Crypto Carnage: BTC, XRP, SOL, ETH Get Crushed in Long Squeeze as Futures Open Interest Collapses

Blood in the crypto streets—again. Bitcoin and altcoins just got steamrolled by a brutal long squeeze, with futures open interest nosediving alongside prices. Here’s the wreckage.

The domino effect: Leveraged longs got liquidated en masse as BTC, ETH, SOL, and even XRP—yes, the zombie that won’t die—all tanked in unison. Open interest? Evaporated faster than a meme coin’s utility.

Why it matters: When futures markets unwind this hard, it’s not just paper hands crying. Real pain hits overleveraged degens and institutional ‘smart money’ alike (though let’s be real—the latter probably hedged).

The silver lining? Liquidations flush out weak hands. And if history’s any guide, crypto’s next pump will arrive right after everyone declares it dead. Again.

*Bonus finance jab: Traders who ‘buy the dip’ today will either be geniuses or bagholders—Wall Street’s favorite 50/50 bet.

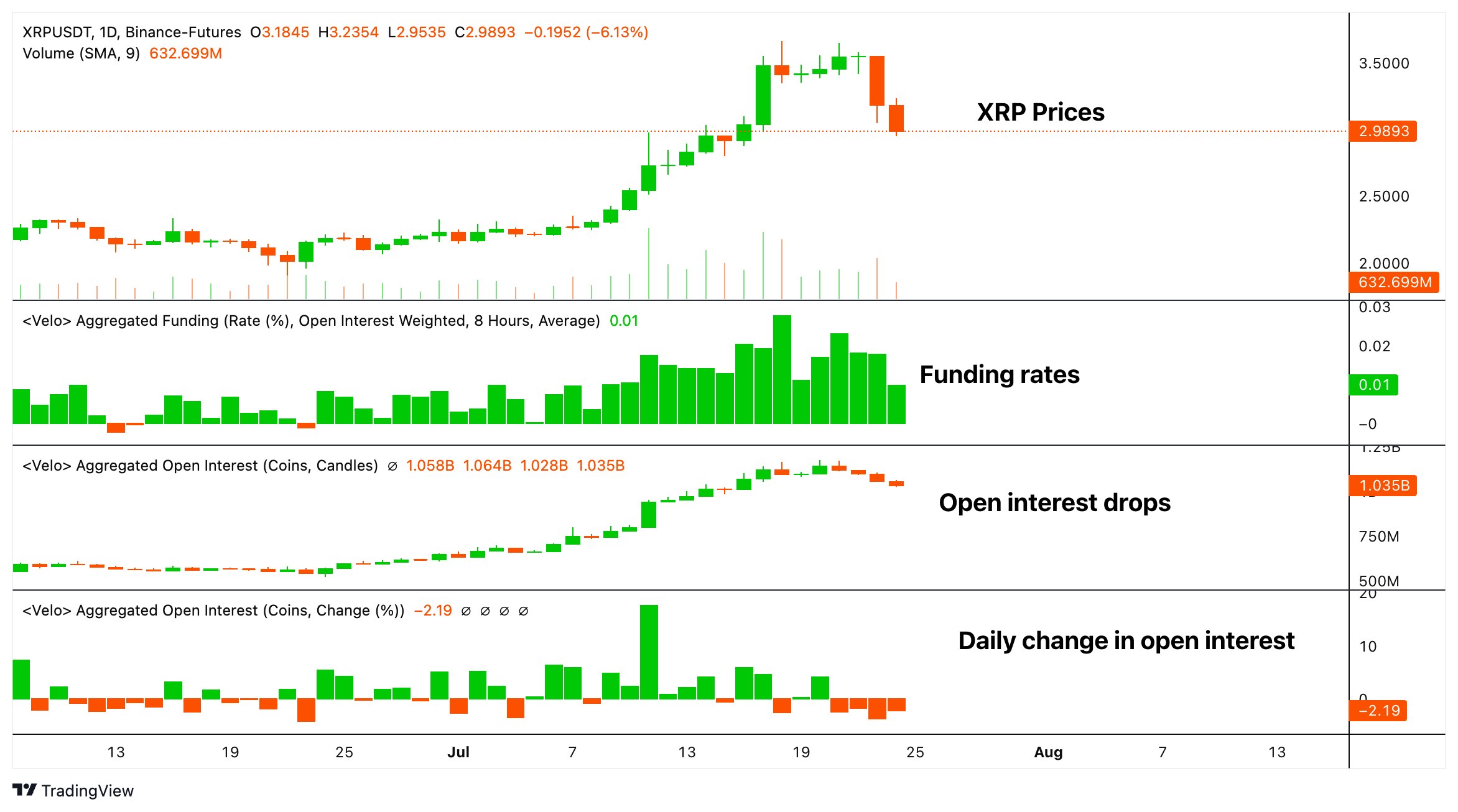

The combination of falling prices, lower open interest and positive funding rates suggests that bullish bets are being actively removed from the market.

It rules out the likelihood that the price decline is backed by investors taking new short, or bearish, positions because in that case the funding rate WOULD have dropped into negative territory as the short holders would need to pay the longs.

Furthermore, the new shorts would have increased open interest as prices dropped, which is not the case either.

The decline in open interest suggests that traders are closing their positions, a characteristic of leveraged longs being liquidated or voluntarily exiting the market, rather than new shorts entering the market. Put together it signals that while the price is dropping, sentiment remains fairly robust.