Crypto Bloodbath: Why Digital Assets Are Tanking Today (June 17, 2025)

Crypto markets just got sucker-punched—again. Here''s why your portfolio''s bleeding.

Macro Mayhem Hits Digital Gold

Traditional markets sneeze, crypto catches pneumonia. Fed jitters, inflation data, or another ''unexpected'' recession warning? Take your pick—traders are panic-dumping risk assets.

Whale Games & Leverage Liquidation

Those 100x leverage positions? Obliterated in minutes. CEX order books look like Swiss cheese as cascading liquidations trigger stop-loss avalanches. Bonus pain: OI-weighted funding rates flipped negative—shorts are feasting.

Regulatory Déjà Vu

Some bureaucrat muttered ''investor protection'' again. Newsflash: Politicians still don''t get self-custody. Meanwhile, Tether''s lawyers are billing overtime.

This isn''t crypto''s first rodeo. Every bear market births the next paradigm—just ask the ''experts'' who called Bitcoin dead at $3K. Pro tip: When CNBC runs another ''Crypto Winter'' headline, start DCAing.

The crypto market today is trading in the red, with the total valuation dropping by 0.97% to $3.33 trillion. Despite this, market activity has surged, with 24-hour trading volume taking a 33.54% leap to $131.69 billion. The Fear & Greed Index stands at a neutral 53, reflecting marketers awaiting a clear direction.

A key driver of caution is the ongoing FOMC meeting, where no immediate rate cuts are expected, but investors are carefully watching for signals on future policy shifts. Meanwhile, U.S. equities are slightly outperforming, with NASDAQ up 1.52%, S&P 500 rising 0.94%, and the Dow Futures gaining 0.75%. However, Trump’s early exit could have hampered DJT’s numbers, which is down more than 4%.

Talking about market share, the Bitcoin dominance has inched up to 63.9%, while ethereum lags at 9.4%, and the Altcoin Season Index remains subdued at 23/100, highlighting a lack of momentum outside the major caps.

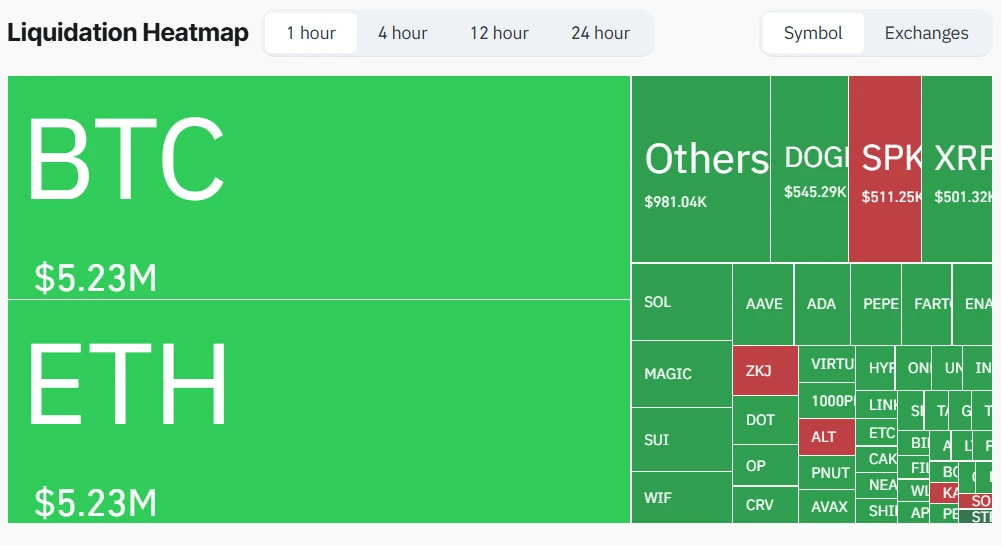

Liquidation Grips the Market?

According to CoinGlass, in the past 24 hours, 106,815 traders were liquidated across exchanges, with total losses tallying to $363.46 million. The largest single liquidation order was a $3.32 million SOLUSDT trade on Binance. This wave of forced closures reflects the vulnerability of Leveraged traders in volatile markets, especially amid unclear macroeconomic signals.

What is Happening in Crypto Today?

Bitcoin is currently priced at $106,170.88, down 0.92% over the past day, with a market cap of $2.1 trillion and 24-hour trading volume spiking by 24.40% to $53.09 billion. Ethereum follows with a drop of 2.67%, now trading at $2,550.01. Solana and XRP have mirrored this weakness, both slipping by 3.61%, with Solana priced at $150.68 and XRP also at $150.68 at press time.

Read our Bitcoin (BTC) Price Prediction 2025, 2026-2030!

Top Gainers:

- Pendle (PENDLE): +3.51% | Price: $3.92

- Bitcoin Cash (BCH): +3.45% | Price: $470.34

- Monero (XMR): +3.34% | Price: $327.91

Top Losers:

- SPX6900: -15.79% | Price: $1.42

- ImmutableX (IMX): -10.77% | Price: $0.428

- ZCash (ZEC): -8.93% | Price: $42.31

Also read our Ethereum (ETH) Price Prediction 2025, 2026-2030!

FAQs

Why is the crypto market down today?The market is reacting to macroeconomic uncertainty around the FOMC meeting, a shift in investor capital to outperforming equities, and a sharp rise in liquidations.

How much was liquidated in the last 24 hours?A total of $363.46 million was liquidated, impacting 106,815 traders, with the largest single liquidation order valued at $3.32 million on Binance.

Which tokens gained and lost the most today?Top gainers include Pendle, bitcoin Cash, and Monero, while SPX6900, ImmutableX, and ZCash led the declines.