Dormant Ethereum Whale Awakens: $393 Million ETH Stirs After 9-Year Slumber

A sleeping giant in the Ethereum ecosystem just blinked awake.

The Whale Emerges

After nearly a decade of absolute stillness, an early Ethereum address—untouched since the network's infancy—suddenly moved its colossal holdings. The transaction didn't just ripple through the blockchain; it sent a tidal wave across crypto markets and social feeds. Analysts scrambled, charts twitched, and the perennial question echoed: is this a strategic repositioning or a simple portfolio check-up?

Decoding the Movement

Whale movements always tell a story. A transfer this size, from an address this old, isn't casual. It suggests deliberation. The owner weathered ICO mania, DeFi summers, bear market winters, and countless 'Ethereum killers' without flinching. Their sudden activity now cuts through the noise of daily trading, forcing everyone to pay attention to the original smart contract platform's foundational wealth.

Market Mechanics & Ripple Effects

Such a massive, single-entity move bypasses typical market mechanics. It doesn't follow retail sentiment or react to weekly news cycles. This is capital on a different timeline—patient capital that just reminded the market where the real value often sits: in cold storage. It's a masterclass in holding, with a side of elegant timing that would give any Wall Street quant an ulcer trying to model it.

One thing's certain: in a space obsessed with the next big thing, a nine-year-old wallet moving nearly four hundred million dollars is a powerful reminder that sometimes, the most bullish signal isn't a new trade—it's ending an old one. Or maybe they just finally remembered their password.

A dormant Ethereum OG whale deposited 135,284 ETH worth $393.4 MILLION into Gemini today, marking its first activity in 9 years. pic.twitter.com/Xv4PSHjWtT — Coin Bureau (@coinbureau) January 26, 2026

Will The Ethereum Whale Sell Its Holdings?

Given the surge in gold and silver prices over the past few months, investors may be shifting their focus away from the cryptocurrency market for the time being. Market participants are most likely adopting a risk-off approach. The Ethereum (ETH) could be following a similar pattern. However, it is also possible that the wallet owner is shuffling their holdings and may not sell their ETH coins.

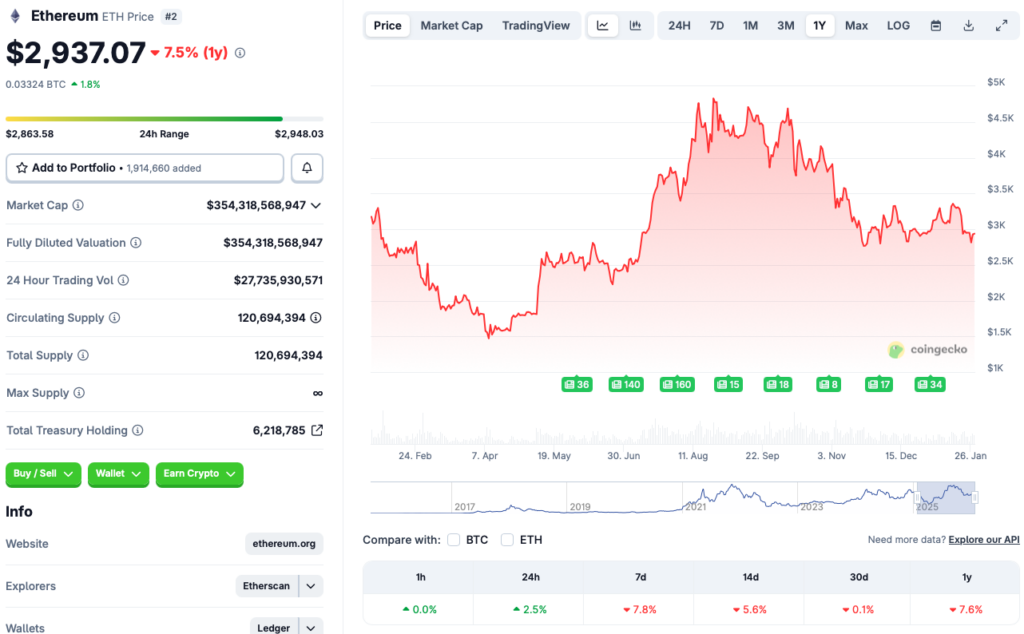

The crypto market has faced substantial losses over the last few months. While January started with some recovery, the market took another hit over the previous few days. According to CoinGecko’s ETH data, Ethereum’s price has recovered 2.5% in the daily charts, but is still red in the other time frames. ETH’s price has dipped 7.8% in the weekly charts, 5.6% in the 14-day charts, and 0.1% over the previous month. The second-largest crypto has also fallen by 7.6% since late January 2025. Ethereum (ETH) is currently struggling to hold $3,000 but has found some support at the $2900 level.

Ethereum (ETH) may not recover until the larger economy improves. Geopolitical tensions, macroeconomic concerns, and slow growth may be deterring investors from taking on riskier assets. ETH hit an all-time high of $4,946.05 in August of last year. However, the asset’s price has fallen by more than 40% since its 2025 peak. Ethereum (ETH) could see some relief if ETF inflows pick up steam and market confidence improves. However, the journey back to $4000 may take longer than what many expect.