BlackRock’s Bold Move: iShares Bitcoin Income ETF Yield Fund Filing Shakes Crypto Landscape

Wall Street's heavyweight just placed another massive bet on Bitcoin's future—and this time, it's all about generating yield.

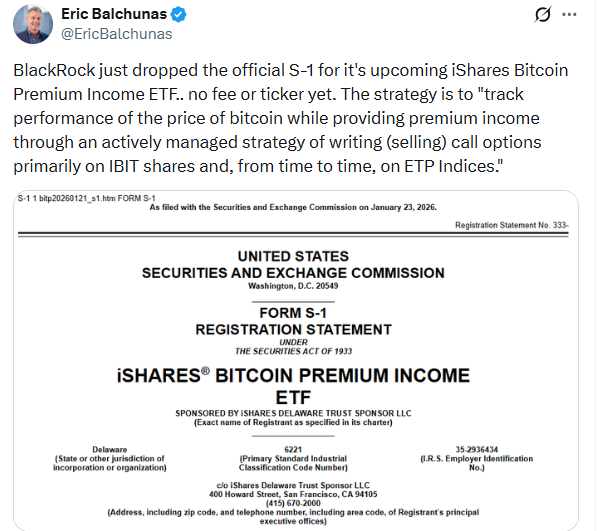

BlackRock, the world's largest asset manager, has officially filed paperwork with regulators for an iShares Bitcoin Income ETF Yield Fund. This isn't just another spot ETF application; it's a strategic pivot designed to turn Bitcoin from a speculative digital gold into a cash-flow-producing asset.

The Yield Play: Bitcoin's Next Evolution

The proposed fund aims to generate income primarily through staking Bitcoin—a process where holders earn rewards for helping to secure and validate transactions on certain blockchain networks. It's a direct answer to the classic institutional critique: "What's the yield?" BlackRock's move suggests they have one.

This filing bypasses the passive holding strategy of existing spot Bitcoin ETFs. Instead, it actively puts the underlying asset to work. Think of it as transforming Bitcoin from a static store of value in a digital vault into a productive asset on the blockchain, earning its keep.

Why This Filing Cuts Deeper

The implications are profound. First, it signals that a titan of traditional finance sees a mature, long-term revenue model within Bitcoin's ecosystem, beyond mere price appreciation. Second, it could open the floodgates for a new wave of risk-averse capital—pension funds, endowments, income-focused investors—who've been sitting on the sidelines waiting for a "responsible" way to earn yield in crypto.

It also throws a gauntlet down to the entire crypto-native staking and DeFi sector. When BlackRock enters your market, competition gets real. Their scale, compliance muscle, and client trust could attract billions that might have otherwise flowed into decentralized protocols. A cynical finance jab? Nothing legitimizes a market faster than a giant firm figuring out how to skim a fee from it.

The filing is now in the hands of regulators. Approval isn't guaranteed, but BlackRock's track record is formidable. Their successful launch of a spot Bitcoin ETF shattered records. This could be the sequel that changes the game again, morphing Bitcoin from a trade into a treasury asset.

One thing's clear: the race to institutionalize crypto is accelerating. And it's no longer just about buying the dip—it's about earning while you HODL.

It’s a massive signal. It means the "HODL" era is getting an institutional upgrade. We’re moving from just holding an asset to making that asset work for us.

How the New iShares Bitcoin Income ETF Generates Yield

If you’ve used BlackRock’s standard spot fund (IBIT), you know it just tracks the price. If Bitcoin goes up, you’re happy; if it goes sideways, you’re bored. The Bitcoin Income ETF is built for those "bored" moments. It uses what’s called an "options overlay." Essentially, the fund holds BTC and then "sells" the potential upside to someone else in exchange for immediate cash, known as a premium.

Think of it like renting out a spare room in a house you own. You still own the house (the Bitcoin), but you’re getting a monthly check (the yield) from the tenant. While BlackRock hasn't promised a specific percentage yet, similar "covered call" funds in the market right now are hitting yields between 8% and 12%. For an asset that usually just sits there, that’s a game-changer for people who need regular cash flow.

The Mechanics of the Covered Call Strategy

Here’s the catch because there’s always a catch in finance. This is a "covered call" strategy. The fund writes contracts saying, "If BTC hits $110,000, you can buy it from us at that price." If BTC stays at $95,000, the fund keeps your investment plus the premium they sold. You win. But if Bitcoin pulls a classic moonshot and hits $150,000? The fund is forced to sell at $110,000.

You’re basically trading the "lottery ticket" potential of Bitcoin for a steady, predictable paycheck. For retirees or those managing their own super funds (SMSFs), that’s often a trade worth making. It dampens the wild swings and makes the portfolio feel a bit more "grown-up."

Market Context and the Great Outflow of 2026

The timing here is actually pretty gutsy. We just saw a brutal week for crypto funds, with $1.73 billion walking out the door the biggest exodus we've seen since late 2025. Even BlackRock’s flagship IBIT took a hit. BTC is currently wrestling with the $90,000 level, and a lot of investors are nervous.

By launching a Bitcoin Income ETF now, BlackRock is giving people a reason to stay. It’s a lot easier to stomach a 5% price drop if you know a yield check is hitting your account at the end of the month. It changes the psychology from "swing trading" to "income investing."

Institutional Safeguards and Custody

BlackRock isn't cutting corners on security here. They’ve tapped Coinbase Custody to guard the actual BTC, while Bank of New York Mellon, a bank that’s been around since the 1700s handles the cash and the paperwork. It’s the ultimate "bridge" between the crypto and the world of Wall Street.

Expert Analysis: The Future Outlook

We’re entering the "utility phase" of crypto. The first phase was just proving Bitcoin wasn't a scam. The second was getting it onto the stock market. This third phase is about making it a functional part of a diversified portfolio.

In my view, this fund is going to be the preferred choice for the "cautious bull." If you think BTC is going to $1,000,000 tomorrow, don't buy this you'll leave too much money on the table. But if you think this digital asset is going to be the backbone of the future economy and you want to get paid while that happens, this is exactly what the market has been waiting for. Watch the fee battle, though. Once this launches on the Nasdaq, expect Grayscale and Fidelity to start slashing prices to keep up.