Bulls Triumph as Anti-MSTR Leveraged ETF Crashes—Bears Forced to Capitulate

Short-sellers just got steamrolled. The once-defiant anti-MicroStrategy leveraged ETF has imploded—cratering to all-time lows as Bitcoin's resurgence leaves bears scrambling for cover.

How the tables turn. Wall Street's latest 'smart money' bet against crypto-linked equities now looks like a reckless gamble—another case of traditional finance underestimating digital asset resilience.

Blood in the water. With MSTR shares riding Bitcoin's bullish momentum, inverse ETF operators face brutal margin calls. Some things never change: fighting crypto's upside remains a fast track to liquidation.

Another victory lap for HODLers. While shorts get squeezed, MicroStrategy's billion-dollar Bitcoin treasury keeps printing—proving once again that diamond hands beat hedge fund algos every time.

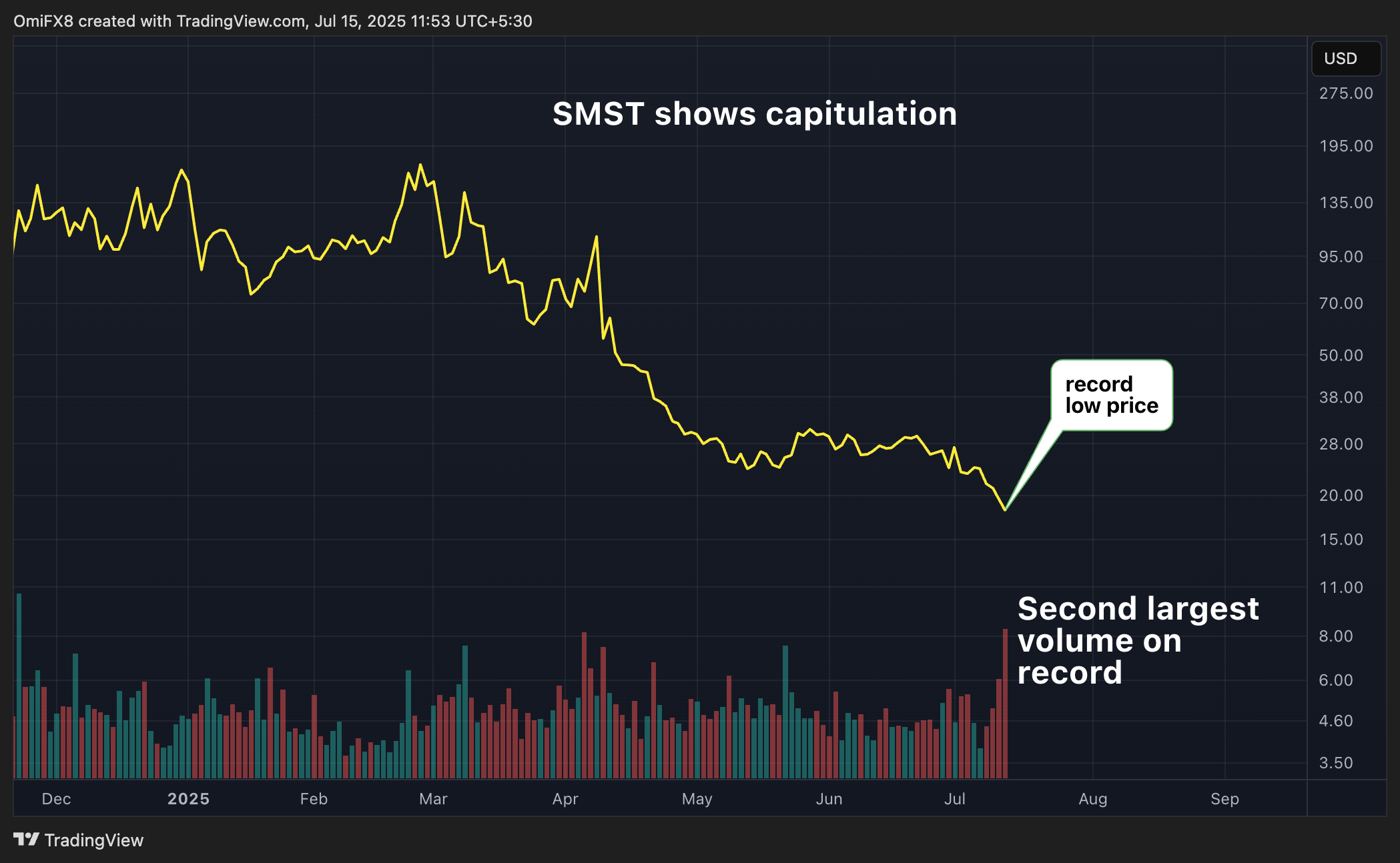

Bears capitulate as BTC surges

SMST's high-volume collapse points to capitulation of bears – those betting against MSTR have likely given up and are exiting the market.

A high-volume record low typically indicates capitulation – market participants surrendering to the relentless bearish trend and exiting all their positions, giving up all hope of a recovery. This type of price action often marks peak bearishness in the market or bottoms.

Bitcoin's price tapped record highs above $122,000 during Monday's Asian trading hours, providing bullish cues to all things tied to crypto. Later in the day, shares in MSTR ROSE over 3% to $456, the highest since November.

Leveraged bearish bet

The 2x short ETF seeks to deliver daily investment results that are -200%, or minus 2x, the daily percentage change in the MSTR share price. In other words, it's a leveraged bearish bet.

The ETF's price, however, has collapsed from over $2,000 on the inception day in August last year, and has been primarily in a downtrend, barring the brief uptrend from $1,600 to $2,368 in late August last year. As of Friday, the fund had a net inflow of $8.2 million in six months, according to VettaFi.

MSTR's share price has increased multi-fold from $100 to over $440 during the same time. MicroStrategy is the largest publicly-listed bitcoin holder in the world, boasting a coin stash of 601,550 BTC ($70.56 million) as of writing.

2x long MSTR ETF rises

The Defiance daily target 2x long MSTR ETF rose to nearly $50 on Monday, the highest since January 24, with trading volumes rising for the fourth straight day to tally 9.2 million.

As of Friday, MSTX had a net six-month outflow of over $175 million, per VettaFi.