Goldfinch Wallet Breach: $330K ETH Vanishes as PeckShield Sounds Alarm

Another day, another crypto wallet gets picked clean. This time, it's Goldfinch on the hook for a cool $330,000 in Ethereum.

The Heist in Plain Sight

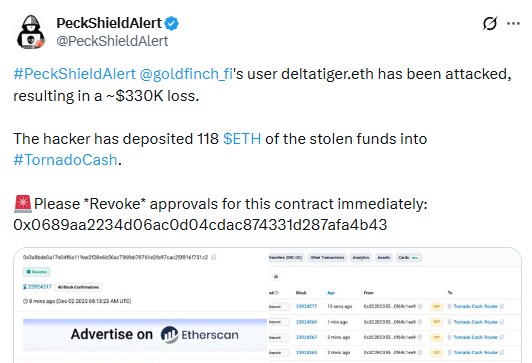

Security sleuths at PeckShield flagged the breach, warning the community faster than you can say 'rug pull.' The exploit didn't need fancy new tech—just a classic vulnerability turned into a six-figure payday for some anonymous actor. It's a stark reminder that in DeFi, your keys aren't just your coins; they're the entire bank vault.

The Aftermath and the All-Too-Familiar Pattern

The funds moved through the usual laundering maze—swapped, bridged, and scattered. Meanwhile, the 'builders' are left doing damage control, promising audits and upgrades. It's the decentralized finance version of closing the barn door after the horse has not only bolted but already been sold on a darknet market.

So, while VCs pour billions into the next 'Web3 revolution,' the old-school problems of basic digital security keep cutting the legs out from under it. Maybe the real innovation needed isn't another layer-2 solution, but a system where $330K doesn't just evaporate into the ether—pun very much intended.

Source: X (formerly Twitter)

What "Revoke Approvals" Means

Anytime user interact with websites like Goldfinch, user permit smart contracts to transfer the tokens. And if that contract gets compromised, hackers can drain users wallet.

Prevents risky contracts from touching tokens

Protects wallet from future hacks

Can be done with tools like Revoke.cash or Etherscan Token Approval Checker

Checking approvals now-even if user has never had a problem in this area-can prevent a lot of problems.

Why This Hack Is Part of a Bigger Problem

But this isn't just about one user account, AI is starting to play a role in crypto hacks. Researchers at Anthropic tested AI models like Claude Opus 4.5, Sonnet 4.5, and GPT-5 and showed that they could automatically exploit smart contracts. Using a tool called SCONE-bench, AI recreated past hacks worth $4.6 million and even discovered new vulnerabilities in fresh contracts.

AI reasoning through complicated steps, automated fixing of mistakes, and automatically generating exploits allows for quicker and more unpredictable threats of hacks.

Recent Similar Attack

Take the Yearn Finance yETH hack in November 2025. The attacker didn't directly break the code; the pricing of the vault was changed to withdraw more ETH than was deposited, and then the stolen crypto was laundered through Tornado Cash.

This shows that security isn't just about code; it's also about how tokens interact, how pricing works, and how liquidity is managed. Even trusted platforms can be prone to vulnerability if precautions aren't taken.

Why Goldfinch Users Should Take Action Now

The hack of Goldfinch's wallet is another warning to everybody in DeFi: users should

Revoke risky approvals immediately

Be vigilant regarding wallet security.

Consider AI tools to monitor smart contracts. Goldfinch is still a pretty trusted platform that offers private credit funds on-chain, but an incident like this shows even the best platforms can't protect users who leave risky approvals active. Fast action will avoid losses and keep funds safe.

This article is for informational purposes only and does not constitute financial advice. Readers should verify details independently.