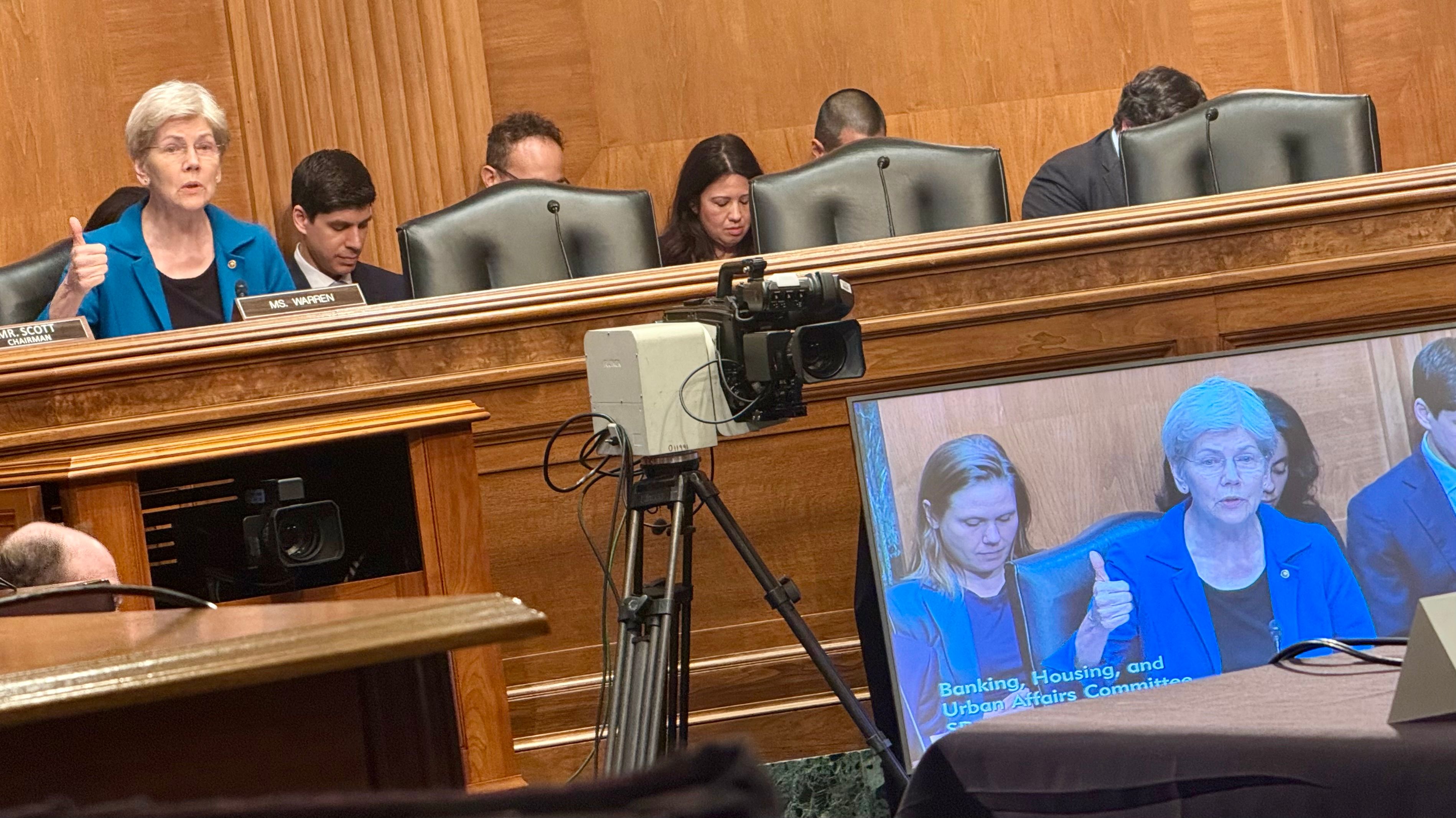

Crypto Leaders Clash With U.S. Senators Over Market Structure Reforms in Pivotal Hearing

Crypto heavyweights threw down the gauntlet in Washington today—laying out bold visions for reshaping America's digital asset markets. The Senate hearing crackled with tension as industry reps pitched regulatory frameworks to skeptical lawmakers.

Key demands? Clear rules, innovation-friendly policies, and a seat at the legislative table. The crypto camp argued current regulations force innovation offshore—while senators grilled witnesses on investor protections.

Behind the scenes: Lobbyists are scrambling to influence what could become the most significant crypto legislation since the Infrastructure Bill's tax reporting debacle. One banking committee staffer muttered about 'DeFi developers treating KYC like optional DLC.'

The bottom line: With 2025 shaping up as a make-or-break year for U.S. crypto policy, this hearing marks Round 1 in a heavyweight regulatory fight. Place your bets—the house always wins.

She also said that proposals including the House's Clarity Act "will allow noncrypto companies to tokenize their assets in order to evade" regulation from the Securities and Exchange Commission.

"Think for just a minute about what that means," Warren said. "Under the House bill, a publicly traded company like Meta or Tesla could simply decide to put its stock on the blockchain" to escape SEC scrutiny.

The House's Clarity Act has already cleared the relevant committees in that chamber, so it's the piece of legislation furthest along and has been suggested by Scott as a template for Senate work on market structure. One of the key provisions in the bill is to set up the Commodity Futures Trading Commission as a primary regulator of U.S. digital assets activity. A former chairman of that agency, Tim Massad, was among the witnesses on Wednesday and was asked about his thoughts on the act.

Massad responded, "I think it's got a lot of problems. I think it's 236 pages of regulatory arbitrage opportunities."

Scott's committee has previously set out a series of guidelines for its own work on market structure legislation that will "recognize the need to clearly define what is a commodity, what is a security, and how digital assets can trade and be custodied in a way that fosters innovation while protecting investors," he said at the hearing.

"We don’t need more roadblocks," he said. "We need rules that actually work."

Trump has added urgency to the crypto policy debate in Congress at the moment, because he'd set his own August deadline for the Senate and House to produce stablecoin and market structure bills. While it's possible the House signs off on the Senate's stablecoin bill next week and sends it to the president to be signed into law, the timeline for the more complex bill may be further out. Senator Scott has declared a September 30 deadline for the Senate to finish market structure legislation.