RTX Coin Explodes: The Real Reasons Behind RateX’s Meteoric Surge and What’s Coming Next

RTX isn't just climbing—it's rocketing. Forget gradual gains; today's price action screams a market-wide recalibration. Something fundamental shifted.

The Catalysts Aren't What You Think

Look past the basic hype cycles. This surge taps into deeper currents: a flight to utility in a meme-saturated landscape, and genuine protocol adoption that's moving faster than analysts predicted. The narrative flipped from 'speculative asset' to 'essential infrastructure' overnight.

Technical Breakout or Fundamental Re-rate?

Charts show a clean breakout, but the volume tells the real story—institutional-sized blocks hitting the tape. This isn't retail FOMO alone. It's smart money positioning for the next phase, where functional tokens separate from the noise. The usual pump-and-dump playbook got shredded.

What's Next? Navigating the Volatility

Expect turbulence. Parabolic moves always correct. The key question: will it consolidate at a new, higher base or retrace into the abyss? Watch for sustained developer activity and partnership announcements—the boring stuff that actually builds long-term value, unlike another celebrity endorsement that'll be forgotten by next earnings season (if those traditional finance dinosaurs even know what an earnings season is anymore).

The old guard is watching, confused. Digital assets aren't waiting for permission. RTX's surge is just another tremor before the quake.

Binance Alpha Listing: A Huge Visibility Enhancer

On December 19, RateX Binance Alpha listed, which is one of the largest and most popular cryptocurrency exchanges, with considerable influence in the market.

When listings occur on major exchanges, such as Binance, it normally triggers a buying rush. Binance’s massive reach quickly drew a large number of traders to the platform, causing trading activity to explode.

Within just 24 hours, volume jumped by over 276,000% to cross $100 million, which directly fueled the sharp surge in RTX’s price.

However, the buzz created after the listing might not be for the long haul. If the volume of trading per day goes below $50 million, it might indicate that traders are selling their stocks, and the stock price might hit a downturn.

Airdrop Campaign: Increasing Short-Term Demand

Other than the Binance Alpha listing, there is an airdrop taking place from the 19th of December to the 26th of December. Anyone can earn rewards by either holding or trading the RTX tokens.

When crypto Airdrops take place, the demand increases, and people will be scrambling for the token distribution. However, when the reward is acquired, some traders might just sell their tokens for cash. This could lead to the weakening of the token price, specifically prices lower than $1.50.

If prices go below $1.50, it could be the start of a selling process, perhaps because the airdrop recipients are cashing out. As long as prices remain above $1.50, the demand caused by the airdrop should sustain the prices.

RateX Tokenomics

RateX tokenomics has largely contributed to its success.

Approximately 44.18% of the total token supply has been allocated for rewards, partnerships, and other benefits within the community and the overall ecosystem.

Only 6.66% of the total token supply was allocated through the initial airdrop.

The tokens allocated for the team and investor rewards are locked for 3-6 months.

The RateX distribution of the tokens will help mitigate the risk of a sudden flood of tokens entering the market.

This will protect the price from being negatively affected by the sudden sell-off. With the tokens released at a steady pace by RateX, the market will not be oversaturated.

Price Prediction: Will RTX Stay Above $2.00?

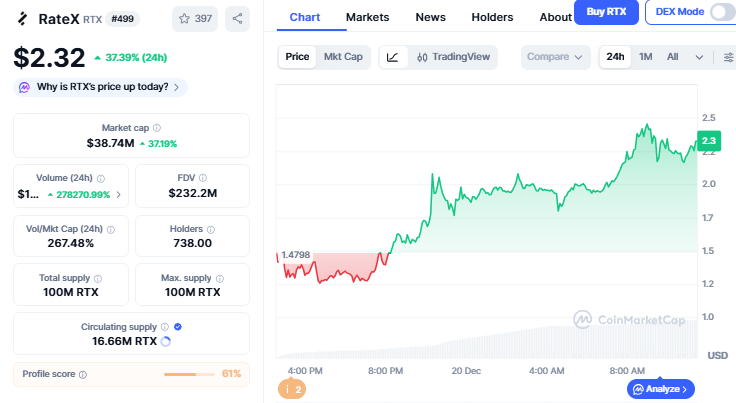

According to the CoinMarketCap, RateX is trading at $2.32, which is a strong price appreciation. Although it is exciting to see the rapid appreciation in prices, it is crucial to note that cryptocurrencies experience volatile market conditions, which result in quick changes in market prices.

Source: CMC

The level of $2.00 is an important price to keep an eye on. The fact that the price is able to maintain levels above $2.00 could be an indication that there is solid support for RTX. However, a price below $2.00 could mean that traders are selling their shares, leading to a possible price depreciation.

Conclusion

The recent run seen in RTX can be associated with some aspects such as the RateX Binance Alpha listing, as well as its airdrop campaign and tokenomics. The token is looking good in terms of its price; however, its $2.00 level needs to be observed to establish whether its run is maintained or not.

This article is for information purposes only, kindly do your own research before investing.