Zero-Tax Crypto Havens: The 2026 Investor’s Ultimate Destination List

Forget the old financial hubs—the new wealth magnets levy nothing on digital gains.

The Zero-Tax Exodus Is Real

Capital floods toward jurisdictions waving the zero-tax flag. It’s a straightforward calculation: keep 100% of your crypto profits or surrender a slice to legacy systems. Smart money is voting with its wallet, bypassing high-tax regimes for clear, favorable rules.

More Than Just a Tax Break

These havens aren't just offering a free ride. They're building the infrastructure—clear regulations, crypto-friendly banks, and innovation hubs—that turns tax savings into long-term ecosystem growth. It’s a strategic play for talent and capital, not just a revenue giveaway.

The Regulatory Tightrope

Zero tax doesn't mean zero rules. The winning destinations balance attractive policy with robust anti-money laundering frameworks. They're aiming for legitimacy, not a lawless reputation, understanding that sustainable adoption requires trust.

A Lasting Trend or a Closing Window?

As crypto matures, the global tax consensus tightens. The OECD's framework looms. The 2026 list might represent a peak, a final call for investors to position assets before the global net draws shut. After all, traditional finance never met a revenue stream it didn't eventually try to tax.

The hunt for zero is reshaping the global financial map. For now, the opportunity is stark: find your haven, or fund someone else's government.

Verified data from 2026 sources confirms that many of these countries still allow individuals to earn from cryptocurrencies without paying capital gains duties.

The interest comes at a time when global crypto reporting rules are expanding, making investors more aware of digital assets levy by country differences.

Instead of illegal crypto tax avoidance, many users are choosing legal relocation or residency options in jurisdictions where taxes are zero or very low. This allows them to earn extra from trading, investing, or holding virtual currencies long term.

Best Crypto Tax Free Countries to Earn More Profit

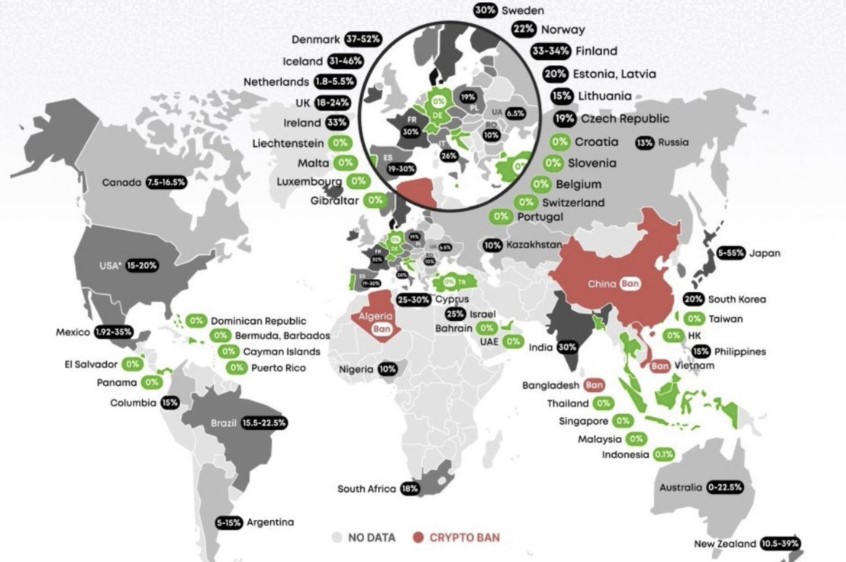

Several countries continue to offer 0% Crypto Tax on individual cryptocurrency gains in 2026:

United Arab Emirates (UAE): No personal income-tax or capital gains digital currency taxes

Singapore: No capital gains crypto-tax for non-professional traders

El Salvador: One of the biggest National-level Bitcoin holder, allows levy free Bitcoin gains

Cayman Islands, Bermuda, Gibraltar: Offshore crypto-tax free countries

Switzerland: Private investors often enjoy 0% levy on cryptos

These locations are considered some of the best countries for legally earning more from cryptocurrency activities.

Nations With Partial or Conditional Tax Benefits

Not every low-tax country is fully tax-free. Some apply conditions that investors must understand before moving:

Portugal: Short-term cryptocurrencies gains are taxed, but long-term holdings remain tax-free

Germany: Capital gains crypto-tax is 0% only if digital asset is held for over one year

Malta: Crypto-tax benefits depend on long-term investment structure

Knowing these rules helps investors avoid mistakes while planning earnings across borders.

High Crypto Taxes and Bans Push Investors to Relocate

While some countries offer 0% Crypto Tax, others impose heavy levy and stricter regulations. In some states even without strict rules, absence of clarity or vagueness on the digital assets’ status can also put pressure on traders.

India: India has the largest digital coins adopting population, still it does not consist of any clear rules for virtual assets trading except a heavy 30% crypto tax rate with 1% TDS on transactions.

United States: Despite being known as a favorite destination for the enthusiasts, the country imposes high capital gains taxes along with state-level taxes.

Japan & Denmark: Some of the highest levy rates globally, where Japan is planning lower rates, but they are not in effect yet.

However, countries such as China, Algeria, Bangladesh, Egypt, and Morocco continue to prohibit most cryptocurrency trading, payments, or mining activities. They have taken an even more strict approach.

In these regions, cryptocurrencies is often restricted due to concerns over capital control, financial stability, and misuse. For investors searching for more profits, these locations are generally avoided, as earning or holding virtual tokens can lead to legal risks rather than benefit in taxes.

Earning More Through Smart Planning

Cryptocurrency has moved beyond speculation. Today, it is used for payments, reserves, and investments by individuals, institutions, and governments. As virtual currency adoption grows, tax-planning has become part of the earning strategy.

Choosing a country with 0% Crypto Tax does not mean avoiding the law—it means understanding rate by country and earning smarter. With regulations tightening globally, legal tax-friendly locations are becoming key destinations for the investors looking to maximize real returns.

This article is for informational purposes only and does not constitute financial advice. Always consult a qualified professional before making relocation or investment decisions.