Michael Saylor’s Orange Dots Signal a New Bitcoin Purchase

Michael Saylor's cryptic orange dots are flashing again—and the market knows what that means.

The MicroStrategy co-founder's now-famous visual shorthand has become Wall Street's favorite buy signal. When those orange circles appear on his social feed, traders brace for another nine-figure Bitcoin acquisition.

Decoding the Signal

Saylor doesn't announce purchases with press releases. He paints with pixels. The orange dot pattern—first spotted during MicroStrategy's initial billion-dollar Bitcoin pivot—has evolved into a sophisticated corporate communication tool. It bypasses traditional disclosure channels, speaking directly to the crypto-native audience that actually moves markets.

The Institutional Playbook

While retail investors chase memecoins, Saylor executes a different strategy entirely. MicroStrategy's treasury transformation represents the most aggressive corporate adoption of digital assets in history. Each orange dot cluster corresponds to a strategic accumulation phase, timed during market dips when traditional finance hesitates.

The company's Bitcoin holdings now rival some national reserves, creating a feedback loop where every purchase announcement drives further institutional FOMO. Hedge funds that once mocked the strategy now scramble to replicate it—though few can match the conviction behind those orange pixels.

Market Mechanics in Motion

These aren't random buys. Saylor's team employs sophisticated dollar-cost averaging across multiple exchanges, minimizing market impact while accumulating at scale. The orange dots merely confirm what blockchain analysts already see: massive wallet movements heading to cold storage.

The strategy creates a supply shock that reverberates through derivatives markets. Options traders adjust positions, miners hold rather than sell, and the entire ecosystem recalibrates around MicroStrategy's growing position.

Traditional finance analysts still don't get it. They see a software company turned Bitcoin ETF. Crypto natives see something different: a publicly-traded vehicle executing the purest HODL strategy ever conceived—with better tax treatment than your average spot ETF, naturally.

When the orange dots appear, it's not just a purchase. It's a statement. And in a market drowning in hype and hollow promises, Saylor's silent pixels speak louder than any investment bank's research report.

Just a day before, Michael Saylor posted a short but telling message on his official X handle: “₿ack to More Orange Dots.” For long-time observers, this phrasing is anything but random. Over the past month, Saylor has repeatedly used images and posts featuring orange dots to signal fresh bitcoin buys by Microstrategy.

Now, with orange dots back in focus, the market is widely expecting a formal purchase announcement in upcoming days, consistent with the firm’s usual disclosure cadence.

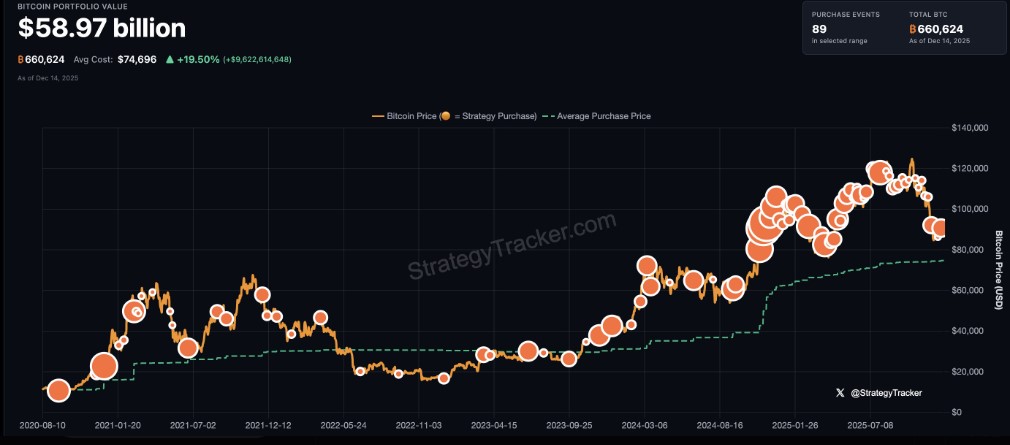

If confirmed, the addition will further fuel Microstrategy’s massive treasury, which currently holds 660,624 Bitcoins, solidifying Strategy’s position as the largest corporate holder of Bitcoins globally.

Microstrategy Bitcoin Holdings and Market Position

The company’s balance sheet reflects both the scale and conviction behind its Bitcoin strategy. At current prices of BTC NEAR $89,500 per coin, the firm’s reserve is valued at around $59.1 billion, exceeding its market capitalization of about $53 billion. While Strategy remains profitable long term due to its low average BTC cost, the value of its holdings have weakened with BTC’s 24% three-month pullback.

Strategy’s stock ($MSTR) is under pressure, driven by the broader crypto market downturn along with the golden asset. As of the current situation, MSTR was trading at $176.45 (down 3.74%), with a 47% decline in the last three months, and a 55% drop year-over-year.

Although the asset and $MSTR have shown some weaknesses in recent months, the company continues to see every dip as an opportunity. The net asset value of this company remains above 1.1, which indicates that investors have placed a premium on the firm’s exposure to Bitcoin and accumulation planning.

How the Timing Matters for This Purchase

The Much-Needed Bitcoin Purchase comes at a time when there is great macro-economic uncertainty. The coin is down by nearly 1% over the last 24 hours and by over 2% this week, with its price below the important level of $90,000.

The principal factors which are affecting this sentiment include fears of a rate hike by the Bank of Japan, a drop in spot liquidity despite an increase in derivative liquidity, and liquidations in the long positions with a total of $59 million.

Against this backdrop, support from broader institutes including Microstrategy’s in-flows, WOULD signal confidence at a moment when fear dominates short-term price action.

Institutional Signals Clash With Macro Headwinds

While macro pressures remain a concern, institutional adoption continues to build underneath the surface. U.S. spot BTC ETFs now collectively hold more than 1.5 million BTC, and major financial institutions are beginning to formalize allocation guidance.

Notably, Brazil’s Itaú Bank has recommended a 1–3% BTC allocation starting in 2026, considering BTC a tool for hedging against currency risk. These developments support the long-term bull case, even as near-term liquidity conditions remain fragile. A fresh bitcoin purchase by Strategy could reinforce this institutional narrative, reminding markets that long-term buyers are still active despite volatility.