Whales Are Dumping Bitcoin for Ethereum—Here’s Why

Big money’s flipping the script—ETH is now the institutional darling. Three market signals scream ’alt season’ while Bitcoin plays catch-up.

1. Futures flows show ETH contracts outpacing BTC by 3:1. 2. Grayscale’s Ethereum Trust premium surged 48% last quarter—Bitcoin’s? Flatlined. 3. CME’s ETH options open interest just hit $2B, proving hedgies want exposure without the crypto-bro baggage.

Guess Wall Street finally realized smart contracts print money better than ’digital gold’ memes.

CME futures open interest

CME futures open interest

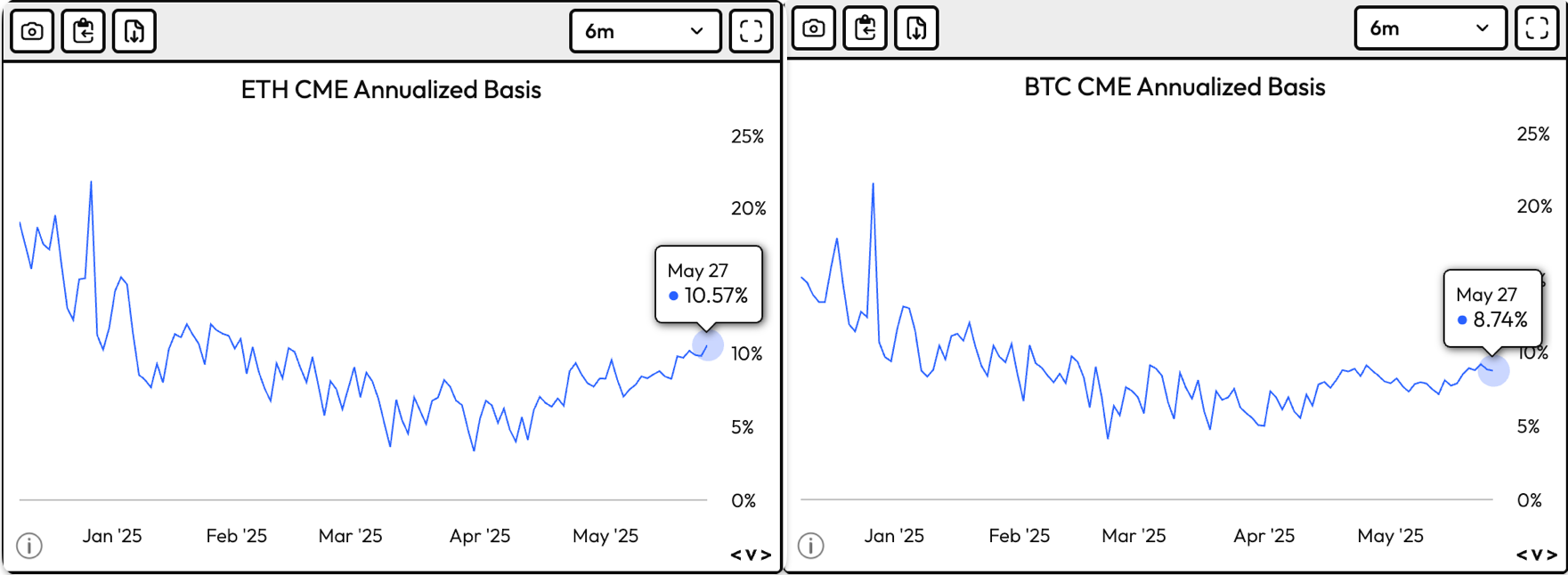

The notional open interest in CME bitcoin futures, which represents the dollar value of the number of active contracts, has risen by roughly 70% to over $17 billion since the early April crash, according to data source Velo.

The growth, however, has stalled above $17 billion over the past seven days. The CME is considered a proxy for institutional activity.

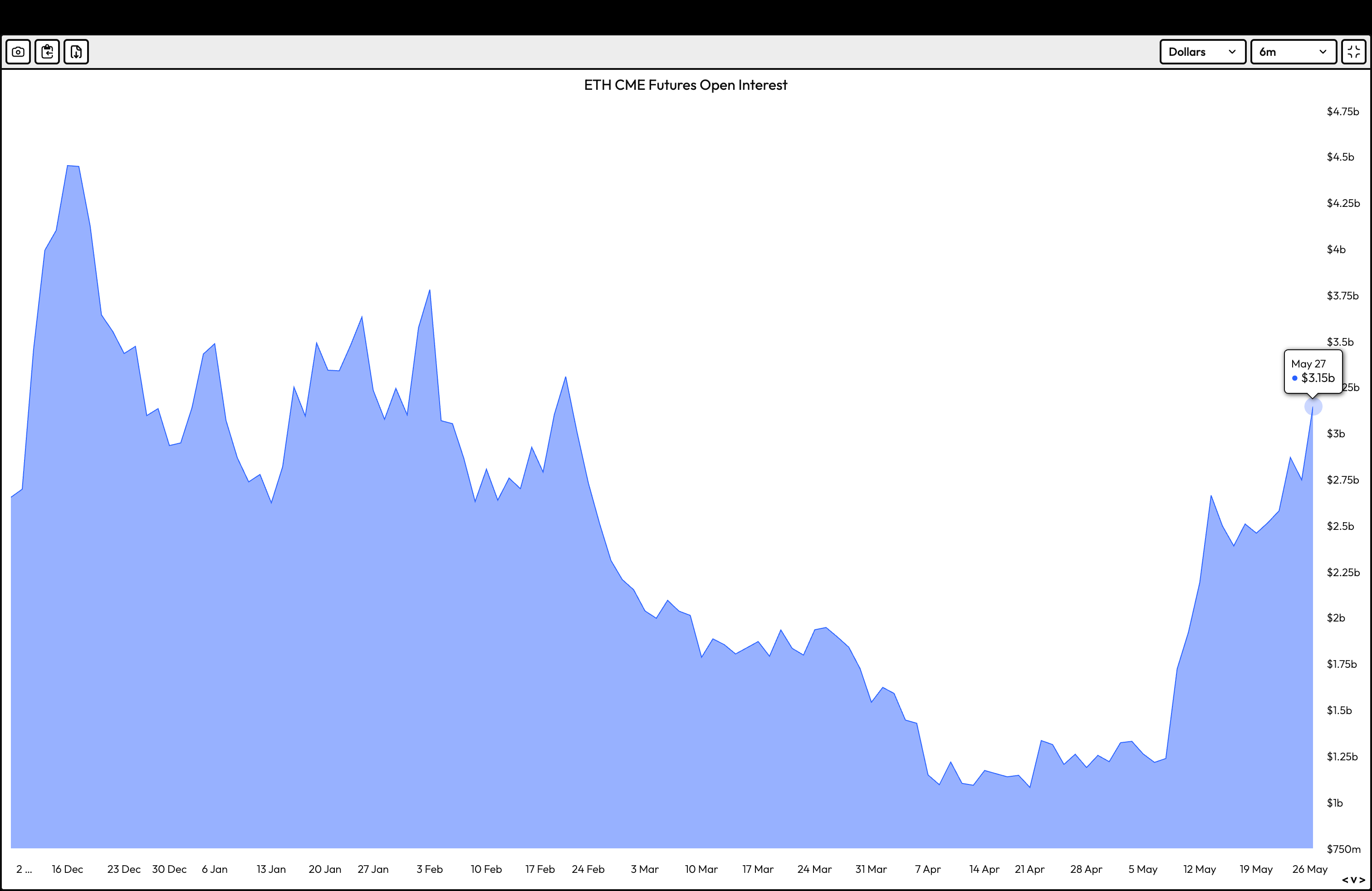

Meanwhile, ether’s open interest has jumped 186% to $3.15 billion since the early April crash. The growth has accelerated over the past two weeks.

The diverging trends show institutions are increasingly leaning toward ether.

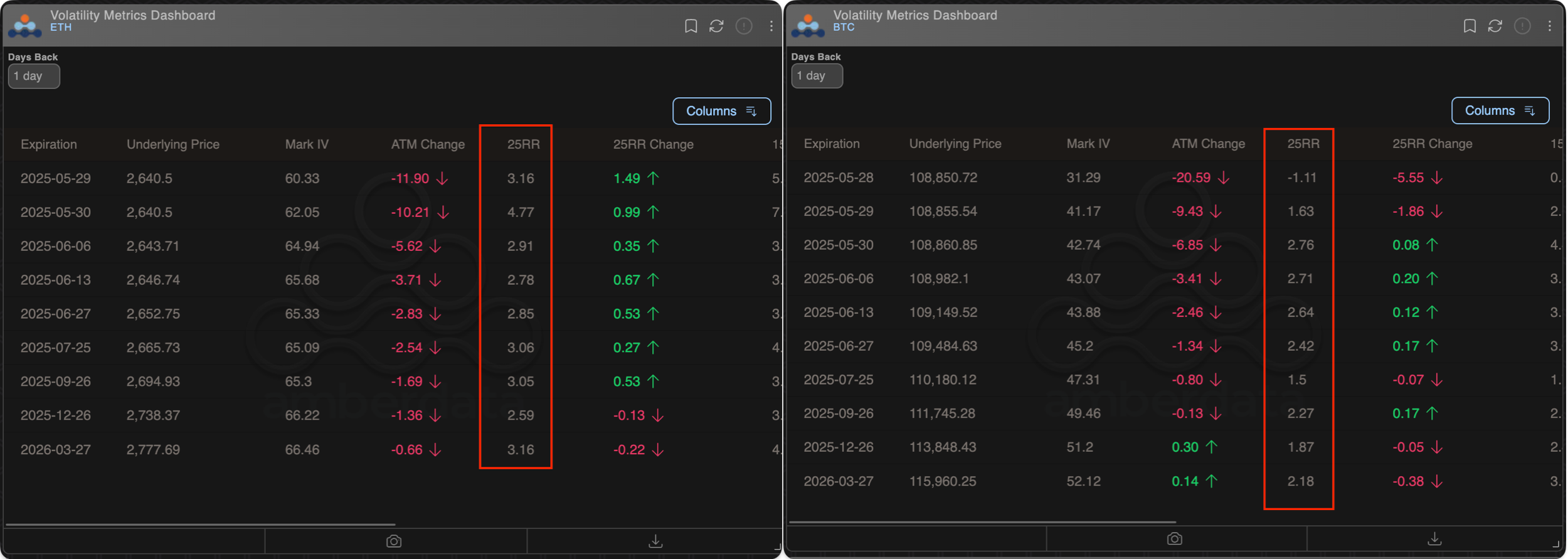

The bias for ETH is also evident from the relative richness of premiums in ether futures.

As of the time of writing, one-month Ether futures boasted an annualized premium of 10.5%, the highest since January, according to Velo. Meanwhile, Bitcoin futures premium was 8.74%.

Elevated premiums indicate Optimism and strong buying interest, often signaling a bullish trend. Therefore, the relative richness of ether futures premium suggests traders are more bullish on ETH compared to BTC. After all, ether is still 84% short of record highs reached during the 2021 bull run.

There is also a possibility that the BTC’s basis may have been held lower by cash and carry arbitrage (non-directional) traders.

A similar divergence is observed on offshore exchanges, where annualized funding rates, representing the cost of holding long positions in ETH perpetual futures, has neared the 8% mark. Meanwhile, BTC’s funding rates hold below 5%.