Bitcoin Longs Surge as Demand Stalls: The Hidden Fuel for BTC’s Next Price Rally

Bullish bets on Bitcoin are stacking up, even as fresh buying interest takes a breather. This classic divergence often signals a major move—but which way?

The Setup: Leverage vs. Liquidity

Traders keep piling into long positions, betting with borrowed money that Bitcoin's price will climb. Meanwhile, spot market demand—the kind fueled by actual wallets and cold storage—has flatlined. It's a high-wire act: all conviction, no new capital.

Why This Tension Matters

Markets hate uncertainty more than bad news. When leverage rises without underlying demand, it creates a fragile equilibrium. A single catalyst can trigger a massive squeeze, liquidating overextended positions in a cascade. Conversely, if genuine demand returns, those leveraged longs become rocket fuel, accelerating gains.

The Cynical Take

It's the oldest story in finance: everyone's a genius in a bull market, until the margin calls start rolling in. The 'smart money' often just means someone who borrowed more, faster.

The Bottom Line

Watch the spot flows. When real buyers step back in, this wall of leveraged optimism could propel Bitcoin to heights that make current prices look like a footnote. Until then, buckle up—volatility isn't just coming; it's being built into the market's very structure.

Since the start of December, the Bitcoin price has largely traded sideways, oscillating between roughly $85,000 and $90,000, with no sustained follow-through on either breakouts or breakdowns. Daily ranges have narrowed, and volatility has continued to compress, signalling a market stuck in balance rather than a trend. While this calm price action may appear stable on the surface, it has created conditions where positioning and demand dynamics carry more weight.

As volatility remains subdued, shifts in trader behaviour and underlying demand are becoming increasingly important in determining how the BTC price reacts once this range finally breaks.

Bitcoin Long Position Rising—Have Traders Turned Optimistic?

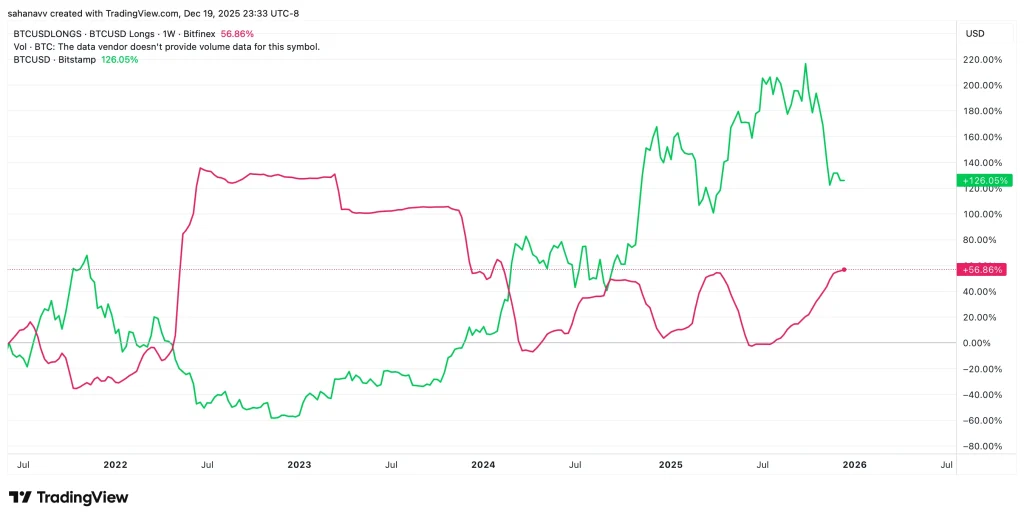

Bitcoin longs, where the traders bet on the rising BTC price over time, highlight the growing confidence in the crypto. A massive rise was recorded at the beginning of 2022, which elevated the BTC price from its historical lows close to $15,000. Currently, the longs appear to be stronger than before, as they have reached a 22-week high. This tells us that traders are increasingly positioning for upside in anticipation, rather than in response to confirmed price strength.

The chart compares Bitcoin long positioning with price action and highlights a recurring inverse relationship. Historically, spikes in long positions have often coincided with local price pullbacks, while periods of declining longs have aligned with price recoveries. A similar pattern has played out multiple times since 2024. Currently, long exposure has climbed toward recent highs, even as bitcoin price trades closer to the lower end of its range. This divergence increases downside sensitivity.

If price fails to regain momentum, the buildup in long positioning could amplify a corrective move, potentially dragging Bitcoin toward deeper support zones rather than extending the current consolidation.

Conclusion

Bitcoin’s price may still be holding its range, but the balance underneath is tilting toward risk. With long positioning stretched, volatility compressed, and demand no longer expanding, the price is becoming increasingly vulnerable to a downside reaction if support fails. A loss of the $83,000–$82,000 zone would likely expose bitcoin to a deeper corrective move toward $78,000–$75,000, where stronger historical demand has previously stepped in.

These levels are not targets to chase but zones where market behaviour is likely to change. Until Bitcoin (BTC) price can reclaim higher levels with strong acceptance, the risk of a sharper pullback remains elevated, and traders should treat stability as conditional rather than secure.