Bitcoin’s Bull Run Hits a Speed Bump: Long-Term Holders Take Profits

Bitcoin's meteoric rise faces resistance as veteran investors start cashing out—just when retail FOMO was heating up.

Whalesale exits trigger volatility

The OG HODLers are finally moving coins to exchanges, signaling a potential local top. On-chain data shows the highest long-term holder outflow since the 2021 cycle peak.

Market braces for impact

This profit-taking wave comes as Bitcoin struggles to hold $60K—a psychological support level that's now becoming resistance. Traders watch BTC's weekly close like hawk-eyed chartists waiting for divine signals.

Silver lining for diamond hands?

History suggests these sell-offs create buying opportunities—if you believe the 'four-year cycle' gospel Wall Street suddenly pretends to understand. Meanwhile, crypto VCs quietly accumulate at discounted prices (how convenient).

The real question: Is this the healthy pullback before another leg up, or are we witnessing the slow-motion unwinding of crypto's latest 'this time it's different' narrative? Only your portfolio manager's ulcer knows for sure.

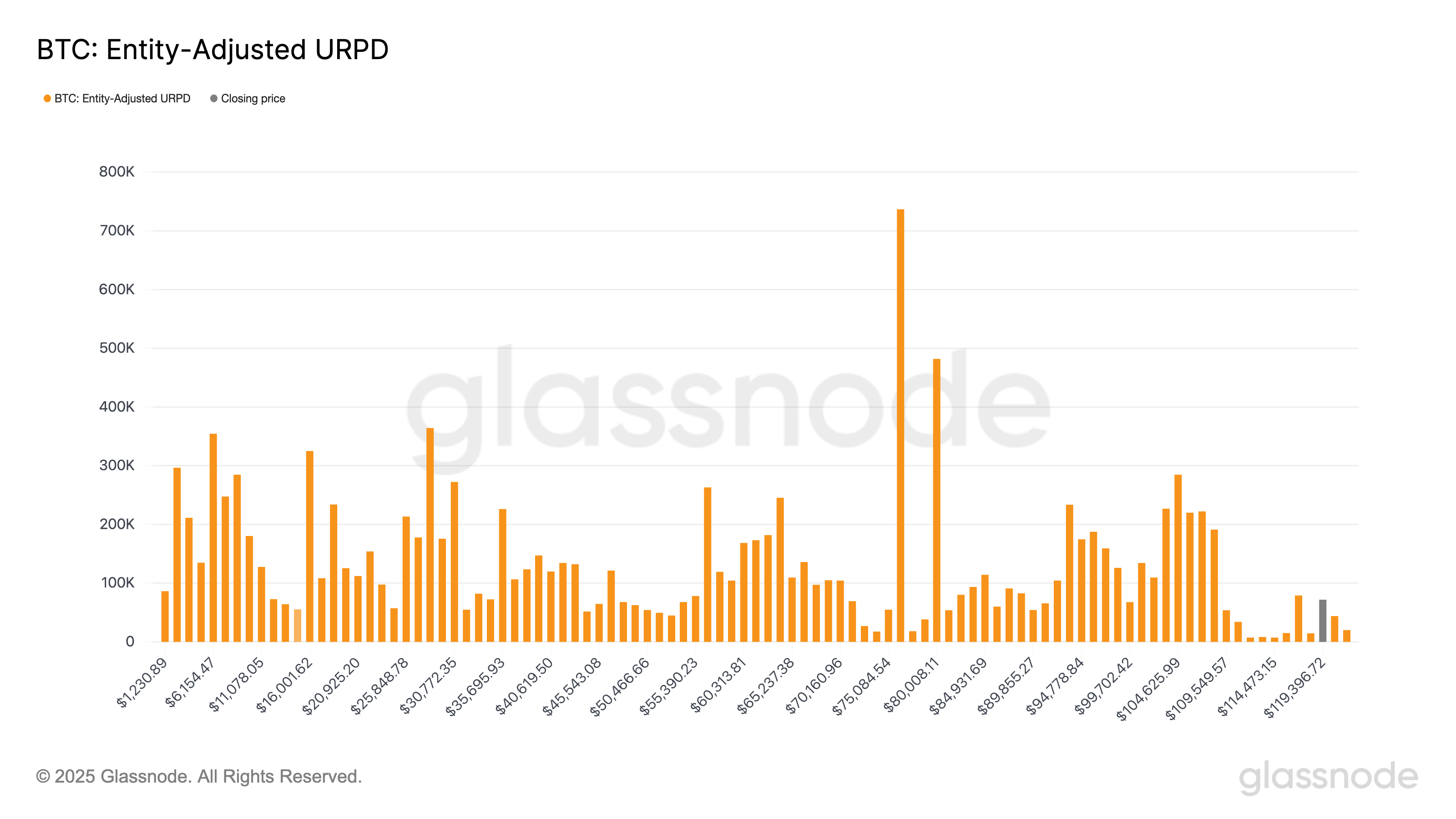

Each bar in the chart shows the amount of bitcoin that last moved within a specific price range. The entity-adjusted version of this data show above accounts for the average purchase price of each entity’s full balance and excludes internal transfers between addresses owned by the same entity, which do not represent genuine market activity. It also filters out supply held on exchanges, because aggregating millions of users’ funds into a single price point WOULD create distortions in the data.

With minimal supply sitting between $110,000 and $116,000, as shown by the dip at the right-hand side, the market remains vulnerable to sharp moves in either direction.