SPX6900 Cools Off After Parabolic Rally—Is SPX Really Headed Back to $1.77?

After a blistering rally that defied gravity, the SPX6900 finally hits the brakes—but traders are already bracing for the next wild swing.

Parabolic moves never last, but this one left scorch marks. Now the question looms: Is this a healthy cooldown or the start of a brutal reckoning?

Some chartists whisper about a return to $1.77—a number so absurd it would make even Wall Street''s most shameless permabulls blush. Then again, in a market where ''fundamentals'' means whatever CNBC says before commercial breaks, who''s counting?

One thing''s certain: The algos aren''t sleeping, and neither are the leverage junkies. Buckle up.

- SPX Price rallied over 230% from May to mid-June, peaking just below its all-time high of $1.77.

- Open Interest surged to $171M before a sharp 25% decline, suggesting overleveraged longs were flushed.

- Spot outflows hit $6.4M on June 14, signaling strategic exits

SPX6900USD Technical Analysis: A Classic Parabolic Advance

The rally was triggered by a golden cross on May 6, when the 50-day EMA crossed above the 200-day EMA—a bullish signal in technical analysis.

Following this crossover, SPX coin accelerated through successive resistance zones, kicking off a multi-leg parabolic advance.

SPX Price followed a textbook parabolic rally between May 7 and June 11, rallying from $0.50 to almost break its previous all-time high of $1.77 in just over a month. The MOVE unfolded in four accelerating legs, each followed by shallow pullbacks.

This structure often signals a blow-off top or exhaustion phase, especially when volume and sentiment spike at the peak.

A temporary top formed on June 11 as the SPX price began to fade under $1.70. The correction intensified on June 14, driven by heavy profit-taking, and is now consolidating above key support at $1.30.

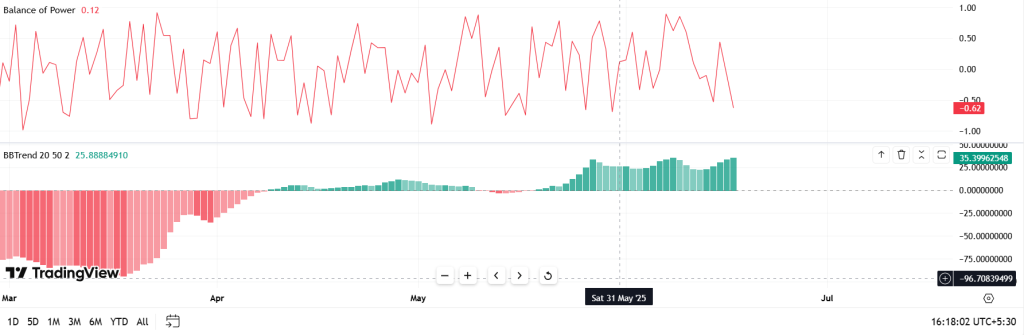

Indicators Point to Cool-Off, Not Collapse

- RSI has dropped from 75 to 40.19, cooling from overbought territory.

- MACD shows a bearish crossover, confirming waning momentum.

- Balance of Power is soft at 0.12, while BBTrend and BBP show weakening bullish energy.

The indicators align with a standard post-rally reset. A base is likely forming between $1.30–$1.35.

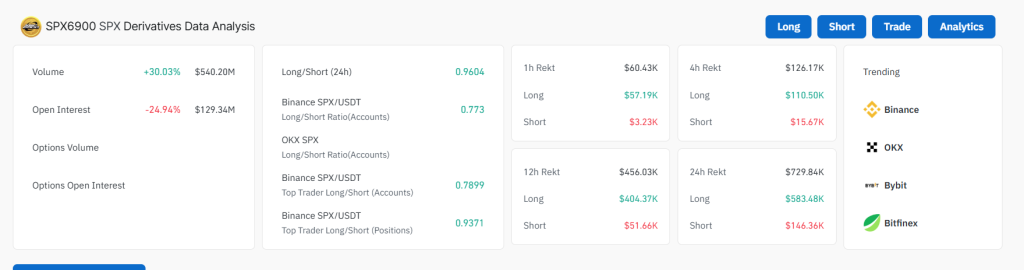

Derivatives Flash Warning: Open Interest Collapse, Sentiment Flip

Open interest reached an ATH of $171.7M on June 13, but rapidly fell by 25% as the price retraced. At the same time, long/short ratios flipped bearish across major exchanges:

- Binance L/S (accounts): 0.773

- 24h Global L/S: 0.9604

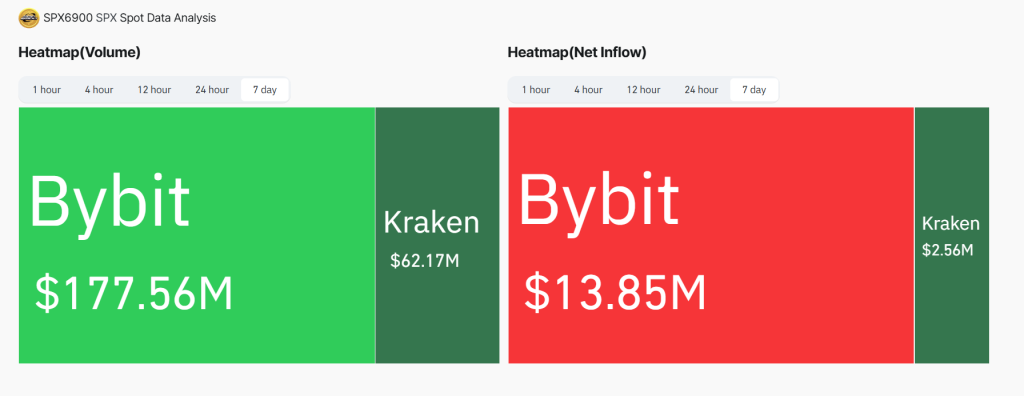

This shift indicates that traders began aggressively closing long positions or opening shorts as the rally lost momentum. Bybit, which led trading volume with $177M, also saw over $13M in net outflows.

On-chain flows show over $6.4M in net outflows on June 14 alone, with additional daily exits continuing through June 17. Coinbase saw light inflows (~$367K), but Kraken and OKX recorded significant net exits, confirming that the move was not retail-driven accumulation but strategic unloading.

SPX6900 Price Prediction: Bounce or Breakdown?

SPX coin trades at $1.39. Holding $1.30 support could see price test $1.50 and potentially retarget the $1.71 ATH by late June. A breakout may push SPX toward $2.00.

If $1.30 fails, downside targets include $1.18 and $1.05 (Fib retracement levels).

For now, SPX shows signs of stabilizing. Traders should watch for volume return NEAR $1.50 and RSI flattening to confirm bullish continuation.

SPX6900’s rally followed technical structure, and its cooldown reflects healthy market rotation. A breakout or breakdown in coming sessions will define the next meme cycle leg.