Chainlink Joins SEC Crypto Task Force: Is a LINK Price Explosion Imminent?

Chainlink's surprise inclusion in the SEC's new crypto regulatory task force sent shockwaves through DeFi circles today. The oracle network's native token (LINK) immediately rallied 18% on the news—because nothing makes crypto traders more bullish than government oversight (irony intended).

Why This Matters

The SEC doesn't invite just any blockchain project to its regulatory roundtables. Chainlink's seat at the table signals two things: 1) Regulators view oracles as critical infrastructure, and 2) They're probably coming for DeFi's plumbing next.

Market Reaction

Traders piled into LINK futures within minutes of the announcement, with open interest spiking 42%. The sudden volume crushed Binance's API briefly—because why would crypto infrastructure work smoothly during actual volatility?

What's Next

Watch for Chainlink to position itself as the 'compliant oracle solution.' If they successfully navigate regulatory waters while maintaining decentralization cred, LINK could flip from blue-chip to institutional darling overnight. Just don't expect the SEC to suddenly start loving crypto—this is about control, not embrace.

The LINK price has surged with renewed momentum, reacting to a blend of institutional partnerships, favorable legislation, and technical indicators pointing toward further upside.

Recently, a strong 15% intraday rally lifted the token to $19 recently, marking over 70% gains since the late-June ceasefire, and signaling an important turning point for the chainlink ecosystem.

LINK Price Gains Steam with SEC Task Force Entry

In a recent rally, much of the recent strength in LINK price was fuelled by BTC rise and the announcement of a strategic partnership with Mastercard in early July.

The Chainlink crypto also saw a boost in market sentiment as recently on X Chainlink co-founder Sergey Nazarov acknowledged the growing adoption of the project.

He said the utility is boosting as major financial institutions like Westpac and Imperium Markets, further reinforcing LINK’s use case within real-world finance.

In another pivotal development, Chainlink revealed its inclusion as one of five crypto projects to join the newly-formed U.S. SEC Crypto Task Force.

Chainlink Labs joined the SEC Crypto Task Force along with @ERC3643Org, @EntEthAlliance, @Etherealize_io, and @lfdecentralized to discuss the need for standards enabling the compliant issuance and trading of tokenized assets at scale.

For the blockchain industry to reach its… https://t.co/8EBiR35C2w

This MOVE boosts Chainlink’s legitimacy in regulatory circles and raises investors trust. It also hints at its increasing influence on crypto policy shaping and infrastructure-level integration in U.S. financial systems.

Moreover, the passing of the CLARITY and GENIUS Acts, aimed at improving regulatory transparency and innovation in crypto, also contributed to broader bullish momentum.

Technical Indicators Signal Strong Accumulation, but Short-Term Cooldown Possible

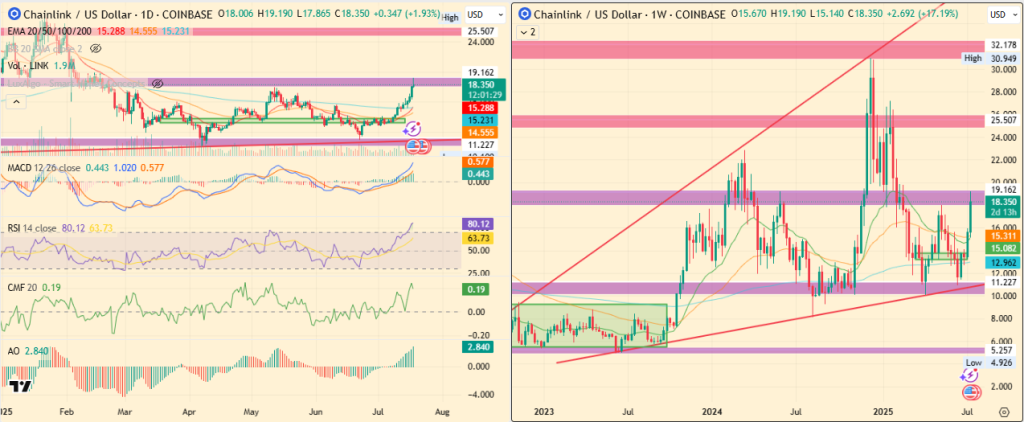

On the technical front, LINK price has reclaimed the 200-day EMA, with a golden cross now confirmed between the 20-day and 50-day EMAs.

Bullish momentum is also backed by a golden cross seen in the MACD indicator, with the histogram reading 0.441. The Awesome Oscillator (AO) also supports the upside view, printing a value of 2.840, while the Chaikin Money FLOW (CMF) rose to 0.19 from 0.03, clearly signaling rising accumulation.

Yet, while the indicators lean bullish, the Relative Strength Index (RSI) shows overbought conditions at 80.16. This raises the possibility of a temporary consolidation or pullback before LINK price resumes upward movement.

LINK Price Chart Forms Multi-Year Ascending Wedge

Technical chart patterns add further interest to the bullish narrative in Chainlink crypto.

The LINK price history suggests that its entire price action in the last couple of years occurred within a multi-year ascending broadening wedge, and its recent 25-day rally appears to stem from a bounce off the wedge’s lower boundary.

If this pattern continues to play out, it could unlock upside levels above $28 and even approach $30.

Prominent analyst Ali Martinez echoed this view, stating that LINK price is hovering just under the $18 resistance and a breakout could push it toward the $22–$28 range.

Chainlink $LINK looks ready to break out, with eyes on $22 and possibly extending to $28! pic.twitter.com/FVreWNjGB9

— Ali (@ali_charts) July 18, 2025Nonetheless, downside risks remain. If LINK fails to sustain above $18, and the broader market turns bearish, the price could retrace toward $13 in a major correction.

Still, current indicators suggest that the breakout above $19 may be imminent as market forces continue to favor LINK’s climb.