Crypto Market Bull Run: Over or Just Starting? 2025 vs 2026 Analysis

Bull run or bull trap? The crypto market's next move divides analysts.

The 2025 vs 2026 Outlook

Two competing narratives are clashing. One camp sees the recent surge as a classic blow-off top—a final, euphoric gasp before a major correction. The other views it as a mere opening act, with the main performance slated for 2026, fueled by maturing institutional infrastructure and broader regulatory clarity. The data doesn't lie, but it also doesn't agree.

Institutional Catalysts vs. Retail Fatigue

On one side, the plumbing is getting stronger. Real-world asset tokenization is moving beyond PowerPoint slides, and major financial players are building quietly in the background. This isn't 2017's wild west. On the other, retail sentiment remains fickle, easily spooked by regulatory headlines or macroeconomic shivers. The market's direction hinges on which force proves dominant: steady institutional capital flows or the famously emotional retail crowd.

The Final Countdown

So, is it over or just beginning? The answer likely depends on your time horizon. Short-term, volatility reigns—welcome to crypto. Long-term, the underlying digital transformation of finance grinds forward, indifferent to daily price swings. One thing's certain: calling a definitive top or bottom remains a fantastic way to look foolish, a pastime as old as finance itself.

Crypto Market Bull Run 2025: A Year of Highs and Lows

Indeed, the year 2025 proved to be a rollercoaster for the cryptocurrency in terms of market cap. The cap touched records of $4 trillion and plummeted to less than $3 trillion.

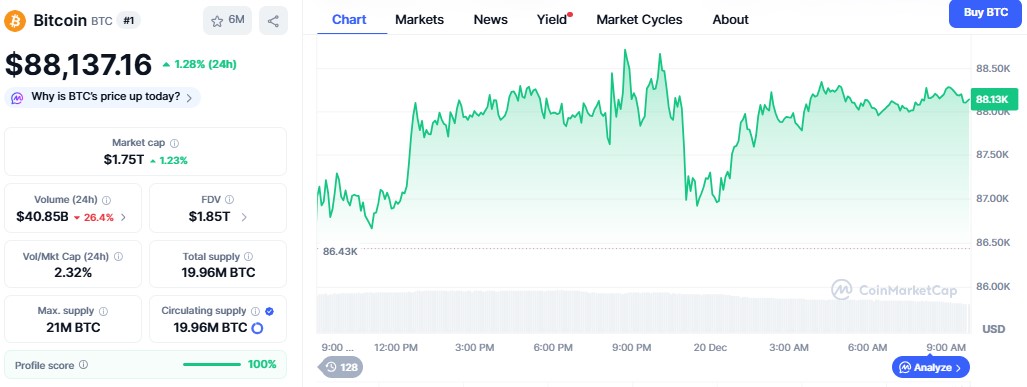

Bitcoin touched an all-time high of $126,198 in October 2025, which was a record indication of confidence. At the time of writing, BTC price is trading at $88,139.99, after an intraday surge of over 1% with $1.75T in cap.

Ethereum also broke records, reaching $4,953.73 in August 2025, and is currently hovering at $2,984 with $360.13B in market cap.

The U.S. Securities and Exchange Commission (SEC) finally approved spot ETFs for various altcoins such as XRP, Solana, and Dogecoin. Its approval encouraged institutional investors, leading to higher liquidity.

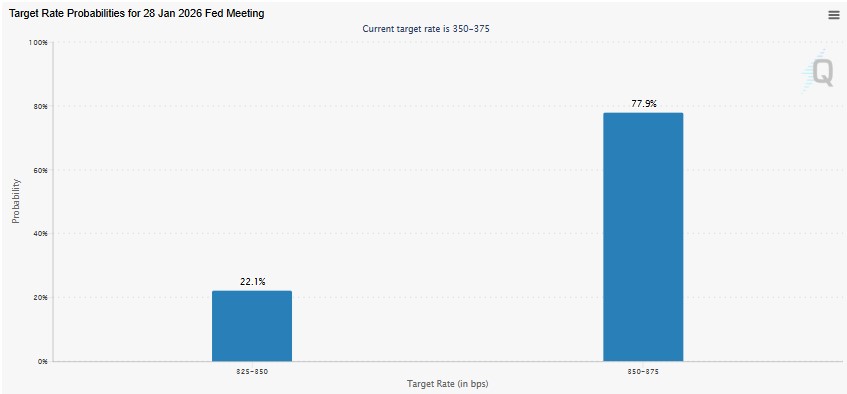

The decision taken by the US Federal Reserve to lower interest rates thrice in 2025 had played a crucial part in changing sentiments. The reduction in interest rates to 350-375 basis points encouraged risk-takers to invest in cryptos.

Although there were many good aspects, there are also negatives in the year 2025, including the TRUMP tariff. Nevertheless, the landscape was quite strong and coped well with the challenges.

What’s Ahead for the Crypto Market in 2026?

One of the largest pressing questions that people have been asking since the start of the year, 2026, is whether the crypto rally will continue or not. Although a definitive answer cannot be drawn due to its uncertain nature, the leaders have been quite optimistic about the possibility of a bull run in the year 2026.

BitMEX co-founder Arthur Hayes believes that the value of Bitcoin could reach between $80K and $100K in the short run, and eventually reach $200K.

This, he says, will be the result of the continued liquidity infusion introduced by the Reverse Repo Program introduced by the Federal Reserve. This program, he says, “is QE in disguise.”

One well-known crypto analyst, Tom Lee, predicts that bitcoin will move to fresh highs by January 2026. The crypto expert thinks that the market has already seen the bottom and that there is still significant growth to be achieved. Tom’s projection comes as the adoption of cryptocurrencies is still on the rise, and it is expected to see 200x growth.

Robert Kiyosaki, a well-known expert in building wealth, has expressed a more conservative perspective regarding the global economy. He thinks the global economy could be threatened by a possible hyperinflation caused by the Fed’s policy. But at the same time, Kiyosaki asserts that investing in cryptocurrencies, such as Bitcoin and Ethereum, could help investors survive the impending disaster.

2025 Vs. 2026: What Investors Should Expect?

Whereas 2025 was marked by intense volatility, the year 2026 might be the turning point at which the crypto will likely hit its peak. As the trend of interest from institutions via ETFs, positive macroeconomic trends, and forecasts from Hayes, Lee, and Kiyosaki unfolds, the bull trend can be seen as only just beginning.

In short, as an investor, one should take note to stay updated on trends. The question of whether there will be a crash or a boom in the market in 2026 is highly uncertain.

Conclusion

As the crypto market moves further in the year 2026, it is likely that a fresh wave of a ‘bull run’ could arrive. Traders need to monitor ‘Bitcoin forecasts,’ ‘judicial Fed cut impacts,’ and institutional trends. This is the best moment to prepare for a fresh wave of growth in the world of cryptocurrencies.

This content is for informational purposes only and should not be construed as financial advice. Crypto investments are highly volatile and risky. Always conduct your own research before making any financial decisions.