Stablecoin Market Shatters Records: Hits $310.11 Billion Milestone

The digital dollar's quiet takeover just hit a new decibel level.

From Niche to Necessity

Forget the wild volatility of Bitcoin's peaks and troughs. The real story in crypto is the relentless, boring march of stablecoins—digital tokens pegged to assets like the US dollar. They're the plumbing of the decentralized finance world, and that plumbing just got a massive upgrade. The market's total value locked has surged past a once-unthinkable threshold.

The Engine Room of Crypto

This isn't just a number on a chart. It represents capital poised for action—liquidity for trading, collateral for loans, and a safe harbor during market storms. It's the grease that lets the multi-trillion dollar DeFi machine actually function, allowing users to swap assets and earn yield without ever touching a traditional bank. A cynic might say it's the ultimate irony: the most revolutionary adoption in crypto looks an awful lot like people desperately chasing the stability of the old financial system they claim to disrupt.

What's Fueling the Fire?

Several forces are converging. Mainstream financial institutions are dipping their toes in, using stablecoins for faster, cheaper settlements. In regions with shaky currencies or capital controls, they offer a digital lifeline to the global economy. And let's be honest—in a world of 5%+ Treasury yields, parking cash in a yield-bearing stablecoin pool starts to look less like speculation and more like...sensible asset management. The lines are blurring.

The market has spoken. While the headlines chase the next meme coin, the foundational layer built on stability just proved it's the sector's most powerful—and perhaps most subversive—force.

Read us on Google News

Read us on Google News

In brief

- The stablecoin market reached a historic peak of $310.117 billion on December 13, 2024.

- Tether’s USDT and Circle’s USDC dominate with 85% combined market share.

- The capitalization grew by 52.1% in one year, from $203.7 to $309.9 billion.

- Yield stablecoins lose ground with a 1.9% decline over 30 days.

A meteoric rise driven by industry giants

On Saturday, December 13, the stablecoin market crossed a symbolic milestone by reaching $310.117 billion in capitalization.

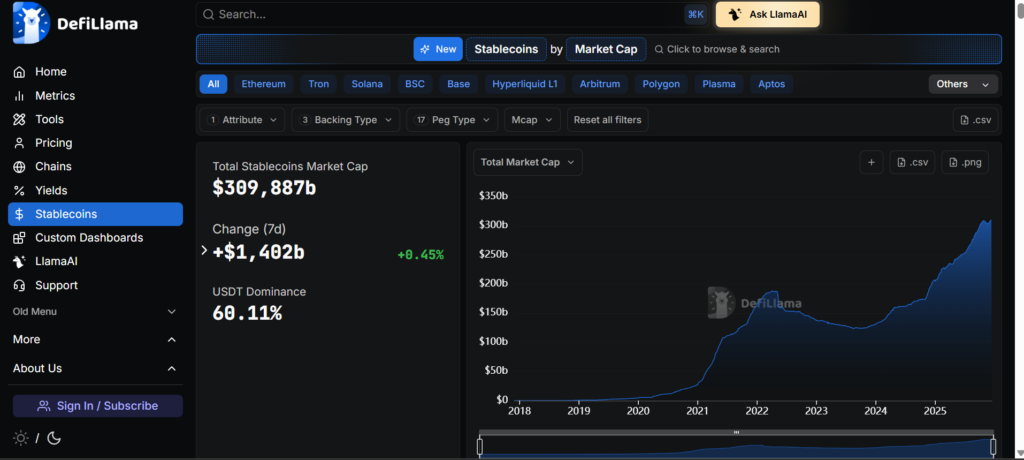

Currently stabilized around $309.9 billion according to DeFiLlama, this new record illustrates investors’ persistent confidence in these digital assets backed by traditional currencies.

DeFiLlama .

Tether’s USDT maintains its position as the undisputed leader with $186.2 billion in capitalization, representing 60.10% of the total market.

Its rival Circle, with USDC, solidly holds second place with $78.3 billion and 25% market share. This two-headed dominance forms the backbone of a rapidly evolving ecosystem.

The sector’s growth impresses with its vigor. In twelve months, valuation jumped 52.1%, adding over $106 billion to overall capitalization. This expansion continued despite October’s turbulence, during which the market briefly retreated to $302.8 billion before rebounding strongly.

The issuance of new tokens fuels this momentum. Over the last seven days, Tether injected $593.3 million of USDT across several blockchains such as Tron, Solana, and Arbitrum. Circle followed with $555.5 million of USDC deployed on Ethereum, Solana, and Base. In total, the sector gained $1.79 billion in a week.

Yield stablecoins suffer a worrying setback

While traditional stablecoins thrive, their yield cousins face troubling turbulence.

Ethena’s USDe fell by 2.98% this week, while USDtb plunged 18.99%. These figures reveal growing disillusionment among investors toward these more complex products.

This disenchantment stems from October events when USDe temporarily lost its peg to the US dollar. This incident shook confidence and triggered massive sell-offs. Over thirty days, yield stablecoins’ capitalization shrank by 1.9%, with investors preferring the safety of non-yield products.

Weekly losses illustrate this flight to quality. alUSD collapsed 80.5%, smsUSD 68.1%, and sBOLD 13.6%. BlackRock’s BUIDL, despite being backed by a prestigious institution, dropped 13.24%. These setbacks contrast with the stability of market leaders.

Meanwhile, institutional adoption progresses quietly but surely. YouTube started paying its American creators in PayPal’s PYUSD, confirmed by May Zabaneh, crypto lead at PayPal.

This integration into Google’s ecosystem marks a significant step toward stablecoins’ normalization in the digital economy. PYUSD has also risen 13.33% in thirty days, reaching $3.86 billion in capitalization.

Crossing the $310 billion mark confirms the growing maturity of the stablecoin market, now established as an essential infrastructure of the crypto ecosystem. While yield products struggle to convince after October’s shocks, traditional stablecoins stand as preferred refuges, attracting institutions and individuals alike.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.