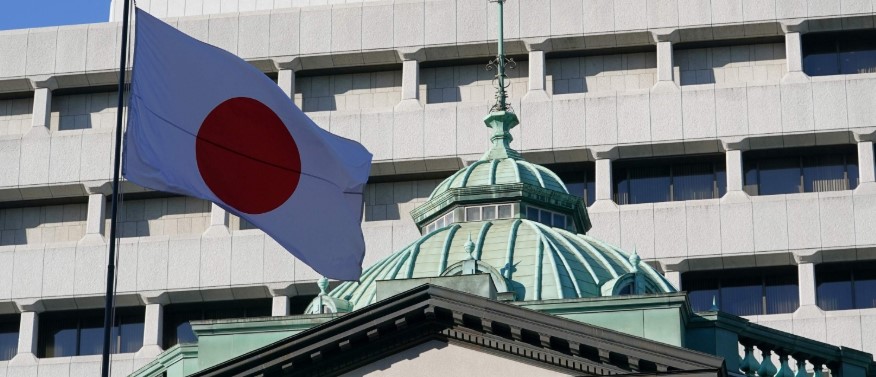

Bank of Japan Rate Hike Decision: What Was Decided and Why?

Tokyo's monetary masters just made a move that's rippling through global markets. The Bank of Japan's latest decision on interest rates isn't just a domestic affair—it's a tremor felt from Wall Street to the crypto exchanges.

Why the Central Bank Pulled the Trigger

For years, the BoJ played the world's most patient game, clinging to ultra-loose policy while others hiked. That era's over. Faced with persistent inflation that finally stuck—not the transitory kind bankers love to cite—the institution had to act. It's a classic, if delayed, response to price pressures that refuse to vanish. Some analysts call it catching up; others say it's a desperate bid to protect a weakening yen. Either way, the free-money party for carry trades just got a last call.

The Ripple Effect Beyond Traditional Finance

Don't think this is just about bonds and fiat currencies. When a G7 central bank shifts gear, capital flows change direction. Suddenly, the 'risk-off' playbook gets dusted off. Traditional safe havens get a look, but so do digital assets for those betting against the old system. It highlights a brutal truth for crypto advocates: we're still tied to the whims of legacy monetary policy. Every basis point change in Tokyo echoes in Bitcoin's volatility—a frustrating tether for a technology built to bypass these very institutions.

A Cynical Take from the Finance Trenches

Let's be real. This 'historic' hike is about as surprising as a banker taking a bonus. They're reacting to data they ignored for months, following the herd with all the boldness of a middle manager. It's financial theater, designed to project control in a system that has very little of it left. Meanwhile, the real innovation—decentralized, global, and un-printable money—keeps building in the background, waiting for the next crisis of confidence in the guys with the printing presses.

The takeaway? Central banks are still writing the market's script. But each clumsy, reactive move like this adds another paragraph to the case for an exit. The door to a parallel financial system just creaked open a little wider.

This BOJ rate decision comes at a time when inflation remains high and the economy shows mixed signals. But what does this mean for everyday investors, the yen, and the markets, especially crypto?

The decision marks an importance for both domestic and global markets as Japan is one of the top economies in the world, and changes in its policy directly affects the broader market. But how? Before that, understanding what the decision gives, is also a crucial point.

What BOJ Rate Decision Brings?

In December’s latest news, the Bank of Japan rate hike saw policymakers raise the short-term policy rates by 25 basis points, exactly as markets expected. This marks the highest interest level since 1995 and a part of Japan’s long-term plan to normalize policy after ending negative rates in 2024.

Despite the increase, the central bank emphasized that real interest rates are expected to remain “significantly negative.” In simple terms, borrowing costs will still remain low for businesses and consumers. According to BoJ news today, the goal is to keep the economy growing while managing inflation.

Decision Baseline – Current Economic Conditions in Japan

Inflation and wages remain the key factors behind the BOJ interest rates strategy. Inflation in Japan has stayed above the BOJ’s 2% target for4 consecutive years. Consumer prices also ROSE 2.9% year-on-year in November, keeping pressure on households. Inflation has exceeded the BOJ’s 2% target for 4 consecutive years. At the same time, real wages have been falling for 10 straight months, according to labor ministry figures, making daily expenses harder to manage.

Economic growth also remains weak. Revised GDP data showed that Japanese economy shrank by 0.6% in the third quarter, which equals a -2.3% on an annual basis. Even so, the BOJ noted that corporate profits remain strong and believes companies will continue raising wages in 2026, helping stabilize the economy. These mixed conditions shaped the latest interest rate decision.

Effects: Yen, Bonds, and Debt Concerns After the Hike

The Bank of Japan rate hike result also affects financial markets. Japanese government bond yields have reached multi-decade highs, increasing borrowing costs for a country with very high debt. Japan already has one of the highest debt levels in the world, so rising yields matter.

Meanwhile, the yen has remained weak, trading between 154 and 157 per dollar, the currency has lost more than 2.5% since October.

A softer currency increases import costs and inflation, which partly explains the price hike. Policymakers are trying to balance currency stability with economic growth.

Crypto Market Reaction: Cautious Optimism

While higher rates typically pressure risk assets, the crypto market showed resilience. Total crypto market capitalization rose 0.43% over the past 24 hours, rebounding from deeply oversold conditions after a 6.6% weekly decline.

Technical indicators drove the move. The RSI fell to 29.18, its lowest since April 2025, a level that usually leads to strong rebounds. Spot trading volume rose 18% to $253 billion, showing algorithmic buying.

Derivatives activity also increased, with perpetual futures volume up 31%, though open interest dropped 1.7%, meaning traders were closing positions rather than adding risky bets. Institutional investors also stepped in, buying crypto-related stocks after the recent dip.

Outlook: Macro Caution Meets Technical Support

The Bank of Japan rate hike highlights a delicate balance between controlling inflation and protecting growth. Economists expect another hike in 2026, where Governor Kazuo Ueda has acknowledged uncertainty, with estimates ranging from 1% to 2.5%, depending on inflation dynamics.

For markets, the net takeaway is clear: the Bank of Japan's rate hike is a crucial move in managing inflation and supporting the country's economic growth, while crypto markets continue to react cautiously. How this decision shapes future financial landscapes will unfold over time.