Bitcoin’s Grip Slips: Is This the Dawn of a New Crypto Era for BTC Price?

Bitcoin's dominance is crumbling—and the crypto world is holding its breath. As altcoins chip away at BTC's throne, traders are scrambling to decode what comes next.

The king isn't dead... but the courtiers are getting restless.

When the flagship crypto stumbles, the whole market holds its breath. This isn't your 2017 altseason—this time, the smart money's watching institutional flows while retail traders FOMO into 'the next big thing' (spoiler: it's probably another memecoin).

Technical indicators scream volatility ahead. On-chain metrics hint at accumulation. And somewhere in a Miami penthouse, a VC just minted another 'Web3' fund with your future exit liquidity.

One thing's certain: when Bitcoin sneezes, the whole crypto market catches a cold. Buckle up.

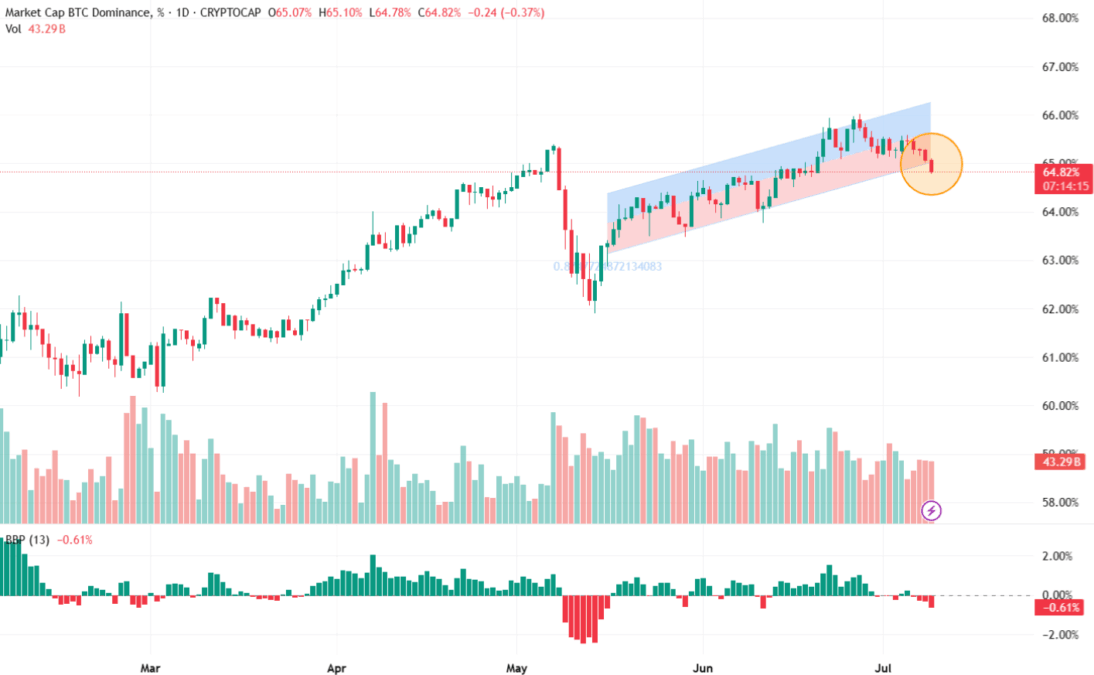

Bitcoin Dominance Loses Momentum

As per the latest data, the Bitcoin dominance (BTC.D) is breaking below the ascending channel in the daily frame, suggesting a shift toward the altcoin market. The chart displays a constant drop for 5 days, resulting in the dominance dropping to 64.82%. This trend suggests a crucial watch period in the market as the dynamics are now changing toward the next phase.

Additionally, there has been a drop in the trading volume. This technical analysis shows the interest among the investors for buying and selling bitcoin compared to other cryptocurrencies is steadily dropping. If the trend continues, it can act as a catalyst for an altcoin season within the next few weeks.

Bitcoin Network Hashrate Drops In June

During the month of June, the Bitcoin network hashrate declined by almost 3%. The prime reason for this drop was considered to be the seasonal weather-related geographics. Increased power cuts were recorded during this period.

However, there was a positive change in the mining profitability as the average daily revenue on block rewards per EH/s was equal to $55,300 or 7% increase compared to April.

Will BTC Price Rise Again?

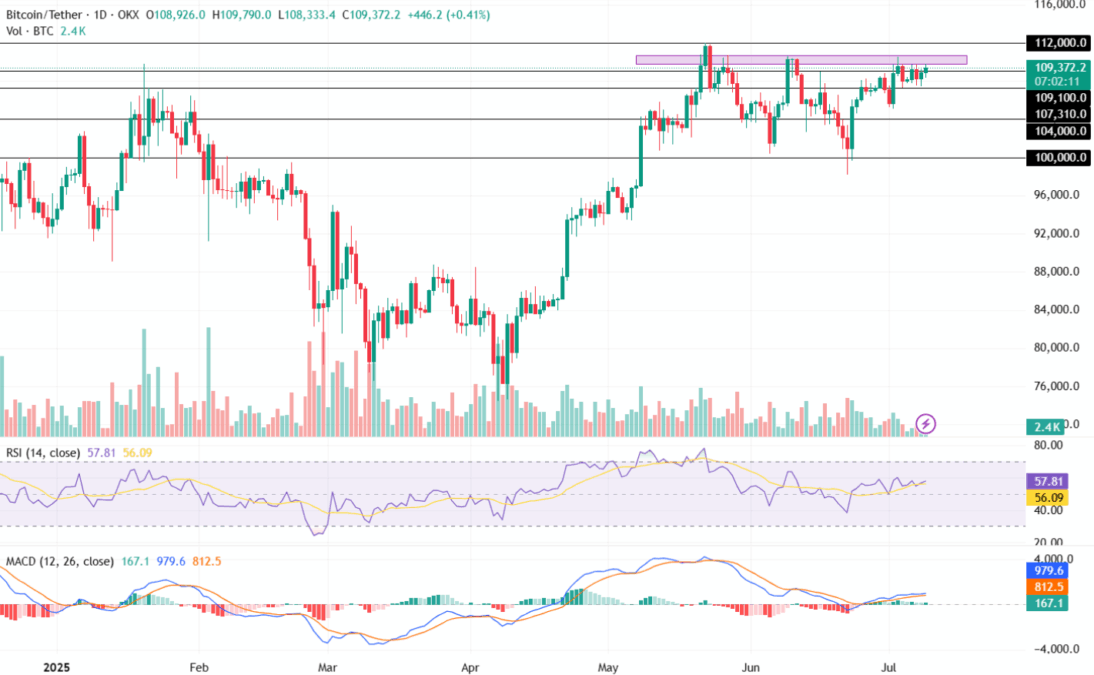

The Bitcoin price has repeatedly failed to break out of its crucial watch zone around the $109,500 mark, highlighting a strong selling point around that level. This has resulted in BTC experiencing a sideways price action for about seven days.

The technical indicators, RSI & MACD have both recorded a positive but stable trend action over the past few days. This indicates a weak market activity around BTC price.

A breakout from its important resistance zone of around $109,500 could result in the bitcoin price retesting its high of $111,970 shortly. Conversely, a bearish action may lead to it retesting its low of $109,100 or $107,310 respectively.

Solana Staking ETF $SSK Crosses $40M AUM, Outspacing Rivals