🚀 Ethena (ENA) Primed for 150% Explosion as Bulls Charge Retest Breakout

Ethena's ENA isn't just knocking at resistance—it's kicking the door down. A textbook bullish retest sparks trader euphoria as the token eyes a potential 150% surge. Here's why the charts scream 'buy.'

## The Setup: A Retest Worth Betting On

ENA's price action mirrors a classic breakout-and-retest pattern—the kind that makes technical analysts drool. After piercing through a key resistance level, the token pulled back gracefully (no panic-selling here) and is now coiling for the next leg up.

## The Target: 150% or Bust

Fibonacci extensions and volume spikes suggest a rally to levels last seen during the 2024 meme-coin frenzy. Shorts are sweating; OI-weighted funding rates hint at a coming squeeze. Meanwhile, 'maximalists' still arguing about Bitcoin's block size miss another altseason payday.

## The Caveat: Crypto Never Goes Straight Up

Liquidity pools look thin above current prices—perfect rocket fuel if bids hold, but a trapdoor if macro turns sour. Watch BTC's correlation and those pesky Fed meeting minutes. After all, what's a crypto bull run without a 30% 'healthy correction' to scare the weak hands?

Ethena (ENA) is currently retesting its previous breakout zone between $0.37 and $0.45, a key level that could define its next major move. The price action remains structurally bullish, with strong support holding after a multi-phase correction. If the ENA price sustains momentum above $0.46, it could initiate a sharp rally toward $0.63 in the short term, with extended targets near $0.80 and $1.00. This setup positions ENA for a potential 150% breakout in the coming weeks.

Why is the Ethena Price Rising?

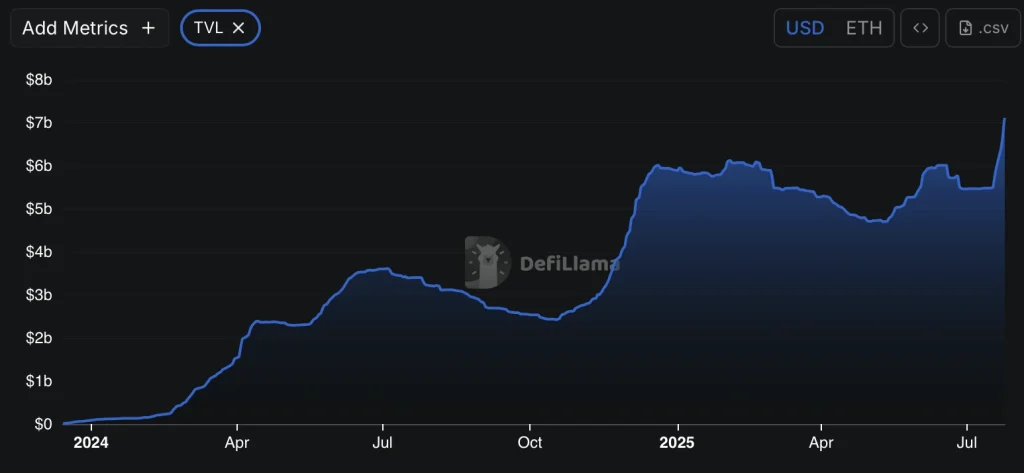

Ethena has recorded exchange outflows of over 693,000 tokens in the past week, which reflects a strong accumulation. Meanwhile, StableCoinX’s $5 million daily buyback program, slated to continue for several weeks, adds consistent demand-side pressure. Open interest across futures markets is rising, confirming that speculative traders are positioning for upside. On the other hand, Ethena’s total value locked (TVL) and protocol usage are also expanding, showing real adoption and increased utility.

Ethena (ENA) Price Analysis: Will it Reach $1?

What makes this retest so important isn’t just the price level—it’s how strong the support has become. ENA is now holding above a zone where it was previously rejected, turning old resistance into a solid base. This kind of setup often comes just before a big breakout. Right now, the price is moving in a tight, steady range, showing strength without wild swings. If ENA can close above $0.46, the next MOVE could be sharp. The first target is $0.63, and if the rally continues, $1.00 may not be far behind.

The historical chart patterns of ENA price suggest the price has begun with a strong recovery phase. The price had surged above the local resistance at $0.5 but failed to hold above the range, triggering a correction. Currently, the 200-day MA is acting as a strong support, and the MACD is showing the possibility of a bearish crossover. Therefore, if the ENA price fails to defend the 200-day MA at $0.4279, then the correction may go deeper.

Considering the wider perspective, it appears that the Ethena (ENA) price is experiencing a short-term pullback, and hence, a rebound seems to be imminent. However, securing $0.5 is extremely important for the rally to keep up the bullish movement, as securing this range may only trigger the price to $1.