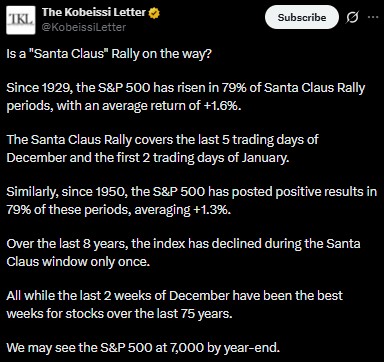

Why the 2025 Crypto Santa Claus Rally Looks Unlikely

Forget the eggnog—this holiday season might leave crypto investors feeling cold. The typical year-end surge, dubbed the 'Santa Claus Rally,' faces strong headwinds in 2025.

Institutional Chill in the Air

Major funds aren't just trimming the tree; they're trimming positions. After a volatile year, large capital is moving to the sidelines, seeking stability over seasonal speculation. The usual inflow of 'bonus season' retail money? It's a trickle, not a wave.

The Regulatory Grinch

Global watchdogs aren't singing carols. From the SEC's ongoing scrutiny to new FSA guidelines in Asia, the regulatory landscape remains a complex maze. This uncertainty acts as a powerful brake on the momentum needed for a classic December sprint.

Technical Patterns Point South

Charts are flashing warning signs, not festive lights. Key resistance levels have held firm, and trading volume—the fuel for any rally—has been conspicuously anemic. The market lacks the decisive breakout pattern that typically precedes a year-end charge.

So, while hope is a strategy beloved by Wall Street and crypto degens alike, the data suggests a quiet close to the year. Sometimes the best trade is to avoid the hype and wait for a clearer trend—even if it means missing out on a mythical gift from Saint Nick.

But 2025 is not following the usual script.

Weak US Consumer Demand is Hurting Risk Assets

One major reason analysts doubt a crypto market Santa Claus rally is falling US consumer strength. In November, Americans expected to spend just $778 on holiday gifts, down $229 from October. This is the largest November drop since 2006 and even worse than the $185 decline seen during the 2008 financial crisis.

Spending expectations are also $234 lower than last year. Both high- and low-income households are pulling back, signaling stagflation pressure. Weak consumer demand reduces liquidity and risk appetite, directly impacting digital assets.

Small-cap Stress and Global Liquidity Tightening

Another red flag comes from US small caps. Around 40% of Russell 2000 companies reported negative earnings over the last 12 months in Q3 2025. This matches post-2008 crisis levels and shows broad fundamental weakness beneath headline indexes.

At the same time, global liquidity is shrinking. While the Fed has ended QT, the ECB, BOJ, and BOE are expected to cut balance sheets by $1.2 trillion in 2026. From 2023 to 2026, central banks will unwind about $5 trillion, reversing nearly 65% of pandemic stimulus. Tight liquidity rarely supports a Santa Claus rally.

Crypto Charts Flash Warning Signs for Bitcoin and ETH

The market news is also bearish. Total market cap has dropped 2.12% to $3.07 trillion. Bitcoin is down 1.75% weekly and over 7% monthly, trading near $89,629 with a $1.78 trillion market cap. ethereum sits near $3,120, with mild weekly and monthly declines.

Analyst Ali Martinez warns of a supertrend bearish cross. In 2022, a similar signal preceded a 60% BTC crash and an 80% drop in Cardano. If repeated, Bitcoin price prediction models suggest a fall toward $70,000.

Technically, Bitcoin has broken a bearish flag after dropping from $106,000 to $80,000 in one month. The measured move points to $60,000–$75,000. RSI remains below 50, showing weak momentum. Without reclaiming $95,000–$98,000, downside risk dominates.

What Next for the Crypto Market?

This week could shape the crypto Santa Claus rally narrative. Key events include retail sales, jobs data, CPI, PCE inflation, housing data, and multiple Fed speakers. Any inflation surprise or hawkish tone could pressure Bitcoin and Ethereum further.

Conclusion

The crypto market Santa Claus rally 2025 faces strong historical support but even stronger current headwinds. Weak consumers, fragile small caps, tightening global liquidity, and bearish charts suggest caution. A surge is possible, but risks clearly outweigh seasonal optimism right now.

This article is for informational purposes only and does not constitute financial, investment, or trading advice. Crypto are highly volatile and speculative. Always do your own research, verify data from reliable sources, and consult a qualified financial professional before making any investment decisions. Never invest money you cannot afford to lose.