Epstein Files Drop Today: Brace for Potential Market-Wide Shockwaves

The long-awaited document release has arrived. Its contents could send ripples—or tsunamis—through global financial markets.

Why Traders Are Watching the Clock

Markets hate uncertainty more than they hate bad news. Today’s data dump injects a massive dose of the unknown. High-profile names, hidden connections, and potential legal fallout create a perfect storm for volatility. It’s not just about scandal; it’s about systemic risk when powerful institutions get rattled.

The Crypto Angle: Flight to Digital?

When traditional finance flinches, digital assets often twitch. A crisis of trust in legacy systems historically fuels crypto narratives. Watch for capital flows. Could this be another stress test proving decentralized networks bypass traditional points of failure? Possibly. Or it could just be another day where the rich find new loopholes while everyone else checks their portfolios.

Stay sharp. Today isn’t about fundamentals—it’s about reaction speed.

The update comes after the U.S. Justice Department on Friday released more than 13,000 documents and hundreds of photographs linked to convicted criminal Jeffrey Epstein who died in jail in 2019, under the new transparency act.

However, officials withheld thousands of files over privacy and legal concerns. The limited release has drawn backlash from lawmakers and survivors, who say the government failed to meet legal requirements of the law.

In November, the Congress party passed the Epstein Files Transparency Act, signed by President Donald Trump. The law ordered the Justice Department to release all unclassified Epstein-related materials within 30 days, with limited exceptions.

For now, what’s drawing attention now is the newly released information and the remaining data withheld reasons? And how does it matter for both political and financial spaces?

What Was Released – and What Was Not

The documents made public include investigative records, phone notes, flight logs, and images collected over two decades.

However, most of the published files come from three major investigations into Jeffrey:

A 2005 Palm Beach police inquiry into Epstein’s abuse

2008: Epstein struck a controversial plea deal in Florida, avoiding federal charges and serving limited jail time

A 2019 federal case in New York, which ended when Epstein died in jail

2021: Ghislaine Maxwell was convicted and sentenced to 20 years in prison

Many files were heavily removed, hiding names, details, and testimony. One 119-page file named “Grand Jury NY” was entirely blacked out (hidden with a black mark to keep information secret).

Deputy Attorney General Todd Blanche said the department identified 1,200 victims or relatives in the records and needed more time to protect their identities. He promised more releases in the coming weeks and said the full review should be completed by the end of the year.

Many of the released photos prominently feature former President Bill Clinton, including images of him with Ghislaine Maxwell, Epstein’s longtime associate now serving a 20-year prison sentence.

By contrast, President TRUMP appears only rarely in the new release. Most Trump photos with Epstein and Maxwell in the 1990s were already public. Written references to Trump appear mainly in address books, flight logs, and phone message notes that had been disclosed earlier.

Meanwhile, Clinton’s spokesman accused the administration of using the release to deflect attention from Trump’s own past friendship with Epstein. No victim has publicly accused Bill Clinton of wrongdoing.

How This Matter for Markets and Crypto

While the Epstein files are not a direct financial issue, the political fallout is adding to uncertainty in U.S. markets – a big market that matters globally. Rising political risk, growing distrust, and legal uncertainty, often volatile risk assets, while safe-haven assets tend to attract attention.

The involvement of Trump, a pro-crypto supporter, in the case can further add fuel to the market volatility, especially when his administration involves many crypto laws and his own digital coins in the market.

However, looking at the current scenario, both traditional and crypto markets are rebounding on the edge of the release.

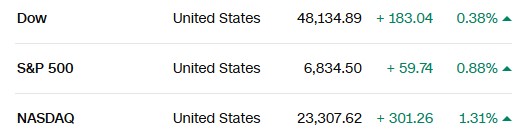

US stocks closed higher on triple-witching Friday, with the S&P 500 +0.88%, Nasdaq 100 gaining +1.31%, and Dow Jones +183 points (up 0.38%), led by tech gains. Nvidia climbed 3.9%, meanwhile, Nike fell 11% on weak China revenue and higher tariffs.

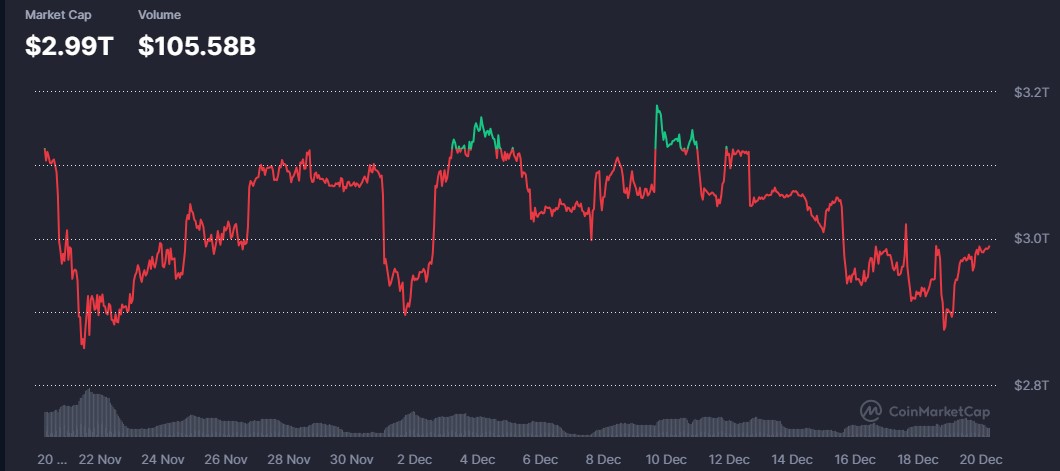

The crypto market also rebounded 1.98% in 24 hours, reversing a week-long 2.64% decline, as whale activity and institutional interest boosted sentiment. Notably, discussions around a US strategic crypto reserve gained momentum, and BTC derivatives showed a healthy 6.7% rise in perpetual open interest with falling liquidations.

But experts are suggesting doubts over whether the currency charts will be able to hold the same after the doc release, given the potential involvement of prominent figures active in the financial markets.

In Summary

As more documents are expected to be released in the coming weeks, the answers will unfold the questions:

Which documents were withheld

Why redactions were made

Which government officials and public figures appear in the files

Until then, the Epstein case remains as a mystery box, poised to shape public perception and influence political and financial landscapes.

User can check the updates here: