Bitcoin Is Absorbing Selling Pressure—Here’s What It Reveals About the Next Price Surge

Bitcoin isn't just holding the line—it's digesting every sell order thrown its way. That's not just resilience; it's a market flex. While traditional assets wobble on shaky fundamentals, BTC's ledger shows a different story: consistent demand meeting every wave of supply. Forget the noise. Watch the absorption.

The Mechanics of a Market Sponge

Think of a classic pump-and-dump. Price spikes, weak hands rush in, then the sell-off crushes momentum. Bitcoin's current chart pattern defies that script. Each dip gets bought, not with a frenzy, but with steady, almost mechanical, accumulation. The order books tell the tale—walls of bids materialize just below key levels, soaking up liquidity that would sink lesser assets. It's a silent battle between fear and conviction, and conviction keeps winning rounds.

What the Charts Whisper (That Headlines Shout)

Technical analysts are circling one phrase: 'distribution absorbed.' In plain English? Large holders aren't panic-dumping to retail bag-holders. Transfers between major wallets suggest strategic repositioning, not a flight to safety—unless your idea of safety is a volatile digital asset, which, for a growing cohort, it apparently is. This isn't speculative froth; it's foundational stacking.

The Bullish Signal Everyone's Ignoring

The real story isn't the price you see. It's the pressure you don't. Sustained absorption during periods of macroeconomic uncertainty acts like a pressure cooker. It suppresses volatility artificially, building potential energy. When this coiled spring releases—often triggered by a macro catalyst or a breakout past a psychological barrier—the move tends to be explosive and trend-defining. The market is literally loading the spring.

A Cynical Nod to Traditional Finance

Meanwhile, in TradFi land, experts are busy adjusting their twelve-month price targets for stocks by 0.5% based on yesterday's sentiment survey, patting themselves on the back for their precision. Bitcoin, by contrast, doesn't do earnings calls or guidance—it just absorbs, consolidates, and eventually, reroutes entire capital flows while pundits are still debating their models.

The takeaway is simple. A market that efficiently absorbs selling is a market building strength for its next leg. Whether that move is up or down ultimately depends on broader tides, but the current structural integrity suggests the path of least resistance is being paved north. Keep watching the bids. They're writing the next chapter.

Bitcoin remained under pressure after falling below $85,000, and the recent rebound above $87,700 suggests that the price has entered a cooling period. However, volatility has been elevated, and sharp intraday swings have shaken both long and short positions. Despite this, the BTC price continues to hold above key higher-timeframe demand zones. This combination suggests the market is transitioning, not collapsing.

Will the current price action, which indicates absorption, where selling is met by steady demand with no emotional buying, help the BTC price reach $100K?

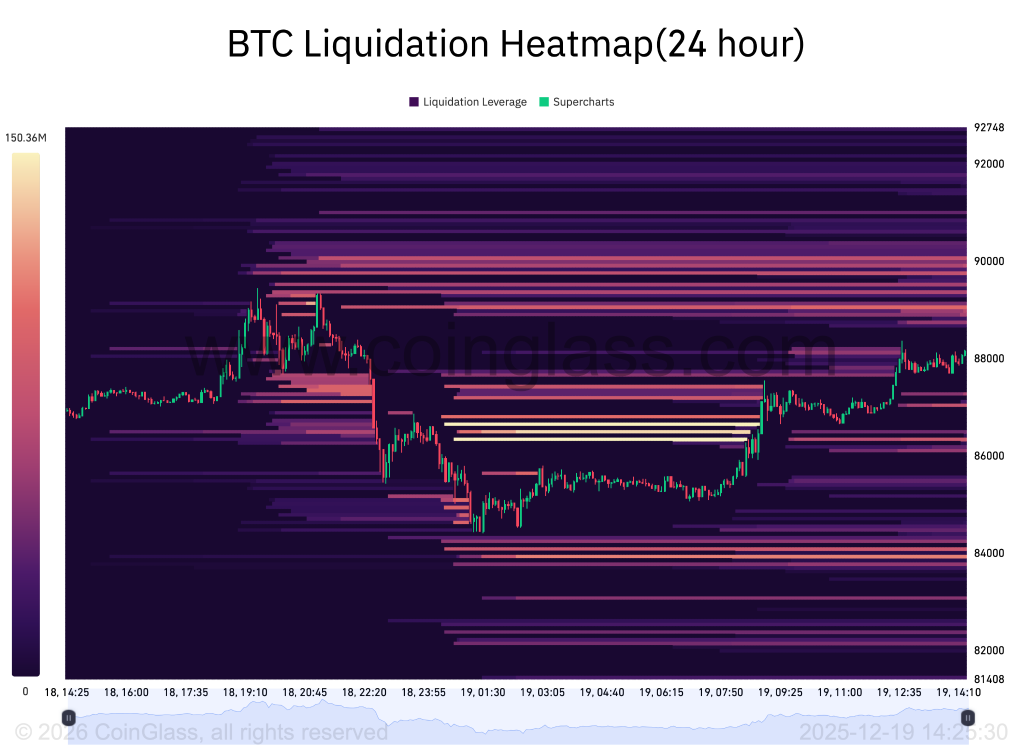

Liquidations Are Cooling—And That Matters

Recent liquidation data shows a sharp decline in forced selling compared to the initial breakdown. Earlier moves saw clusters of long liquidations as the price swept liquidity below local structure. Since then, liquidation intensity has faded, even as Bitcoin continues to trade heavily.

This shift is critical. Forced selling creates disorder and momentum. When it slows, it signals that weak hands have largely exited, leaving price to be governed by spot demand and patient positioning rather than leverage stress. In simple terms, sellers are still present, but they are no longer in control.

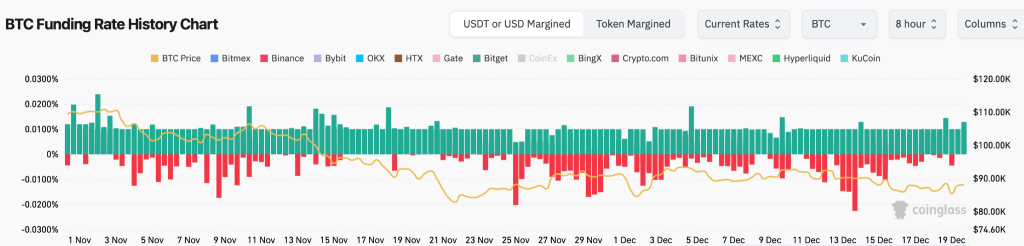

Funding Rates Point to a Reset, Not Panic

Funding across major exchanges has normalised after briefly flipping negative. This indicates leverage has been reduced and the late longs have been flushed out. Importantly, funding is not aggressively positive either—a sign the market is no longer chasing upside prematurely.

Historically, sustainable moves emerge after funding resets, not while it is overheated. The current environment reflects hesitation and balance, which often precedes expansion once the price accepts a direction.

BTC Price Analysis: Structure Holds the Final Clue

On the 4H chart, bitcoin continues to defend a well-defined demand zone and the ascending trend line, despite multiple tests. Each dip below intraday support has been met with responsive buying, suggesting real interest rather than short covering.

For traders, the message is clear:

- Acceptance above this demand zone keeps recovery scenarios alive

- Failure to hold would open the door to another liquidity sweep lower

Until either occurs, Bitcoin remains in a range-bound compression phase, not a confirmed downtrend.

Wrapping it Up- How Can Bitcoin Price Reach $100K?

Bitcoin (BTC) price is likely to trade in a tight range this weekend, with the price stabilizing above key support as the market digests the recent volatility rather than making a decisive move. As far as the $100K is concerned, that level remains out of reach for now, as the current price action reflects consolidation and absorption, not the kind of momentum or volume expansion required for a breakout of that magnitude