Fed’s Next Move: How Interest Rate Decisions Could Reshape Crypto Markets in 2025

Central Bank Policy Meets Digital Asset Volatility—Again.

When the Federal Reserve speaks, traditional markets listen. But in the crypto space, reactions aren't always so predictable. As we head toward the end of 2025, all eyes are on the Fed's interest rate trajectory and its potential ripple effects across Bitcoin, Ethereum, and beyond.

The Liquidity Lifeline (Or Leash)

Rate cuts typically signal cheaper money. For crypto, that's often read as a green light—flooding risk assets with capital searching for yield outside the 0.01% savings account. But hikes? They can pull that liquidity plug, testing the 'digital gold' and 'inflation hedge' narratives during a risk-off scramble.

Beyond the Macro Narrative

Don't just watch the headline rate. Watch the language. Is the Fed dovish, hinting at future easing? That can spark rallies before a single basis point changes. Hawkish tones can freeze momentum, reminding everyone that even decentralized finance isn't fully decoupled from the old guard's balance sheet.

It creates a peculiar dance: crypto touting independence while traders hang on every word from Jerome Powell.

The Institutional Wildcard

This cycle is different. With ETFs live and major funds involved, traditional market mechanics have a stronger grip. A rate decision might not just move prices—it could shift allocation models inside Wall Street firms now holding digital assets. The flow of 'smart money' could amplify or dampen retail sentiment overnight.

So, will crypto finally break free from the Fed's shadow, or is it just becoming a more volatile expression of the same old monetary policy? Place your bets—just maybe not with leverage right before a FOMC meeting.

After all, in finance, the only thing that moves faster than a blockchain is a hedge fund manager's finger on the 'sell' button after a dovish pause.

Summarize the content using AI

ChatGPT

Grok

Just before the interest rate decision, Bitcoin $92,039 formed a $500 candle, and Ethereum

$92,039 formed a $500 candle, and Ethereum $3,314 surpassed $3,400. Hassett was certain about a 25 basis point cut beforehand, and Michele from JP Morgan predicted both a reduction and a decline in inflation. However, the critical issue isn’t just the interest rate decision itself; there is more to it.

$3,314 surpassed $3,400. Hassett was certain about a 25 basis point cut beforehand, and Michele from JP Morgan predicted both a reduction and a decline in inflation. However, the critical issue isn’t just the interest rate decision itself; there is more to it.

Federal Reserve’s Interest Rate Decision

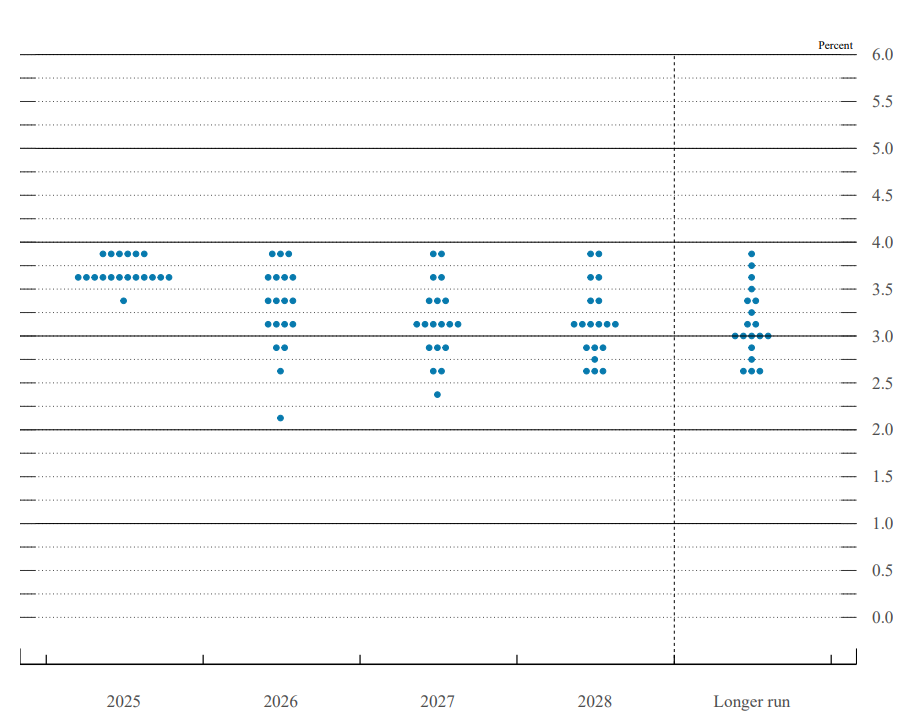

As anticipated, the Federal Reserve announced a 25 basis point cut, and everyone eagerly awaited Powell’s remarks half an hour later. The FOMC’s projections for the economy and interest rates are summarized below. You could follow Powell’s live speech through COINTURK.

The Fed lowered interest rates by 25 basis points. The Fed’s median prediction maintains the projection of a 25 basis point cut in 2026. The Fed stated that it WOULD assess the extent and timing of additional adjustments.

Within the next 30 days, the Fed plans to purchase $40 billion in treasury bonds. There was opposition from Schmid and Goolsbee regarding changes in interest rates. The Fed will begin purchasing treasury bonds on December 12th. The median unemployment prediction is 4.5% for 2025 and 4.4% for 2026.

By the end of 2028, the Fed’s median estimate for interest rates is 3.1%. Four officials expected a two-quarter point cut in 2026. The Fed’s median forecast shows interest rates at 3.4% by 2026 and 3.1% by 2027. Seven officials stated that no rate cuts will be implemented in 2026.

Four officials foresee at least three-quarter point cuts in 2026. Unemployment showed a slight increase throughout September. The Fed removed operational constraints on overnight repo operations, and treasury bond purchases will increase over ‘several months’.

Future reserve management purchases are likely to slow significantly. Considering risks on both sides, downside risks in employment have increased. Uncertainty regarding the outlook remains high. Inflation has risen since the beginning of the year, maintaining somewhat high levels.

The economy grows at a moderate pace; job growth has slowed, and the unemployment rate increased slightly.

was part of the Fed’s announcement. Michele from JP Morgan noted that the Fed’s economic predictions have hawkish tendencies. Although not the worst yet, Powell’s statements will be decisive with weak expectations for cuts in 2026.

You can follow our news on Telegram, Facebook, Twitter & Coinmarketcap Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.