Crypto Bull Run at a Crossroads: Will the Rally Hold or Collapse This Weekend?

Crypto markets flirt with all-time highs—but whispers of a weekend pullback grow louder. Bulls charge while bears sharpen their claws. Who wins?

Market psychology at play

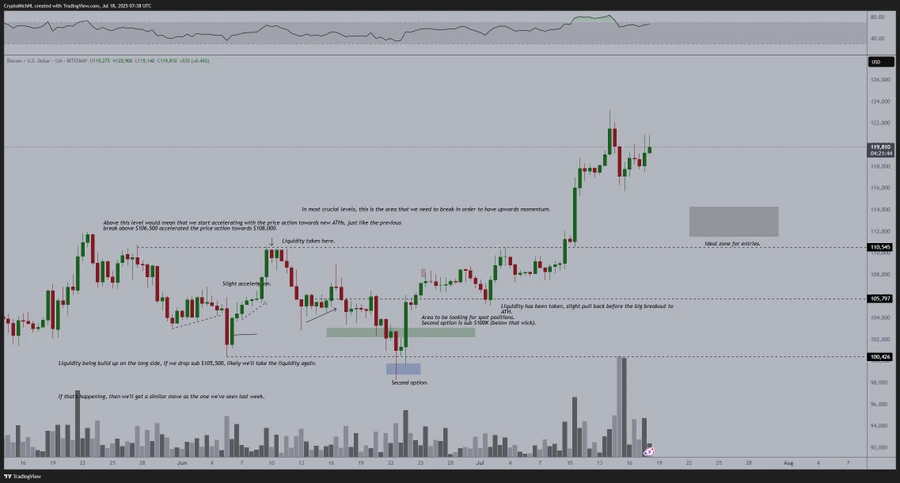

Every trader's watching the same charts: parabolic moves, overbought signals, and leveraged positions stacking up like dominoes. The FOMO is real—but so are liquidation risks.

Technical warning signs

RSI levels scream 'overheated' across major pairs. Bitcoin's weekly candle looks exhausted. Yet funding rates remain positive—a dangerous cocktail of greed and complacency.

The institutional wildcard

Wall Street's latest crypto ETF filings gather dust at the SEC. Meanwhile, OTC desks report record block trades. Smart money accumulates while retail chases pumps.

Weekend liquidity traps

Thin Sunday trading volumes often trigger exaggerated moves. Algorithmic traders feast on stop-hunts when humans sleep. 'Buy the dip' meets 'sell the news.'

One cynical truth: The market takes the stairs up and the elevator down. Whether this bull run survives the weekend depends on who blinks first—the leveraged longs or the patient shorts.

The cryptocurrency market continues its bullish expansion, this time influenced by strong institutional inflows and regulatory clarity. The total market cap has breached $3.91 trillion, marking a significant technical breakout. Talking about sentiments, the Fear & Greed Index sits at 71, indicating rising optimism yet possibly inclining toward overheated conditions.

That being said, as Bitcoin consolidates and altcoins catch the trend, the key question remains: will the crypto bullrun continue, or is a weekend pullback brewing? Join me as I take you through the specifics and an overview of what could be in store.

Total Crypto Market Cap: Cooling Signs Within a Strong Trend?

The 4-hour chart of the total crypto market cap I’ve shared reveals an uptrend, but surfacing short-term exhaustion. The market is currently pressing against the upper Bollinger Band near ~$3.88T, indicating a stretched move that often comes before short-term corrections.

It is evident that the market is approaching the overbought territory, with the RSI at 68.70. That being said, if a pullback occurs, the mid-Bollinger Band at ~$3.73T and the lower band NEAR $3.58T will serve as strong support zones.

Despite this short-term caution, the macro trend remains fairly bullish. The breakout above $3.9T is a strong signal that the business is ready to challenge higher valuations. This is especially if the key levels hold firm ground over the weekend.

Buy-the-Dip Playbook Still in Motion?

Popular analyst Michael van de Poppe highlights that when “Bitcoin consolidates, altcoins start firing off”. He believes that we’ll have some harsh corrections, and those WOULD be great buy-the-dip opportunities. This aligns with what’s playing out now, as BTC is pausing below $120k, altcoins are showing relative strength.

The breakout in total crypto market cap confirms broader strength, yet caution remains warranted given the RSI and overextension. With weekend volatility expected, having an entry plan around $112k for BTC and mid-band support on the TOTAL chart would offer a strategic edge.

FAQs

Is the crypto bullrun over or is this just a pullback?It’s a breather. Most signals suggest continuation after a possible short-term cooldown.

Has the altseason started?Not quite, the Altcoin season index is neutral at 49/100. Altcoins are rotating selectively, not broadly.