India’s FIU Privacy Coin Ban: Crypto’s Slow Acceptance or Government’s Clear Rejection?

India's Financial Intelligence Unit just slammed the door on privacy coins—Monero, Zcash, Dash—and the crypto community is left wondering: is this regulatory caution, or a straight-up rejection?

The Compliance Crackdown

FIU's move isn't subtle. It's a direct hit on anonymity-focused assets, demanding full transaction visibility from Virtual Asset Service Providers. The message? If regulators can't see it, it's not welcome. This goes beyond typical KYC—it's a fundamental challenge to the privacy ethos baked into certain blockchain protocols.

Innovation vs. Oversight

Privacy tech developers argue their coins enable legitimate financial discretion. Regulators see potential blind spots for illicit flows. India's stance creates a stark choice for exchanges: delist privacy features or lose operating clearance. It's a classic tech-regulation clash where 'move fast and break things' meets 'comply first, innovate later.'

The Bigger Picture for Crypto in India

This ban isn't happening in a vacuum. It follows years of regulatory ambiguity—taxation policies that made trading punitive, banking restrictions that choked liquidity, and now, targeted asset prohibitions. Each step looks like cautious deliberation, but the cumulative effect feels like death by a thousand regulatory cuts.

Market Realities and Hypocrisies

Meanwhile, traditional finance still launders more money through shell companies in an afternoon than privacy coins have moved in their entire existence—but that's a conversation for another day, preferably over expensive whiskey with central bankers.

So, slow acceptance or clear rejection? The FIU's latest action suggests India's regulators aren't just moving cautiously—they're drawing bright red lines. For crypto to thrive there, it might need to wear a nametag and let authorities hold its wallet. The dream of permissionless, private digital cash just hit a formidable, bureaucratic wall.

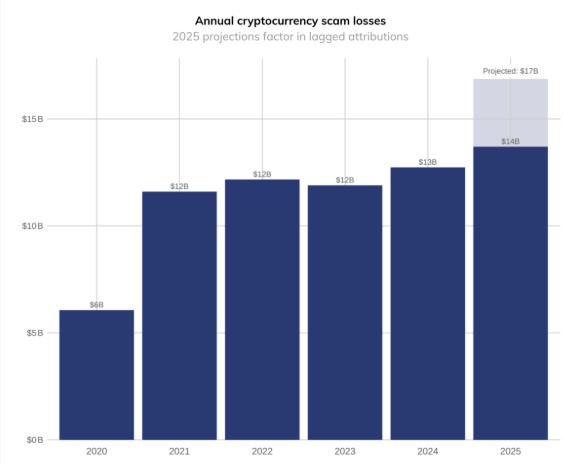

This move is backed by global data. Chainalysis reports that in 2025, on-chain scams reached at least $14 billion, rising sharply from earlier estimates of $9.9 billion in 2024, later revised to $12 billion.

Why the India FIU Privacy Coin Ban Was Introduced?

The India FIU has made it clear that platforms must follow stricter compliance rules. These include appointing an AML officer, completing CERT-In audits, and sharing sender and receiver data, even for self-custody wallets.

This step targets hidden transaction systems that make tracking illegal activity difficult. Assets designed to hide wallet addresses and amounts create challenges for enforcement agencies. From a risk control view, the decision supports transparency and protects users from platforms being misused for scams or laundering.

This also shows that regulation is becoming structured, not random. The restriction applies only to a specific category, not the entire ecosystem. That difference is important.

Tighter KYC Shows India FIU Is Building Trust, Not Blocking Growth

Recent updates show tightened crypto KYC rules for new users, this indicate that the Indian FIU wants cleaner participation, not shutdown. They make platforms safer for long-term users and global partners.

At the same time, the RBI has suggested linking BRICS digital currencies to enable faster cross-border payments and reduce dollar dependency. This proposal may be discussed at the 2026 BRICS Summit hosted by the country, showing openness to regulated digital finance.

Why the Privacy Coin Ban Feels Wrong to Some Users

Privacy tokens are built to protect identity. Unlike open blockchains, they hide sender, receiver, and amount details. Supporters say this is about personal financial freedom, not crime.

The ban affects assets like Monero, Zcash, and Dash. For investors holding them, this is negative. They must either exit or shift to other categories. However, the wider ecosystem remains untouched, which signals selective control, not total rejection.

This balance is why the debate is intense. Safety and freedom are both valid concerns.

Will India Regulate or Reject Crypto?

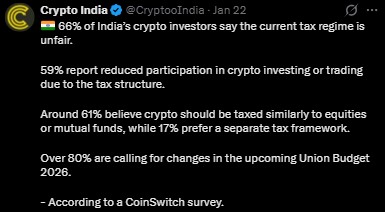

A CoinSwitch survey shows strong dissatisfaction with current policies:

66% say the tax system is unfair

59% reduced participation due to tax pressure

61% want taxation like equities or mutual funds

Over 80% want reform in Union Budget 2026

Binance CEO Richard Teng also highlighted the country’s young and tech-driven population embracing blockchain tools. He pointed out how global leaders like Larry Fink and Jamie Dimon shifted from critics to supporters after understanding the system better.

In 2025, SIP-style investing in digital assets grew nearly 60%, and the country ranked #1 in global adoption. These facts show steady acceptance, just at a controlled pace. Furthermore, the upcoming meetings and policy decisions will help shaping the crypto market in India.

Conclusion

The India FIU privacy coin ban is not pure rejection. It is a slow filter. High-risk tools are restricted, while the wider system remains open. This approach protects users, builds trust, and prepares a stronger regulatory base. Controlled acceptance is replacing blind resistance.

This article is for educational and informational purposes only. It does not provide financial, legal, or investment advice. Readers should consult certified professionals before making any financial decisions.