Standard Chartered Drops Bombshell: Ethereum Treasury Stocks Outperform ETH ETFs for Maximum Gains

Wall Street's latest crypto twist? Skip the middleman. Standard Chartered just declared Ethereum-linked equities a smarter play than spot ETH ETFs—and the market's already scrambling to adjust.

The institutional pivot no one saw coming

While retail investors queue up for ETF approvals, the smart money's loading up on public companies holding ETH reserves. Turns out, old-school equities might be crypto's dark horse.

When traditional finance does a DeFi

Analysts note the irony: TradFi institutions are now advocating for crypto exposure through... wait for it... regulated stocks. The ultimate 'have your cake and eat it' move for risk-averse whales.

One cynical take? This reeks of investment banks creating new products to collect fees on both sides of the trade—because what's a crypto boom without some good old-fashioned rent-seeking?

To be sure, the analyst said that he doesn't see any reason for the NAV to go below 1.0, as these treasury firms provide investors with "regulatory arbitrage opportunities."

Kendrick also highlighted that these treasury companies have bought just as much ETH as U.S.-listed spot exchange-traded funds (ETFs) since June.

Both groups now hold around 1.6% of the total circulating ETH supply — just under 2,000 ETH — over that time period, adding to his call that both the treasury stocks and ETF holders now provide similar exposure to ETH, all else being equal.

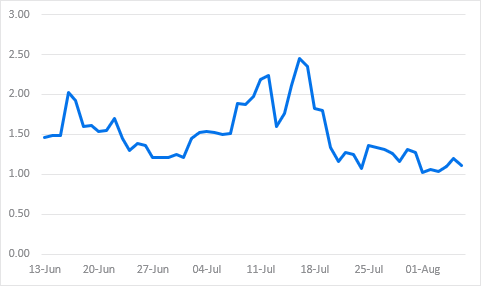

The combination of these two factors is now adding to his thesis that ETH treasury plays are a better buying opportunities than ETFs. "Given NAV multiples are currently just above 1 I see the ETH treasury companies as a better asset to buy than the US spot ETH ETFs," he said.

Standard Chartered is maintaining its year-end price target of $4,000 for ether. ETH is currently trading at $3,652, up 2% over the past 24 hours.