Bloodbath in Crypto: Why Are BTC, ETH, and XRP Leading the Market Crash?

Crypto markets got sucker-punched today—Bitcoin, Ethereum, and Ripple’s XRP spearheaded the nosedive. Here’s the damage.

### The Big Three Bleed Out

No safe havens here. BTC sliced through support levels like a hot knife, ETH got caught in the deleveraging crossfire, and XRP—well, it did what XRP does best: volatility theater.

### Liquidity Ghost Town

Market depth evaporated faster than a meme coin’s promises. Thin order books magnified every sell order into a mini flash crash. Thanks, high-frequency algo traders.

### Macro’s Shadow Play

Fed jitters? Recession whispers? Crypto doesn’t care about fundamentals—until suddenly it does. Today was a ‘does’ day.

### The Silver Lining Playbook

Dips get bought. Always have. Whether this is a blip or the start of something uglier depends on who’s holding the leverage bag. Bonus cynicism: At least the ‘stable’ in stablecoins still refers to their 1:1 peg… mostly.

The global cryptocurrency market has taken a sharp downturn today, shedding over 1% from its total market cap, now sitting at $3.8 trillion. Meanwhile, 24-hour trading volume has spiked by 9.15%, a sign of turbulence rather than growth. From Bitcoin’s stumble below $116k to widespread liquidations across altcoins, today’s decline is driven by a combination of over-leveraged bets, profit-taking, and capital flight from riskier assets.

What Happened?

Long Squeeze Triggers Chain Reaction

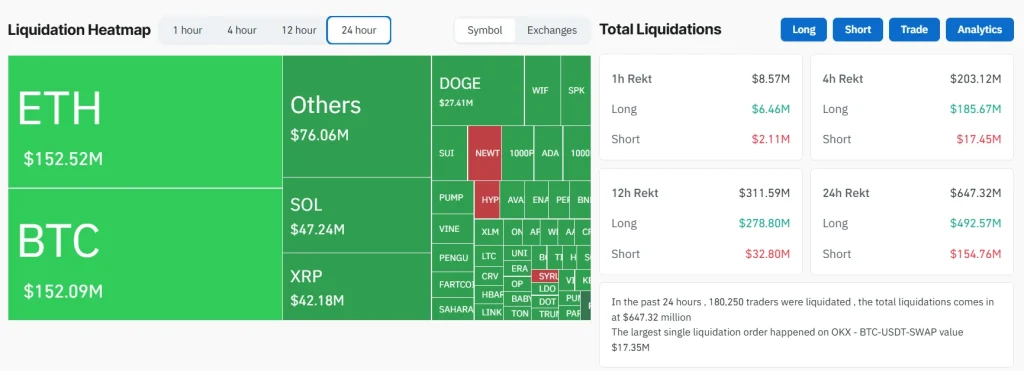

Bitcoin’s drop below $116k shattered its major short-term support, triggering a massive $585M in long liquidations within 24 hours. ETH followed closely, losing $104M in longs, while altcoins like Dogecoin (-7%) and PAAL AI (-4.8%) were among the worst performers.

The average funding rate across exchanges (+0.008%) indicates excessive bullish leverage, now being punished. The domino effect pushed BTC liquidations up by 123%, forcing automated sell-offs and creating further downward pressure.

Why Now?

Profit-Taking After a 30-Day Rally

After a 16% gain over the last month, which was mainly driven by ETF Optimism and retail FOMO, many traders are now cashing in. The 21-day RSI climbed to 74.25 (overbought territory), while MACD showed bearish divergence (-3.68B), hinting at trend exhaustion. Stablecoin inflows surged $11B in July, a signal that investors are temporarily parking funds in safer assets.

Altcoins Face Added Pressure

Rotation into Safety

Altcoins are bearing the brunt as Bitcoin dominance rises to 60.8%. Illiquid and speculative tokens, such as memecoins, tanked sharply due to post-hype sell-offs and thin order books. Uncertainty around the GENIUS Act’s stablecoin regulations is further driving caution, reducing trader appetite for high-beta bets.

Conclusion

Today’s dip is less about panic and more about profit-taking, exaggerated by a high-leverage market setup. With the Fear & Greed Index still at a greed-driven score of 66, sentiment remains optimistic, but fragile. If BTC can defend $115k ahead of Friday’s U.S. PCE inflation data, we could see fresh buying emerge. However, a deeper macro sell-off or further liquidations may flip the sentiment decisively bearish.

FAQs

What triggered the market drop today?A combination of long position liquidations, overbought technicals, and profit-taking after a major rally.

Is this the start of a deeper correction?Not necessarily, as the key support at BTC’s $115k and ETH at $3,500 could bring dip-buyers back if held.

What should I watch next?Keep an eye on Friday’s U.S. PCE data, Bitcoin’s support at $113k–$115k, and ETF inflow trends.