURCE: X

Furthermore, volume behavior supports the divergence thesis. Selling spikes have become less aggressive, suggesting distribution pressure is weakening. Trader Tardigrade explains that a breakout above the recent swing high near $0.1320 WOULD confirm momentum reversal. Such a move could target $0.1450–$0.1500, while a breakdown below divergence lows would invalidate the setup and expose $0.1180.

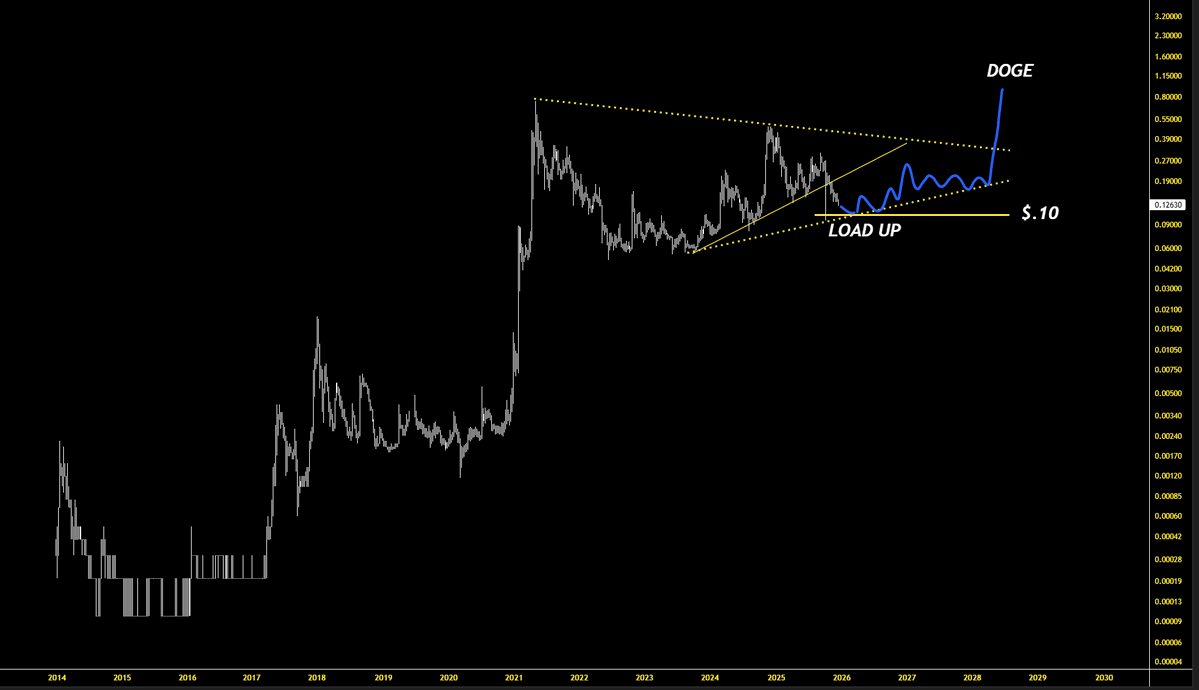

Long-Term Wedge Points to Structural Accumulation

From a macro perspective, analyst Hailey LUNC highlighted a multi-year descending wedge on the dogecoin price logarithmic chart. The pattern shows price compressing between converging trendlines since 2021, marked by lower highs but gradually higher lows. This structure is commonly viewed as a bullish continuation formation when sustained over long periods.

Moreover, volume has steadily declined throughout the wedge, reinforcing the idea of consolidation rather than distribution. The absence of fresh macro lows supports the accumulation narrative. Hailey LUNC suggests that a confirmed breakout above the upper trendline could unlock significant upside over time, with long-term projections extending toward $1.10 in an optimistic scenario, subject to broader market conditions.

Taken together, short-term stabilization, momentum divergence, and long-term compression provide a layered view of DOGE’s market structure. Each timeframe highlights different risks, yet all point to diminishing downside pressure. Confirmation remains essential, particularly around reclaimed resistance and volume expansion.

As crypto market sentiment evolves, Dogecoin price action near current levels may define the next directional phase. Analysts continue to monitor key breakout zones, noting that meme assets often react sharply once momentum shifts.